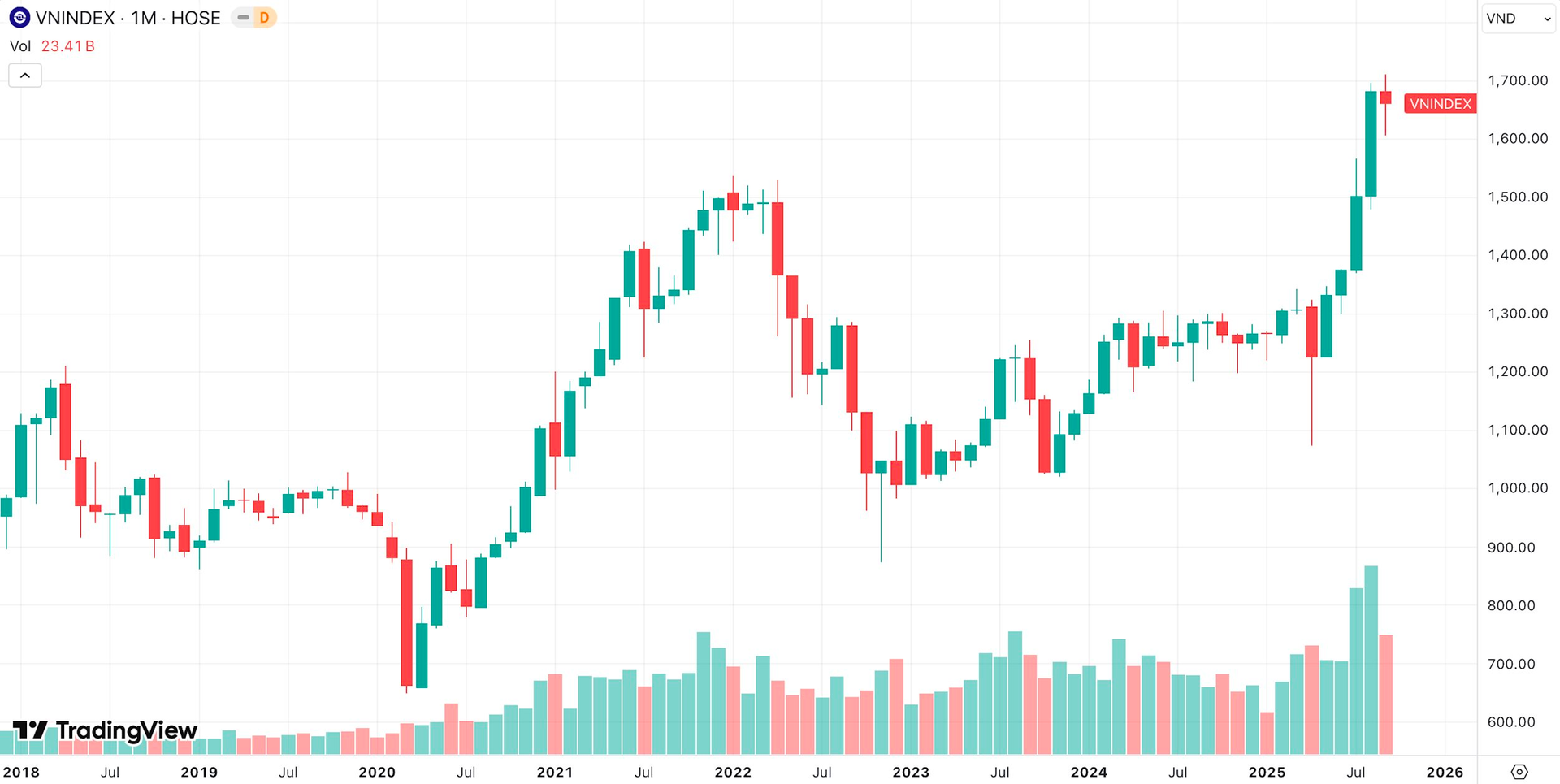

Vietnam’s stock market concluded September with modest volatility, ending a four-month rally. The VN-Index dipped slightly by 20 points (-1.2%), marking a pause after a 37% surge over the previous four months. This correction was anticipated as investors locked in profits near the 1,700-point peak.

Despite foreign investors’ continued net selling, domestic capital inflows, fueled by a low-interest-rate environment, sustained market stability. However, investor sentiment remains cautious ahead of critical updates, including FTSE Russell’s semi-annual market classification review.

All eyes are on October 8th when FTSE Russell announces its decision. Analysts predict Vietnam’s upgrade from Frontier to Secondary Emerging Market status, a move Finance Minister Nguyễn Văn Thắng emphasized through recent regulatory reforms aimed at attracting foreign investment.

SSI Chairman Nguyễn Duy Hưng pegged upgrade odds above 90%, while Guotai Junan Vietnam’s Huang Bo highlighted its potential to unlock billions in foreign capital. Beyond classification, Q3 earnings reports loom as another market catalyst.

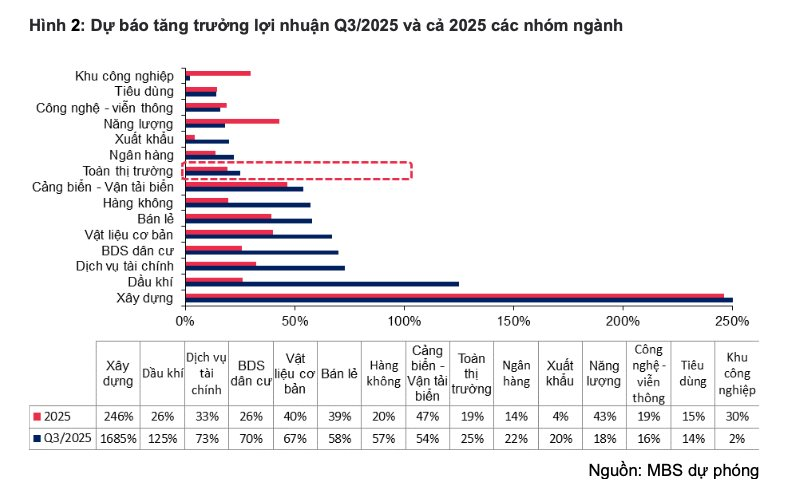

“Our reforms aim to immediately facilitate foreign capital inflows,” Minister Thắng stated, underscoring policy efforts. Securities firms and key sectors like banking and real estate are poised for strong results, though investors should balance optimism with short-term volatility awareness.

Upcoming developments lean positive, but confirmation is pending. Investors should navigate near-term fluctuations while focusing on long-term opportunities.

Premium Stocks Scarce in Vietnam’s Market

The VN-Index has surpassed the 1,600-point milestone for the first time, potentially paving the way for an upgrade. However, experts caution that the market still lacks diversity, heavily dominated by financial and real estate stocks.

Week of September 29 – October 3: Dividend Bonanza Arrives, with One Company Offering Up to 480%

The week of September 29th to October 3rd saw impressive dividend payouts, with 23 companies closing their dividend rights. The highest payout ratio reached a staggering 480%, equivalent to VND 48,000 per share, awarded by a leading coffee enterprise.