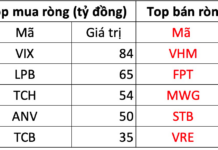

The stock market opened the first trading session of October on a subdued note, with low liquidity. The benchmark index gradually recovered from short-term selling pressure. At the close, the VN-Index rose by 3.35 points (+0.20%) to 1,665.05. Foreign trading was a drag, as foreign investors net sold a significant VND 1.8 trillion across the market.

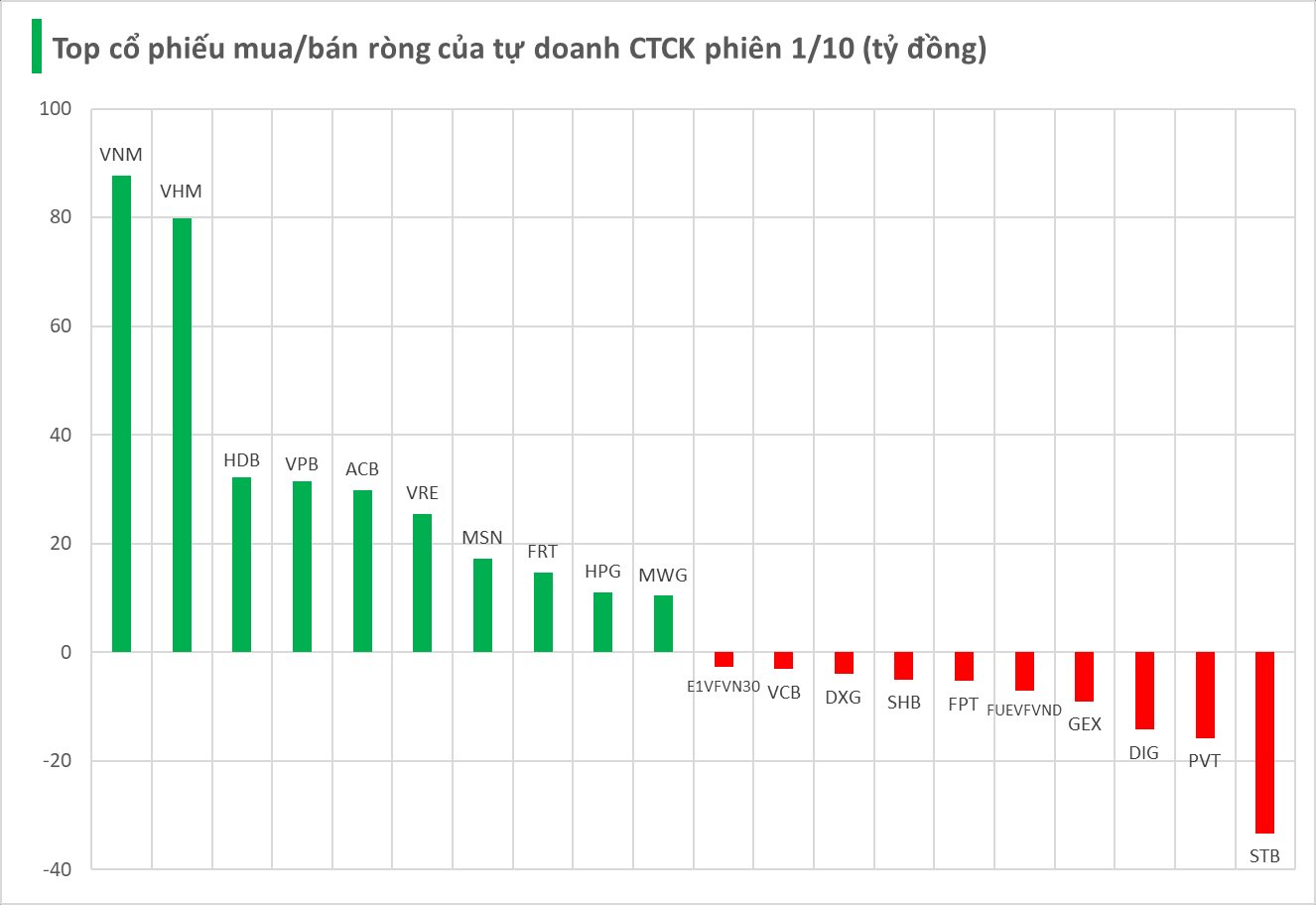

Securities firms’ proprietary trading desks recorded a net buy of VND 285 billion on the Ho Chi Minh Stock Exchange (HOSE).

Specifically, VNM and VHM were net bought with values of VND 88 billion and VND 80 billion, respectively. They were followed by HDB (VND 32 billion), VPB (VND 31 billion), ACB (VND 30 billion), VRE (VND 25 billion), MSN (VND 17 billion), FRT (VND 15 billion), HPG (VND 13 billion), and MWG (VND 10 billion), all of which saw strong buying from securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in STB, with a value of -VND 33 billion, followed by PVT (-VND 16 billion), DIG (-VND 14 billion), GEX (-VND 9 billion), and FUEVFVND (-VND 7 billion). Other stocks also recorded notable net selling, including FPT (-VND 5 billion), SHB (-VND 5 billion), DXG (-VND 4 billion), VCB (-VND 3 billion), and E1VFVN30 (-VND 3 billion).

Market Pulse 01/10: VN-Index Sustains Green at 1,665 Points

At the close of trading, the VN-Index climbed 3.35 points (+0.2%) to reach 1,665.05, while the HNX-Index edged up 0.06 points (+0.02%) to 273.22. Market breadth favored the bulls, with 418 gainers outpacing 295 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 6 retreated, and 2 remained unchanged.

Vietstock Daily 02/10/2025: Prolonged Accumulation Ahead?

The VN-Index continues to oscillate around the Middle Bollinger Band, forming a Doji candlestick pattern. Alternating sessions of gains and losses on low liquidity suggest the market is not yet primed for a breakout, indicating that sideways consolidation is likely to persist in the near term.

Vietstock Daily 01/10/2025: Market Remains in Tug-of-War

The VN-Index remains locked in a volatile tug-of-war around the Bollinger Bands’ Middle line. While the Stochastic Oscillator has flashed a buy signal, market churn persists. The August 2025 low (1,600-1,630 range) will serve as a critical support level for the index in the coming period.