I. MARKET TRENDS IN WARRANTS

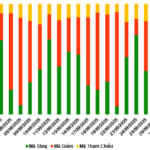

By the end of the trading session on September 30, 2025, the market recorded 120 gainers, 124 losers, and 39 unchanged stocks.

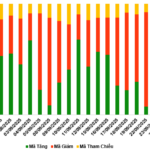

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

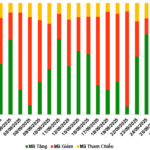

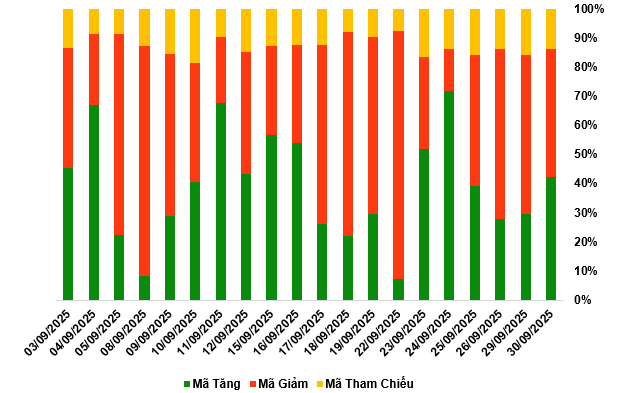

During the September 30, 2025 trading session, sellers continued to dominate the market, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CMWG2511, CHPG2518, CMBB2511, and CVPB2513.

Source: VietstockFinance

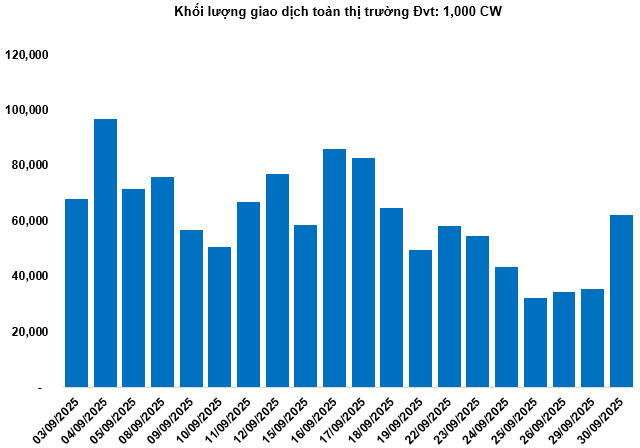

Total market trading volume on September 30 reached 62.29 million CW, up 75.56%; trading value reached 148.17 billion VND, up 112.51% compared to the session on September 29. Among these, CVRE2514 led the market in volume with 4.27 million CW, while CVRE2503 led in trading value with 8.43 billion VND.

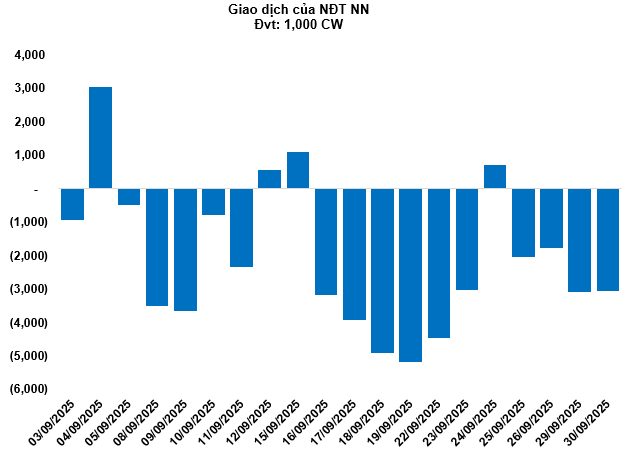

Foreign investors continued to net sell in the September 30 session, with a total net selling of 3.05 million CW. CSHB2512 and CMSN2509 were the two most net-sold codes.

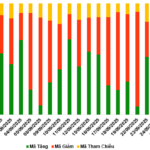

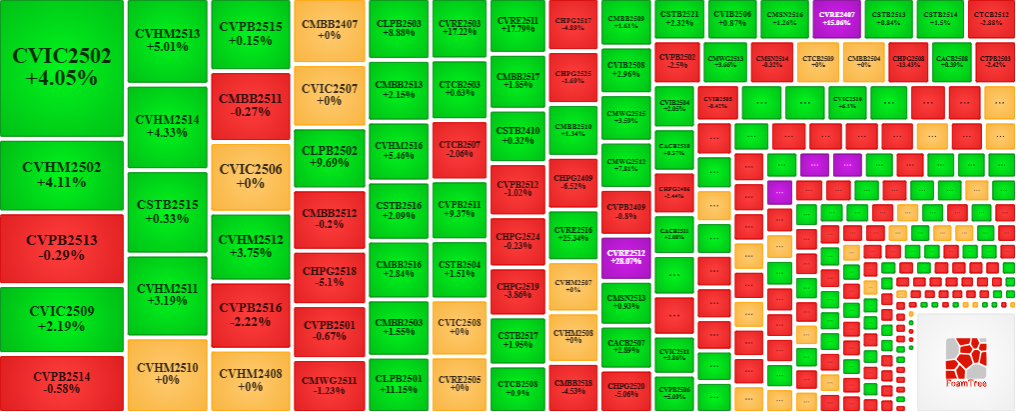

Securities companies SSI, ACBS, HCM, KIS, and VPBankS are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

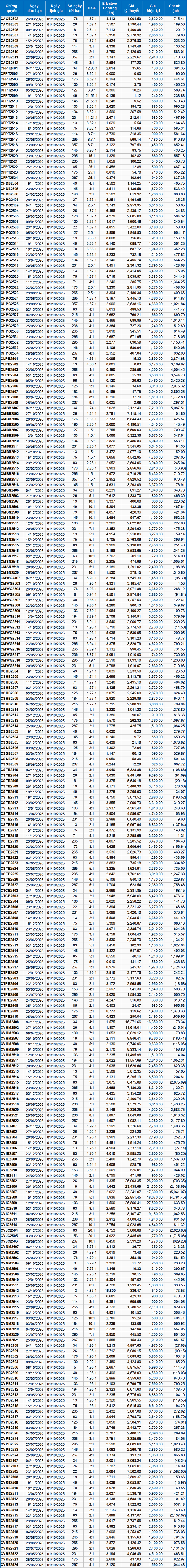

Based on the valuation method suitable for the starting date of October 1, 2025, the reasonable prices of the warrants currently trading on the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (Government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of warrant.

According to the above valuation, CVIC2507 and CVIC2508 are currently the two most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to the underlying securities. Currently, CVNM2512 and CVRE2514 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:58 30/09/2025

Bitter Lessons Learned from Pausing Home Purchases to Avoid ‘Price Hysteria’

The once-viral movement urging people to halt home purchases to combat skyrocketing prices has now morphed into a bitter tale of failure.

Warrant Market Update: September 26, 2025 – Market Liquidity Plunges Further

At the close of trading on September 25, 2025, the market saw 96 stocks rise, 110 decline, and 39 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of 2.05 million CW.