Recently, the Ho Chi Minh City Stock Exchange (HoSE) announced that October 10, 2025, will be the final registration date for the 2024 cash dividend payment by Transimex Joint Stock Company (Stock Code: TMS).

Accordingly, Transimex will distribute a 10% cash dividend to shareholders, meaning each shareholder holding one share will receive VND 1,000. The payment is scheduled for October 23, 2025.

With over 169.3 million TMS shares currently in circulation, Transimex is expected to allocate more than VND 169.3 billion for this dividend payout.

Illustrative image

In other developments, Transimex recently announced changes to its leadership team. Specifically, the company has relieved Mr. Nguyen Hoang Hai of his duties as Deputy General Director, effective October 10, 2025.

Previously, on September 23, 2025, Mr. Hai submitted his resignation to Transimex.

Mr. Nguyen Hoang Hai, born in 1971, holds a degree in Waterway and Road Transportation Economics. He was appointed Deputy General Director of Transimex on March 6, 2023.

Regarding business performance, Transimex’s consolidated financial report for the first half of 2025 shows a net revenue of nearly VND 1,567.1 billion, a slight increase of 3.6% compared to the same period in 2024. After deducting the cost of goods sold, gross profit reached over VND 275.7 billion, up 13.6%.

After accounting for taxes and fees, the company reported a net profit of nearly VND 166.4 billion, a 9.8% decrease compared to the previous year.

For 2025, Transimex set a target of achieving a consolidated after-tax profit of nearly VND 204.2 billion. By the end of the first two quarters, the company has completed 81.5% of its profit plan.

As of June 30, 2025, Transimex’s total assets increased by VND 58 billion compared to the beginning of the year, reaching over VND 8,418.6 billion. Fixed assets account for 40.7% of total assets, amounting to more than VND 3,423.2 billion, while long-term financial investments total over VND 1,875 billion, representing 22.3% of total assets.

On the liabilities side, total payables stand at nearly VND 3,165 billion, a slight decrease of VND 72.3 billion compared to the beginning of the year. Short-term and long-term loans total nearly VND 2,427.9 billion, making up 76.7% of total liabilities.

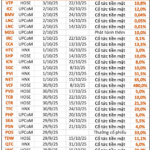

Upcoming Dividend Ex-Dates (Sept 29 – Oct 3): Top Cash Dividends Reach 480%, Techcombank, Vĩnh Hoàn, Viettel Post Lead the Pack

This week, 25 companies are distributing cash dividends, with the highest payout reaching an impressive 480% and the lowest at 0.01%.

Hai Phong Securities Poised to Join the Trillion-Dong Capital Club

On September 25th, the Board of Directors of Hai Phong Securities Corporation (Haseco, UPCoM: HAC) passed a resolution to issue 100 million shares in a private placement. This move aims to raise VND 1,000 billion, increasing the company’s charter capital from nearly VND 292 billion to approximately VND 1,292 billion, a remarkable 4.4-fold increase.

Hoàng Anh Gia Lai Successfully Eliminates Over 2.5 Trillion VND in Debt

Hoàng Anh Gia Lai successfully swapped 210 million HAG shares with Huong Viet Investment Consulting Joint Stock Company and five individual investors: Ms. Nguyen Thi Dao, Mr. Phan Cong Danh, Mr. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung. This swap corresponds to the conversion of a debt totaling over 2.5 trillion VND.