Next week marks a pivotal moment for Vietnam’s stock market. FTSE Russell is set to announce the results of its September 2025 semi-annual market classification review on October 8th (following the close of the U.S. market on October 7th). This announcement will reveal whether Vietnam will be upgraded from Frontier Market to Secondary Emerging Market status. Anticipation surrounding this potential upgrade has heightened anxiety among both institutional and individual investors.

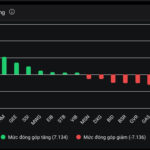

The VN-Index has traded sideways this month, while liquidity has significantly declined, dropping from VND 55.6 trillion in August to VND 39.7 trillion in September.

In its latest report, Vietcap Securities maintains confidence that FTSE Russell will deliver a positive outcome for Vietnam next Wednesday.

According to Vietcap, the first key criterion is the Settlement Cycle (DvP), currently rated as “Restricted” and requiring an upgrade to “Pass” for market reclassification. This criterion pertains to the pre-funding requirement for foreign institutional investors (FIIs), mandating that funds be available on T+0 for buy orders.

The Ministry of Finance issued Circular 68 in November 2024, eliminating this requirement and introducing a new No Pre-Funding (NPF) process. Over the past 11 months, FTSE Russell has assessed the effectiveness of the NPF process and gathered feedback from market participants. Vietcap believes this criterion is now poised to achieve a “Pass” rating.

The second criterion, Settlement – Costs Associated with Failed Trades, was upgraded from “Unrated” to “Restricted” in March 2025 and also requires a “Pass” rating for reclassification. Following the NPF implementation, a failed trade handling procedure was established, clearly outlining critical timelines and associated costs. Vietnam recorded its first and only failed trade in December 2024, which was successfully resolved by a domestic securities firm (Vietcap). This incident served as a practical test case for FTSE Russell to validate the failed trade handling process. Vietcap anticipates this criterion will now be upgraded to “Pass.”

Regarding the account opening process for foreign investors, the State Bank of Vietnam recently issued an official dispatch to commercial banks and foreign bank branches, mandating compliance with new regulations outlined in Circular 03 and Circular 25. This dispatch urges banks to rigorously and promptly implement these regulations to streamline the account opening process. A significant change is the elimination of consular legalization requirements for payment account opening documents. Consequently, Vietcap estimates that the account opening process for foreign investors will now take approximately two weeks, contingent on cooperation between the domestic custodian bank and the investor.

Vietcap reports that FTSE Russell conducted two formal meetings this month: the FTSE Market Classification Advisory Committee on September 2nd and the FTSE Russell Policy Advisory Board on September 18th. The FTSE Market Classification Advisory Committee comprises market experts with technical expertise in trading, portfolio management, and custody, while the FTSE Russell Policy Advisory Board includes senior personnel from investment management firms, investment advisors, and asset owners.

The FTSE Market Classification Advisory Committee formally reviews countries on the Watch List (including Vietnam) for potential upgrades or downgrades. FTSE Russell’s recommendations are then submitted to the FTSE Russell Policy Advisory Board. Subsequently, FTSE Russell seeks confirmation of these recommendations from the Policy Advisory Board, which are then presented to the FTSE Russell Index Governance Committee for final approval. The FTSE Russell Index Governance Committee meeting is scheduled for this week.

Unlock Your Investment Journey with Dragon Capital’s “Metro Thịnh Vượng”

Unlock exclusive benefits when you open a new online investment account with Rong Viet: enjoy commission-free trading, a competitive margin rate of 6.88% per annum, access to our comprehensive ecosystem, and a chance to win VND 10 million in RVPIF fund certificates through our exciting lucky draw.

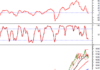

Vietnam’s Stock Market Takes a Breather After Four Consecutive Months of Rally

The stock market traded in a tug-of-war as investor sentiment turned cautious ahead of an upcoming wave of critical information releases.