MB Securities Corporation (MBS) has announced its resolution to implement an Employee Stock Ownership Plan (ESOP) for 2025.

MBS plans to issue 8.59 million shares under the ESOP at a price of VND 10,000 per share. The proceeds of over VND 85.9 billion will be used to supplement margin trading capital.

As of the morning of September 30th, MBS shares were trading at around VND 33,000 per share. The ESOP issuance price is thus only one-third of the market price.

50% of the ESOP shares will be restricted from transfer for 3 years, and the remaining 50% for 5 years.

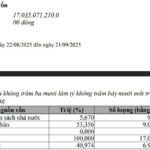

MBS has also released a list of 322 employees eligible to purchase ESOP shares. Chairman Le Viet Hai is expected to receive the largest allocation with 570,000 shares; Vice Chairman and CEO Phan Phuong Anh plans to buy 528,194 shares; and Board Members Nguyen Minh Hang and Pham Xuan Thanh will each receive 200,000 shares.

According to previous announcements, the ESOP issuance will proceed after MBS completes the offering of shares to existing shareholders and the bonus share issuance.

On September 25th, MBS finalized the list of shareholders eligible for bonus shares and the public offering.

Specifically, MBS will issue 17.18 million bonus shares to increase its charter capital from equity (bonus shares). The ratio is 100:3, meaning shareholders holding 100 shares will receive 3 new shares.

The issuance will be sourced from the surplus capital on the audited 2024 financial statements. Bonus shares are unrestricted for transfer.

Additionally, MBS plans to offer 68.7 million shares to existing shareholders. The ratio is 100:12 (shareholders holding 100 shares can purchase 12 new shares).

The subscription and payment period is from October 3rd to 23rd, 2025. The rights transfer period is from October 3rd to 15th, 2025.

The shares are freely transferable. The offering price is VND 10,000 per share, 72% lower than the market price as of September 12th.

MBS expects to raise VND 687.3 billion, with VND 150 billion allocated for proprietary trading and underwriting, and VND 537 billion for margin lending.

All three issuance plans were approved at the 2025 Annual General Meeting on April 15th. Upon completion, MBS’s outstanding shares will increase from 572.78 million to 667.29 million, with a charter capital of VND 6,672.9 billion.

In terms of business performance, MBS recorded VND 1,461 billion in revenue in the first half of 2025, a 6% decrease. Brokerage revenue fell 11% to VND 325 billion, and FVTPL asset profits dropped 38% to VND 300 billion.

Operating expenses decreased by 44% to VND 390 billion, resulting in a 22% increase in pre-tax profit to VND 611 billion for the first half.

For 2025, MBS targets a pre-tax profit of VND 1,300 billion. With the first-half results, the company has achieved 47% of its annual goal.

As of June 30, 2025, MBS’s total assets reached VND 25,551.3 billion, a 15% increase from the beginning of the year.

Loans totaled VND 12,796 billion, up 24% year-to-date. Margin debt alone reached VND 12,633.5 billion, the highest ever.

The FVTPL portfolio had a book value of nearly VND 3,127 billion, up 60% year-to-date. This includes VND 1,012 billion in bonds, VND 1,561 billion in securities, and nearly VND 509 billion in equities, currently at a 6% paper loss.

The Available-for-Sale (AFS) investments totaled nearly VND 1,668 billion, down VND 1,038.6 billion year-to-date. This primarily consists of VND 1,376 billion in bonds, VND 200 billion in other securities, and nearly VND 92 billion in equities, with a VND 56 billion impairment provision.

DSC Securities Finalizes Date for Issuing Over 70 Million Shares in Dividend Payment and Shareholder Offering

On October 6th, DSC Securities will finalize the shareholder list for the issuance of over 70 million shares, encompassing both a stock dividend and a rights offering.