On September 29, Huong Viet Investment Consulting JSC announced it has become a major shareholder of Hoang Anh Gia Lai JSC (HAGL – stock code: HAG).

Specifically, Huong Viet Investment Consulting converted a debt of over VND 720 billion into 60.06 million HAG shares, equivalent to a 4.74% ownership stake. The transaction was executed on September 25.

Following the transaction, Huong Viet Investment Consulting and its related parties now hold nearly 75.6 million HAG shares, representing a 5.96% stake, making them a major shareholder of HAGL.

Among them, Mr. Vo Quang Long, Chairman of the Board and CEO of Huong Viet Investment Consulting, owns 92,000 shares (0.01%); Mr. Dao Duy Hai, Board Member, owns 43,500 shares (0.003%); and its subsidiary, OCBS Securities, holds 15.4 million shares (1.22%).

Huong Viet Investment Consulting is a core member of the Huong Viet Holdings ecosystem, with significant investments in real estate (Metropole Thu Thiem, The Hallmark, The West…) and renewable energy projects.

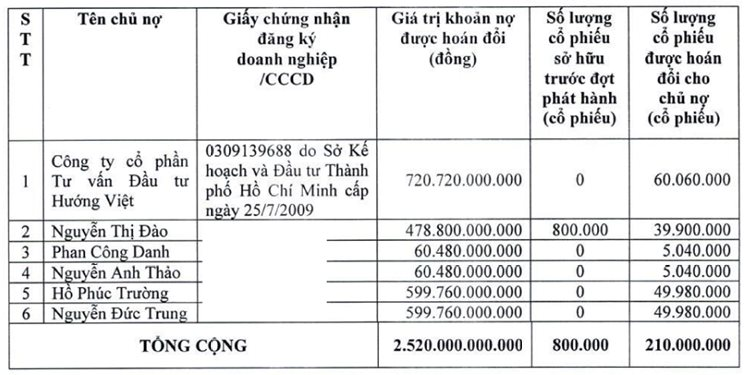

Previously, HAGL successfully issued 210 million common shares to a group of creditors, converting a debt totaling VND 2,520 billion. The conversion price was set at VND 12,000 per share.

After the transaction, this investor group will hold a combined 16.65% of Hoang Anh Gia Lai’s charter capital. According to the issuance terms, all 210 million shares will be restricted from transfer for one year, starting from September 25, 2025.

The debt-to-equity conversion comes as Hoang Anh Gia Lai faces significant debt pressure. Consolidated financial statements as of June 30, 2025, show total liabilities of VND 15,630 billion, 1.5 times higher than equity.

Financial debt accounts for VND 9,320 billion. Interest expenses for the first half of 2025 were VND 360 billion, averaging VND 2 billion per day. This transaction is expected to reduce financial burdens and improve the balance sheet.

