According to a report submitted to the State Securities Commission, Vietnam Airlines successfully distributed 897 million shares, equivalent to 99.68% of the total offered shares, at a price of VND 10,000 per share. The remaining 2.9 million shares were not distributed, as the Board of Directors decided to halt further sales.

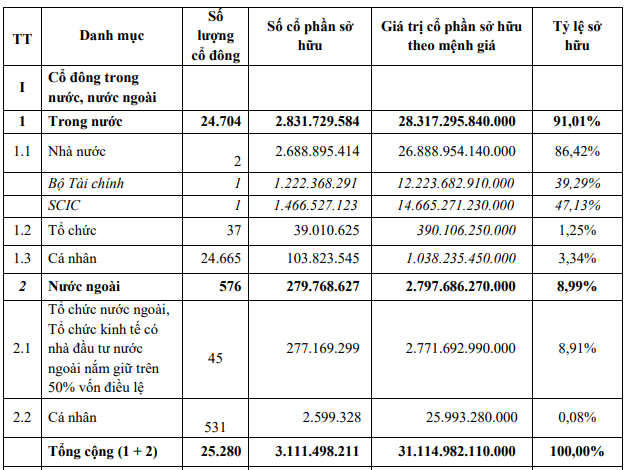

Following the issuance, Vietnam Airlines’ chartered capital increased to VND 31,115 billion, corresponding to over 3.11 billion shares. The ownership structure also underwent significant changes, with the State Capital Investment Corporation (SCIC) becoming the largest shareholder at 47.13%, surpassing the Ministry of Finance (39.29%). Another major shareholder is ANA Holdings Inc. (Japan), holding 5.62%.

This shift occurred after the Ministry of Finance’s purchase rights were transferred to SCIC during the capital increase. However, with a combined state ownership of over 86%, the government’s control over the national airline remains secure.

As planned, the additional shares will complete the supplementary registration process at the Vietnam Securities Depository and Clearing Corporation in Q4/2025 before official trading begins.

Vietnam Airlines stated that the entire raised capital will be used to alleviate debt pressure. Specifically, approximately VND 6,000 billion will be allocated to settle supplier debts and a portion of recapitalization loans, while the remaining VND 3,000 billion will repay short-term and long-term loans due.

After enduring the prolonged impact of the COVID-19 pandemic, Vietnam Airlines has experienced a robust recovery. In the first half of 2025, the airline recorded a net profit of over VND 6,200 billion, the highest semi-annual profit in its history.

| Vietnam Airlines’ Quarterly Net Profit |

Recently, Vietnam Airlines announced plans to purchase or lease 30 wide-body aircraft, either Airbus A350-900 or Boeing B787-9, with deliveries scheduled from 2028 to 2032.

If the purchase option is chosen, the total investment could exceed USD 10 billion for the 30 wide-body aircraft and engines, excluding potential discounts for bulk purchases.

Previously, the government approved the investment plan for 50 narrow-body aircraft (Airbus A320 Neo or Boeing 737 Max) and 10 spare engines, with a total investment of nearly USD 3.7 billion (approximately VND 92,810 billion) – equivalent to 1.6 times the airline’s current total assets.

Vietnam Airlines Chairman Đặng Ngọc Hòa emphasized that this is one of the company’s most critical projects, aimed at supporting its recovery and network expansion plans. This year, the airline intends to launch or resume operations on 15 international routes.

Vũ Hạo

– 11:10 30/09/2025

Trung Đô Offers 7.5 Million Shares at VND 10,000 Per Share to Settle Bank Debt

Trung Đô JSC (UPCoM: TDF) plans to raise VND 75 billion through a 25% rights issue, with proceeds entirely allocated to debt repayment at Vietinbank. This move comes amidst the company’s consecutive losses and a 67% plunge in share price from its peak.