The Ministry of Justice is currently reviewing a draft decree outlining the minimum wage for employees under labor contracts.

According to the Ministry of Home Affairs’ proposal, the decree applies to: Employees working under labor contracts, employers, and other relevant agencies, organizations, and individuals involved in implementing the minimum wage.

The draft decree proposes a 7.2% increase in the minimum wage compared to current levels, effective from January 1, 2026, aligning with the National Wage Council’s plan.

The Ministry of Home Affairs proposes a 7.2% minimum wage increase, effective from 2026.

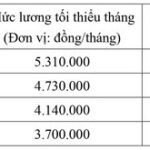

The draft specifies monthly minimum wages for four regions: Region I at 5,310,000 VND/month, Region II at 4,730,000 VND/month, Region III at 4,140,000 VND/month, and Region IV at 3,700,000 VND/month.

These minimum wages represent an increase of 250,000 to 350,000 VND (averaging 7.2%) compared to current levels. The adjustment exceeds the minimum living standards for workers by approximately 0.6% until the end of 2026, aiming to improve workers’ livelihoods.

“This adjustment balances the interests of both workers and businesses, focusing on enhancing workers’ living standards while ensuring the sustainability and growth of business operations,” explained the Ministry of Home Affairs.

The draft also outlines hourly minimum wages for the four regions: Region I at 25,500 VND/hour, Region II at 22,700 VND/hour, Region III at 20,000 VND/hour, and Region IV at 17,800 VND/hour.

Hourly minimum wages are calculated based on the equivalent conversion from monthly minimum wages and standard working hours as defined by the Labor Code.

“This method, recommended by ILO experts, has been adopted by Vietnam since 2022 for determining hourly minimum wages,” stated the Ministry of Home Affairs.

According to the Ministry of Home Affairs, the minimum wage adjustment will take effect on January 1, 2026, providing businesses with sufficient time to prepare their plans and resources.

The Ministry noted that most countries adjust minimum wages at the start of the fiscal year to facilitate business planning. In Vietnam, since 2000, the government has adjusted minimum wages 20 times, with 15 out of 18 adjustments occurring on January 1. Deviations from this date were due to unusual circumstances.

The Power of Deductions: Why a Flat Rate for Dependents is the Fairest Approach

“There has been a debate on whether the personal income tax exemption should be based on regional minimum wages. However, this proposal has not gained the support of the Ministry of Finance. The Ministry argued that the legal regulation on personal exemptions should be unified across the country, regardless of income levels, consumption needs, or geographical differences.”

A Proposed Minimum Wage Increase for the Region from January 1st, 2026

The proposed decree outlines an adjustment to the minimum wage, reflecting a 7.2% increase from the current rate, effective from January 1, 2026. This draft decree also provides a detailed breakdown of the applicable geographical areas across 34 provinces and cities, categorized into four distinct regions.

The Department of Labor Investigates Salaries at 3,400 Businesses

The investigation will be conducted across 3,400 businesses in 18 provinces and cities, representing 8 economic regions nationwide with a significant number of enterprises and a thriving labor market.