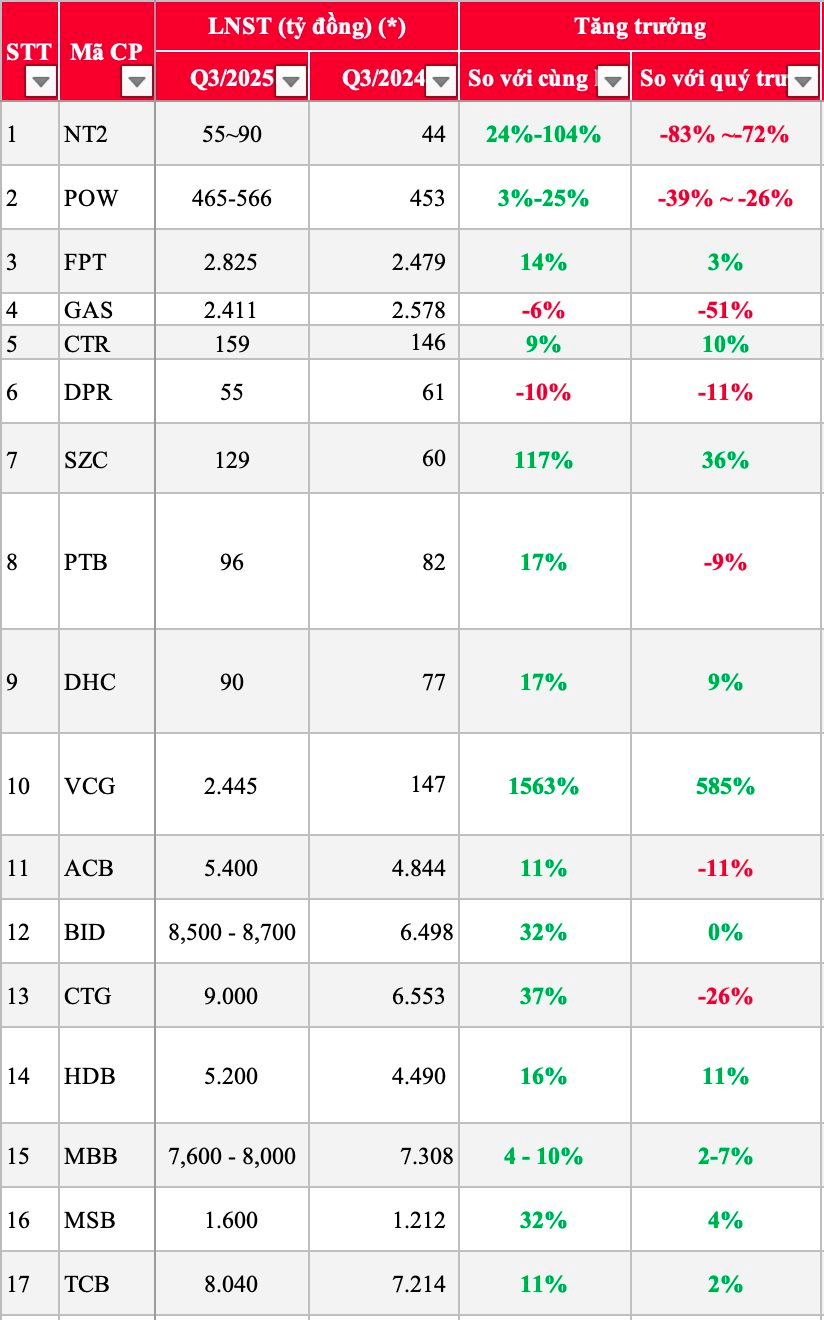

SSI Securities (SSI Research) has released its Q3 2025 earnings estimates for 42 companies. Of these, 36 are projected to report positive year-on-year profit growth, while 6 are expected to see declines.

Specifically, companies anticipated to achieve positive profit growth include: NT2, POW, FPT, CTR, SZC, PTB, DHC, VCG, ACB, BID, CTG, HDB, MBB, MSB, TCB, TPB, OCB, STB, VIB, VCB, VPB, VHM, NLG, KBC, GMD, HAH, HPG, HSG, PVD, IMP, BMP, DGC, PNJ, MWG, DGW, MSN.

Companies expected to report negative profit growth are: GAS, DPR, KDH, VNM, SAB, DBC.

