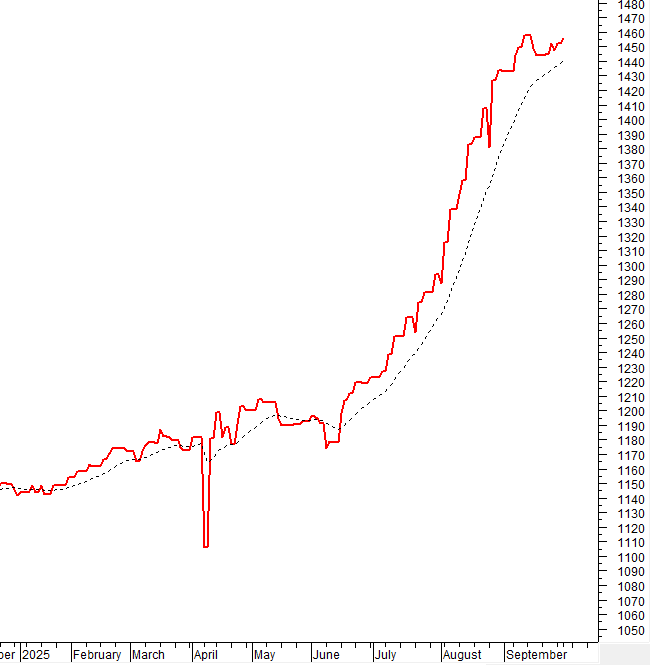

I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 1, 2025

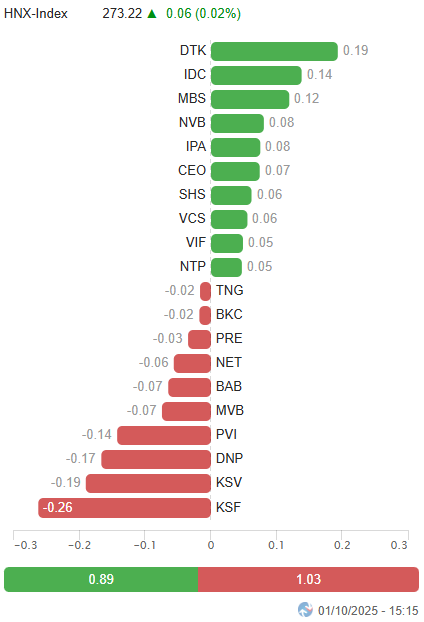

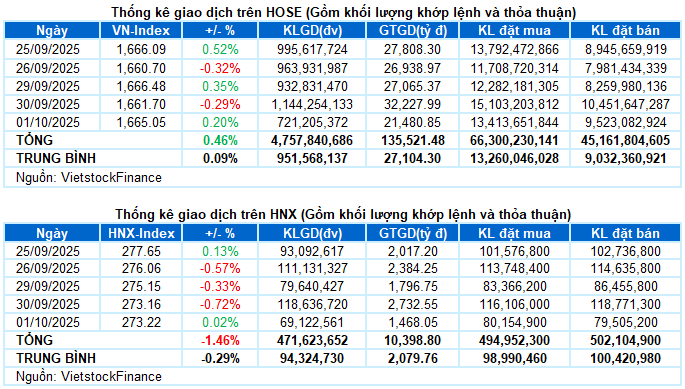

– Key indices saw a slight uptick in the first trading session of October. The VN-Index rose by 0.2%, reaching 1,665.05 points, while the HNX-Index remained nearly flat with a 0.02% increase, closing at 273.22 points.

– Market liquidity continued its lackluster trend. Trading volume on the HOSE floor plummeted by 36.5%, totaling nearly 666 million units. Similarly, the HNX floor witnessed a 37.3% decline compared to the previous session, with just over 65 million matched orders.

