|

Source: VietstockFinance

|

Today’s session saw a significant recovery in liquidity, reaching 35.6 trillion VND, which acted as a crucial buffer against deeper market declines. Investor activity surged during the sharp downturns, indicating a strategic buying interest at lower price levels. Each market adjustment promptly attracted fresh capital.

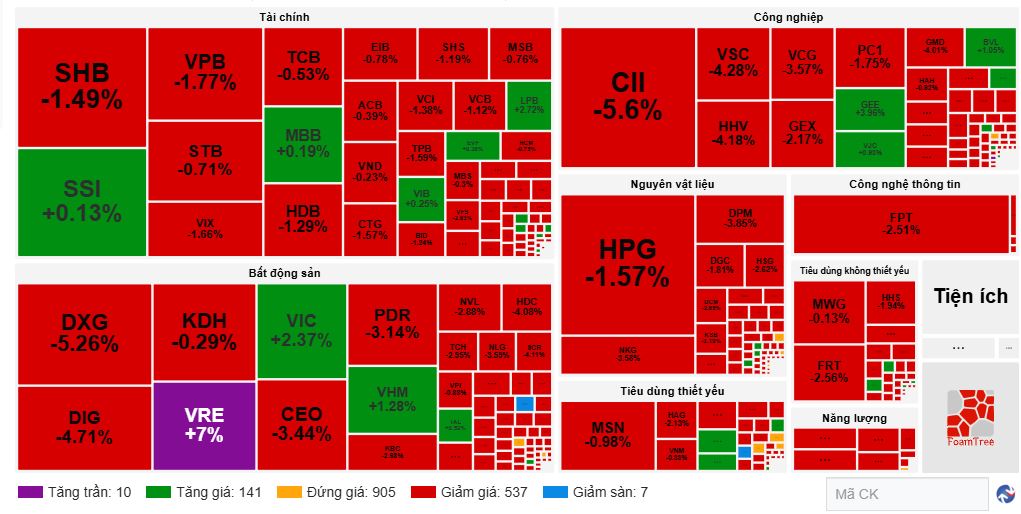

The securities sector performed well today, with notable gains: SSI (+2.6%), MBS (+4%), SHS (+1.6%), HCM (+0.75%), and ORS (+1.4%). Real estate also rallied, primarily driven by Vingroup’s stocks, which rose consistently throughout the session. VRE hit the ceiling with a 7% surge, while VIC and VHM closed with 1% gains.

Most other sectors faced declines. In industrials, CII dropped 5%, with VSC, HHV, VCG, PC1, GMD, LCG, and CTD falling 2-3%. Raw materials were also in the red, led by HPG (-1.6%). The tech sector saw FPT decline 2.6%.

In energy, BSR, PVS, PVD, and PVT all closed lower.

Foreign investors continued net selling, totaling nearly 1.3 trillion VND. KDH faced the heaviest selling pressure (380 billion VND), followed by HPG (170 billion VND).

| Top 10 Stocks with Highest Foreign Net Buy/Sell on 30/09/2025 |

Morning Session: Selling Pressure Intensifies

Negative sentiment dominated as red spread across the market, with nearly 550 stocks declining by the mid-session break. Most sectors were in the red. VN-Index fell 11 points to 1,655.36, and HNX-Index dropped 4 points to 271.05.

Market Heatmap as of 11:30 AM. Source: VietstockFinance

|

Real estate remained resilient, led by Vingroup’s stocks. VRE hit its ceiling, while VIC and VHM gained 1-2%.

Liquidity surged toward the end of the morning session, with trading value nearing 19 trillion VND.

Foreign investors net sold over 1 trillion VND in the morning, with KDH bearing the brunt (360 billion VND).

10:40 AM: Selling Pressure Peaks, Bottom-Fishing Activates

Red dominated the heatmap, though VN-Index held a slight 3-point gain thanks to Vingroup’s support.

By 10:35 AM, 430 stocks declined versus 180 advancing. VIC (+4%), VHM (+2%), and VRE (ceiling) kept the index afloat. In industrials, GEE rose 6%. Despite widespread declines, most losses were moderate, easing overall pressure.

By 10:45 AM, sentiment turned more negative. VN-Index dipped below the reference point, with software, energy, and materials leading declines (over 2 points each). BSR, PVD, PVS, FPT, HPG, GVR, DGC, KSV, MSR, DCM, and DPM fell 2-3%, dragging VN-Index down 10 points.

A silver lining was the liquidity surge, suggesting bottom-fishing activity. By 11 AM, trading value reached nearly 15 trillion VND, up 20% from yesterday.

Opening: Vingroup Stocks Lead Early Gains

The final September session began cautiously, with green prevailing and VN-Index rising 6 points by 9:25 AM.

Market breadth showed 230 advancers versus 150 decliners, with mixed performances across sectors like finance, real estate, and industrials.

Vingroup stocks drove early gains, with VIC, VHM, and VRE lifting VN-Index by 6 points. No single stock significantly weighed on the index, with the top 10 negative contributors accounting for less than 2 points.

Securities stocks were positive, with SSI, VND, VIX, VCI, SHS, HCM, and MBS rising around 1%.

– 16:05 30/09/2025

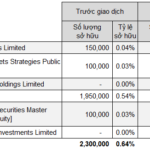

Dragon Capital Group Joins Taseco Land’s Private Placement, Emerging as a Major Shareholder

On September 24th, Dragon Capital-managed funds announced their new status as major shareholders in Taseco Land (HOSE: TAL), a leading real estate investment company. This milestone was achieved through a combination of acquiring shares from a private placement and purchasing additional shares on the open market.

Khang Phát Holdings CEO Honored as “Outstanding Leader 2025”

The Vietnam Excellence Brand 2025 Awards Ceremony, held on September 27th in Ho Chi Minh City, brought together a distinguished gathering of leading businesses, renowned brands, and prominent leaders from across the nation. During the event, Mr. Nguyễn Nhật Anh, CEO of Khang Phát Holdings, was honored with the prestigious “Outstanding Leader 2025” award, marking a significant milestone in his career.

Vingroup Plans to Issue VND 2.5 Trillion in Corporate Bonds

Vingroup is set to issue VND 2.5 trillion in 24-month bonds as part of its debt restructuring strategy.