Vinaconex (VCG) stands out with an estimated Q3 2025 profit of VND 2,445 billion, a staggering 1,563% increase year-on-year and 585% quarter-on-quarter. This surge is primarily attributed to a one-time gain of approximately VND 2,300 billion from divesting its stake in the Cát Bà Amatina project. Additionally, its construction segment is expected to maintain growth, supported by an EPC backlog exceeding VND 26,000 billion.

Sonadezi Chau Duc (SZC) also saw a remarkable performance, with projected profits of VND 129 billion, doubling from the previous year (up 117%). This growth is driven by the leasing of 12.06 hectares of land in Chau Duc Industrial Park to VinaOne Steel for a total value of VND 290 billion, maintaining a gross profit margin of 62%.

Sai Gon Thuong Tin Commercial Joint Stock Bank (STB) is forecasted to achieve pre-tax profits of VND 5,800 billion, up 111% year-on-year and 59% quarter-on-quarter. This is largely due to the bank’s receipt of the remaining proceeds from the sale of debt related to Phong Phu Industrial Park by the end of August 2025, totaling around VND 6,400–6,500 billion, despite increased credit costs.

The Gioi Di Dong (MWG) is expected to report profits of VND 1,700 billion, a 111% year-on-year increase and a 3% quarter-on-quarter rise. The company’s recovery is fueled by rising consumer demand, improved profitability in its general merchandise segment, and the absence of unexpected expenses.

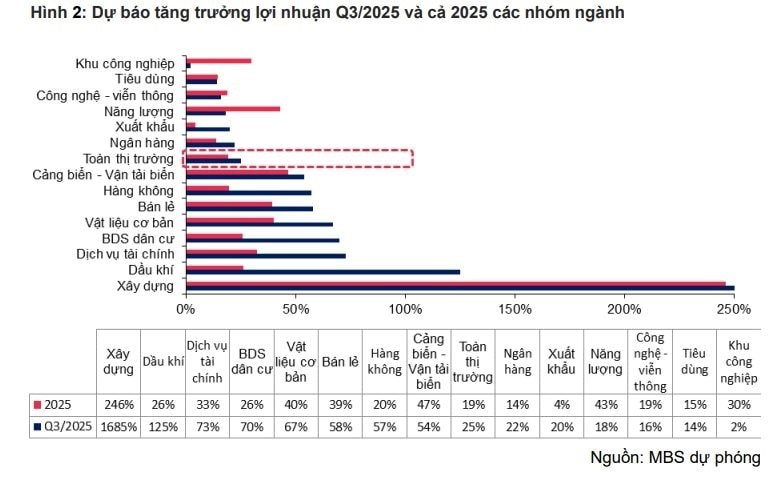

MB Securities (MBS) forecasts that overall market profits could grow by 25% year-on-year in Q3 2025, driven by a low-interest-rate environment, robust public investment disbursement, and supportive policies for businesses.

Among the 60 companies tracked by MBS, several stocks are projected to see exponential profit growth in Q3 2025, including: PLX, BSR, PVS, NLG, PDR, KDH, HSG, VCG, DCM, NT2, HAH, HVN. Conversely, companies like VJC, BCM, POW, IDC are expected to report negative profit growth.

Notably, Vinaconex (VCG) in the construction sector is anticipated to achieve a staggering 3,800% growth, with projected profits of VND 3,120 billion. This extraordinary growth is primarily due to a one-time gain of approximately VND 2,850 billion from divesting the Cát Bà Amatina project. Additionally, its construction segment remains stable, supported by the implementation of the North-South Expressway project.

SSI Chairman: Market Upgrade is No Miracle

The question of whether the market will be upgraded has become a focal point at SSI Securities’ extraordinary shareholders’ meeting held on the afternoon of September 25, 2025, in Ho Chi Minh City. SSI Chairman Nguyen Duy Hung shared his insights on the matter, emphasizing that an impending market upgrade is not a magical solution.

“Hoà Phát’s Profit Forecast for H2 2025: A Bullish Outlook with Expected 42% Growth”

SSI maintains a positive outlook for HPG’s net profit growth for the second half of 2025 and full-year 2026, projecting increases of 42% and 29%, respectively, compared to the same periods last year. This optimistic forecast is attributed to the contribution of the new capacity from the Dung Quat 2 plant, as well as improved prospects for steel prices.

“REE Wins Bid for Two 80 MW Wind Power Projects in Vĩnh Long, Valued at 3.86 Trillion VND”

Vietcap forecasts that the project will yield post-tax profits of VND 123 billion with an average electricity selling price of 7.7 US cents per kWh.