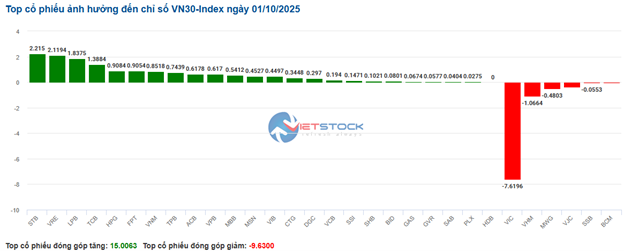

The breadth of the VN30-Index basket leans towards the green, with notable positive contributors including STB, VRE, LPB, and TCB. These stocks added 2.21 points, 2.11 points, 1.83 points, and 1.38 points, respectively, to the VN30 index. Conversely, VIC, VHM, MWG, and VJC faced selling pressure, collectively subtracting over 9 points from the index.

Source: VietstockFinance

|

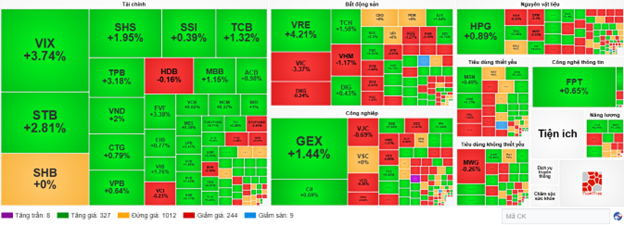

The financial sector continued its recovery, serving as a pillar of support for the index despite mixed performances in other sectors like essential consumer goods and real estate, which constrained the market’s overall upward momentum. On the positive side, BID (+1%), TCB (+1.59%), MBB (+1.15%), LPB (+1.62%), and STB (+3.16%) saw gains. However, HDB (-0.16%), SSB (-0.26%), BVH (-0.18%), and BAB (-0.74%) faced selling pressure, though their impact on the sector’s index was minimal.

The materials sector also recorded a positive performance, rebounding by 0.37% despite strong polarization. Buying activity concentrated on large-cap stocks such as HPG (+0.53%), GVR (+0.72%), and DGC (+0.87%).

Similarly, the industrial sector, though predominantly in the red, saw concentrated buying in leading stocks like GEX (+1.62%), GEE (+0.24%), VGC (+0.18%), and BMP (+0.49%), helping the sector regain its recovery momentum.

In contrast, real estate stocks remained in the red. Selling pressure was evident in sector leaders such as VIC (-3.09%), VHM (-0.97%), and BCM (-0.6%).

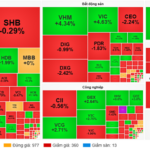

Compared to the opening, buyers maintained a stronger position. There were 327 advancing stocks and 244 declining stocks.

Source: VietstockFinance

|

Opening: Green Dominates Early Session

As of 9:30 AM on October 1st, the VN-Index rose slightly by over 3 points, hovering around the reference level. Similarly, the HNX-Index also saw a modest increase, holding steady at around 273 points.

The energy sector ranked among the top performers, with leading stocks such as BSR (+1.34%), PLX (+0.15%), PVS (+0.61%), and OIL (+0.9%) showing strong recovery.

The financial sector, though mixed, resumed its positive recovery from the previous session, driven by banking and securities stocks like VCB (+0.48%), LPB (+1.01%), VIX (+2.22%), and MBS (+0.29%).

Alongside these sectors, several Large Cap stocks also performed positively. VRE, VHM, VNM, and ACB supported the overall index growth, contributing over 4.6 points to the VN30-Index and more than 2.2 points to the VN-Index.

– 10:35 01/10/2025

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.

Tomorrow’s Stock Market, September 25: Bank and Real Estate Stocks Poised for Another Wave of Momentum

The surge in bank and real estate stocks during the September 24th session has sparked market anticipation of a broader rally in the upcoming trading day.

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.

Market Pulse 11/09: An Exciting Afternoon Session, VN-Index Rebounds 52 Points from Lows

In stark contrast to the morning session’s struggles, which saw the VN-Index dip below 1,606 points, the afternoon session painted an entirely different picture. The index staged a robust comeback, closing at 1,657.75, marking a significant gain of 14.49 points. The real estate sector, particularly Vingroup-related stocks, emerged as the driving force behind today’s impressive rally.