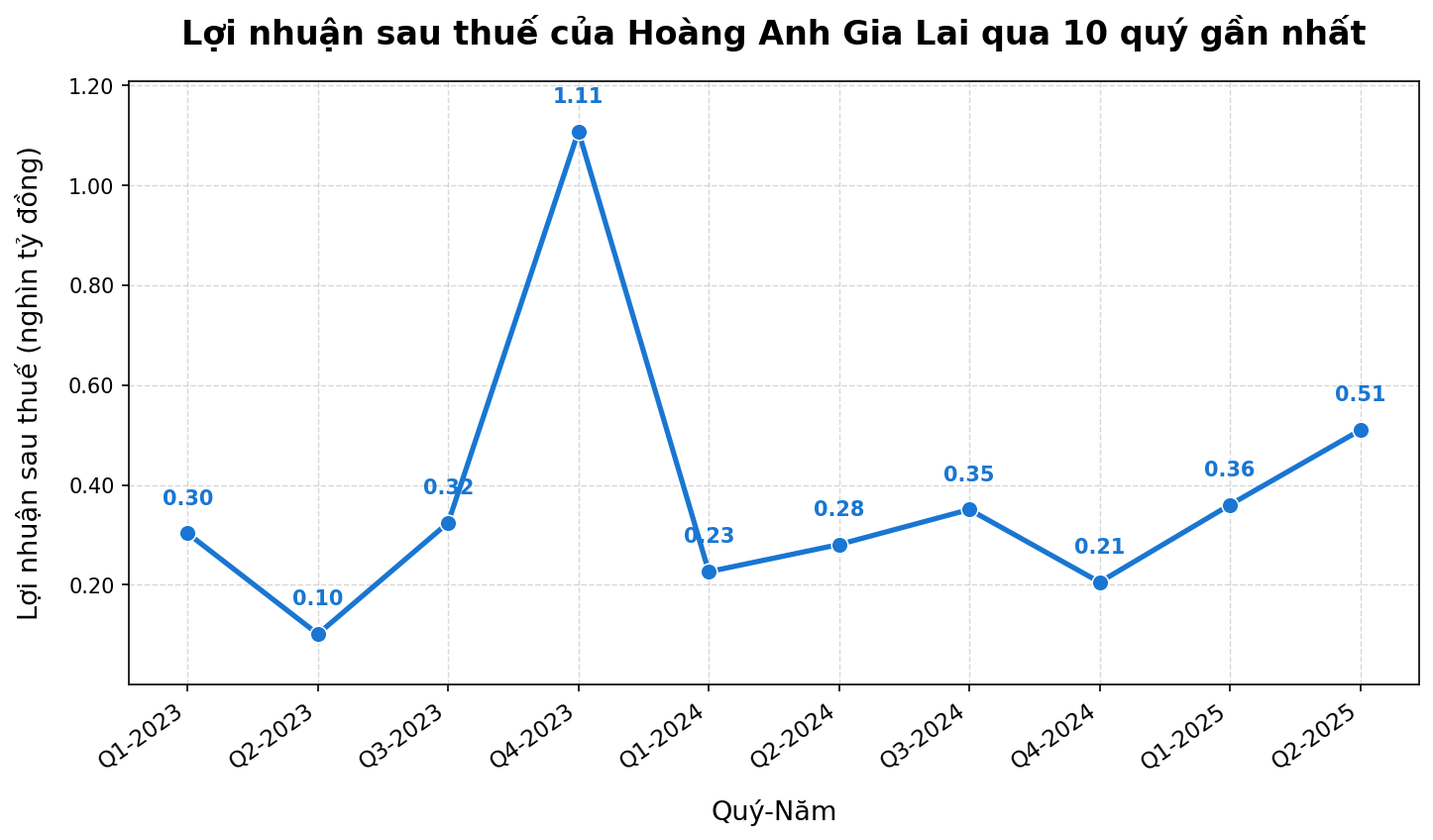

In terms of business performance, HAGL reported VND 3,707 billion in net revenue for the first half of 2025, a 34% increase year-over-year. Net profit reached VND 880 billion, up 76%. The fruit segment remained the main driver with VND 3,005 billion, up 47%, while the pig farming segment declined sharply by 78% to VND 134 billion.

These positive results helped the company eliminate all accumulated losses. Chairman Doan Nguyen Duc stated that from the second half of the year, durian revenue will start being recognized, supporting the company’s target of VND 1,500 billion in net profit for 2025.

Hoàng Anh Gia Lai Successfully Eliminates Over 2.5 Trillion VND in Debt

Hoàng Anh Gia Lai successfully swapped 210 million HAG shares with Huong Viet Investment Consulting Joint Stock Company and five individual investors: Ms. Nguyen Thi Dao, Mr. Phan Cong Danh, Mr. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung. This swap corresponds to the conversion of a debt totaling over 2.5 trillion VND.

Bầu Đức’s Burden Eases: HAGL Eliminates Over VND 2.5 Trillion in Debt, Officially Ending Years of Accumulated Losses

After years of restructuring, Bầu Đức’s Hoàng Anh Gia Lai has reached a turning point, successfully eliminating over 2.5 trillion VND in debt through a strategic conversion into shares for six key shareholders.