Key indices struggled in the red as real estate and public investment stocks faced significant selling pressure. Stocks like DXG, CII, CEO, PDR, and SCR dropped 2-5%, while NVL and other speculative stocks in the sector also declined.

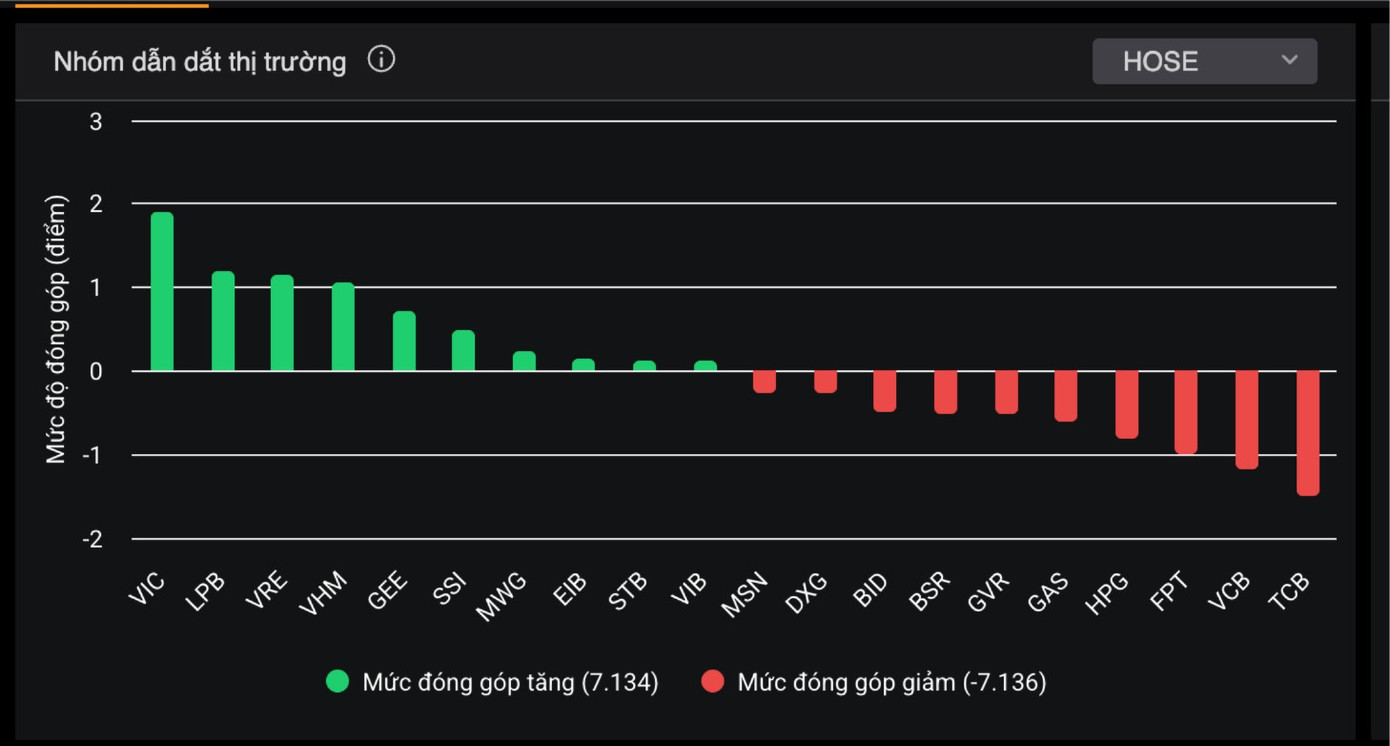

Even influential market leaders, such as Vingroup-related stocks, failed to maintain their momentum. VIC closed with a modest 1.2% increase to 174,900 VND per share, still leading the market but contributing only about 2 points. VHM edged up by 1.1%.

VIC’s momentum slows after a strong rally.

Meanwhile, VRE stood out with a 7% surge to 32,100 VND per unit. However, due to its limited liquidity and market capitalization, this gain wasn’t enough to buoy the overall market. With VIC taking a breather, the market lacked a strong replacement leader or sector.

Banking stocks were mixed, while securities stocks showed more positive movement. Blue-chip securities stocks like MBB, SHB, and TPB returned to the green, though gains were marginal. Conversely, TCB, VCB, and CTG declined, creating downward pressure.

Securities firms also saw modest gains, with SSI, VND, VIX, and MBS rising 1-3%. Vietnam’s stock market is at a critical juncture, as FTSE Russell will announce its market classification review next Wednesday (October 8).

At the close, the VN-Index fell 4.78 points (0.29%) to 1,661.7, the HNX-Index dropped 1.99 points (0.72%) to 273.16, and the UPCoM-Index rose 0.17 points (0.16%) to 109.46. Liquidity rebounded, with HoSE trading value exceeding 32 trillion VND, up nearly 20% from the previous session.

Foreign trading remained a drag, with net selling continuing in September. Today’s net outflow was over 1,278 billion VND, concentrated in stocks like KDH, HPG, FPT, SSI, and VHM.

Foreign Investors Continue Selling Spree, Offloading Nearly VND 400 Billion in Real Estate Stocks on September 30th

In the afternoon session, CII and SHB emerged as the top net buyers in the market, with impressive purchase values of 90 billion VND and 82 billion VND, respectively.