AI-generated illustration

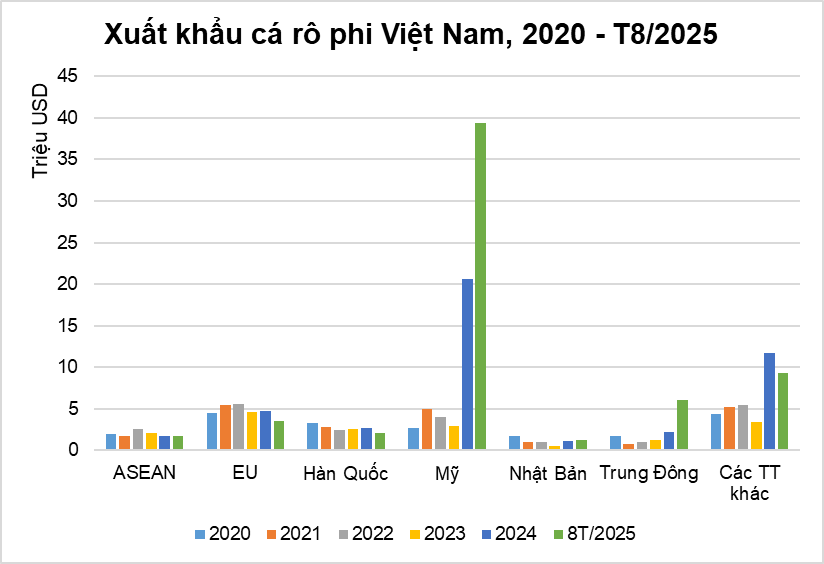

According to Vietnam Customs data, in the first eight months of 2025, pangasius exports (including tilapia) reached over $63 million, a 174% increase compared to the same period last year. Notably, exports to key markets totaled $52 million, a remarkable 359% surge year-over-year. This figure surpasses Vietnam’s pangasius export value over the past five years, since 2020.

The United States leads as the top importer of Vietnamese pangasius, accounting for 70% of Vietnam’s total pangasius exports.

The International Trade Centre (ITC) reports that the U.S. is the largest consumer of pangasius, with China as the primary global supplier. As of July 2025, pangasius is America’s most popular whitefish, outpacing cod and catfish. Frozen pangasius fillets (HS code 030461) are the most consumed product in the U.S. market.

In the first seven months of 2025, the U.S. imported $1.1 billion in whitefish, an 8% increase year-over-year. Specifically, frozen pangasius fillets (HS 030461) accounted for $262 million, up 19% from 2024, representing 23% of total whitefish imports. Vietnam is the second-largest supplier of HS 030461 products to the U.S., trailing only China.

Key pangasius suppliers to the U.S. include China, Indonesia, Egypt, and Brazil. China dominates as the world’s largest pangasius exporter, with the U.S. as its primary market. No other nation can currently rival China in frozen pangasius fillet production.

The global pangasius market is booming, with production projected to exceed 7 million tons in 2025. The Vietnam Association of Seafood Exporters and Producers (VASEP) notes that Vietnam faces challenges in directly competing with industry leaders as a primary global supplier.

However, alongside catfish—a whitefish similar to pangasius—many Vietnamese companies are now farming and exporting pangasius. The top five pangasius exporters in the first eight months of 2025 are: Indian Ocean Co., Ltd., V Investment and Finance Co., Ltd., Nam Viet Corporation, Kim Phat Seafood Import-Export Co., Ltd., and NVD Fisheries Co., Ltd.

AI-generated illustration

VASEP emphasizes that to compete with industry giants, Vietnam must focus on key strategies. First, increasing production volume and expanding farming areas is essential.

Second, ensuring quality and diversifying products to meet stringent international standards, especially in the U.S. and EU, is critical. Focusing on value-added products like fillets and fish cakes will enhance market presence and profitability. Developing frozen fillets can improve competitiveness against China and Brazil.

Third, building a strong brand and enhancing international marketing efforts are vital. Leveraging free trade agreements (FTAs), adopting technology, and optimizing production processes will boost efficiency. Investing in infrastructure and logistics is also crucial.

Navigating U.S. Tax Challenges: A Critical Test for Businesses

The U.S.’s 20% retaliatory tax on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.

U.S. Tax Challenges: A Critical Litmus Test for Businesses

The 20% reciprocal tax imposed by the U.S. on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.