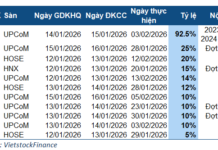

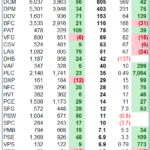

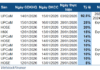

SSI Research has recently released its Q3 2025 earnings estimates for 42 listed companies on the stock exchange. Among these, 34 firms are projected to show year-over-year growth. The list of companies expected to grow includes NT2, POW, FPT, CTR, SZC, PTB, DHC, ACB, BID, CTG, HDB, MBB, TCB, TPB, OCB, VHM, VPB, GMD, HAH, HPG, MSN, DGW, MWG, PNJ, DGC, and BMP, among others.

According to SSI Research, several major banks such as VPB, ACB, BID, CTG, HDB, MSB, TCB, and TPB are forecasted to achieve double-digit profit growth in Q3 2025. This growth is attributed to stable and improving net interest margins (NIM). Notably, Sacombank (STB) stands out with a triple-digit growth rate of 111%, projecting a Q3 profit of VND 5.8 trillion. This surge is driven by the bank’s recent sale of debt related to the Phong Phu Industrial Park in late August, valued at VND 6.4–6.5 trillion.

SSI Research highlights Vinaconex (VCG) as the top performer in Q3 profit growth, with a staggering 1,563% year-over-year increase and 585% quarter-over-quarter growth, reaching VND 2.445 trillion. SSI attributes VCG’s 2025 profits primarily to a significant gain from divesting its stake in VCR, the company behind the Cát Bà Amatina project, valued at over VND 5 trillion, potentially yielding VND 2.3 trillion in post-tax profit.

In the retail sector, SSI Research predicts that Mobile World Group (MWG) will see an 111% profit increase in Q3, reaching VND 1.7 trillion. This growth is fueled by rebounding demand for technology and consumer electronics, alongside improved profitability in its general merchandise segment.

While many companies are poised for growth, SSI Research also forecasts declines for several firms, including VNM, DBC, SAB, KDH, DPR, and GAS.

“Hoà Phát’s Profit Forecast for H2 2025: A Bullish Outlook with Expected 42% Growth”

SSI maintains a positive outlook for HPG’s net profit growth for the second half of 2025 and full-year 2026, projecting increases of 42% and 29%, respectively, compared to the same periods last year. This optimistic forecast is attributed to the contribution of the new capacity from the Dung Quat 2 plant, as well as improved prospects for steel prices.

“REE Wins Bid for Two 80 MW Wind Power Projects in Vĩnh Long, Valued at 3.86 Trillion VND”

Vietcap forecasts that the project will yield post-tax profits of VND 123 billion with an average electricity selling price of 7.7 US cents per kWh.