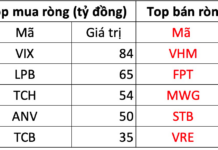

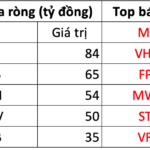

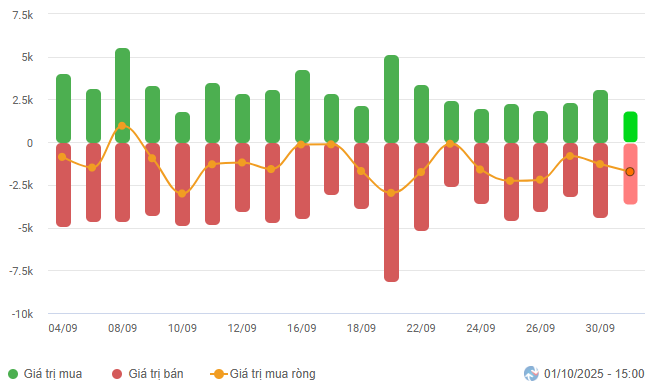

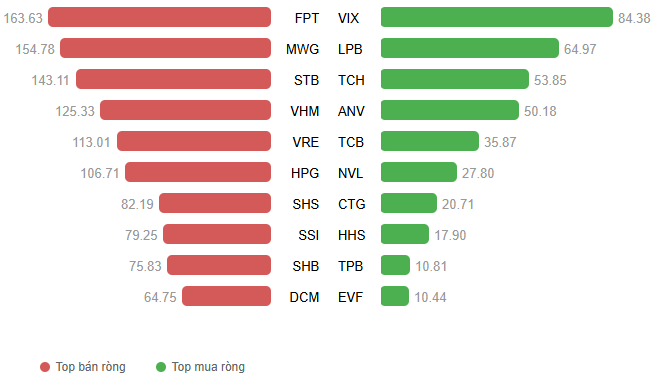

– Foreign investors maintained a strong net selling position, with values exceeding 1.5 trillion VND on the HOSE and nearly 126 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

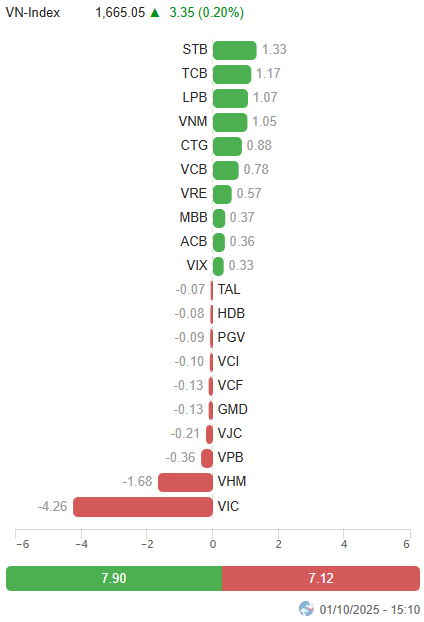

– The market kicked off October with familiar tug-of-war dynamics, as cautious sentiment prevailed. Selling pressure from the VIC and VHM duo initially weighed on the VN-Index, but a rebound in the financial sector quickly restored balance. Market breadth improved significantly, with more gainers than losers, though investor sentiment remained cautious. Weak liquidity kept the VN-Index from breaking out, hovering around 1,665 points for most of the session. It closed at 1,665.05 points, up 3.35 points from the previous session.

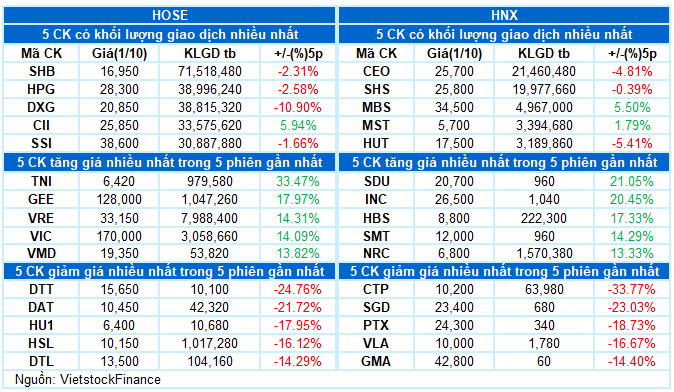

– The financial sector led the charge, contributing 8 out of the top 10 stocks with the most positive impact on the VN-Index, adding over 6 points. However, this effort was largely offset by pressure from the VIC and VHM duo.

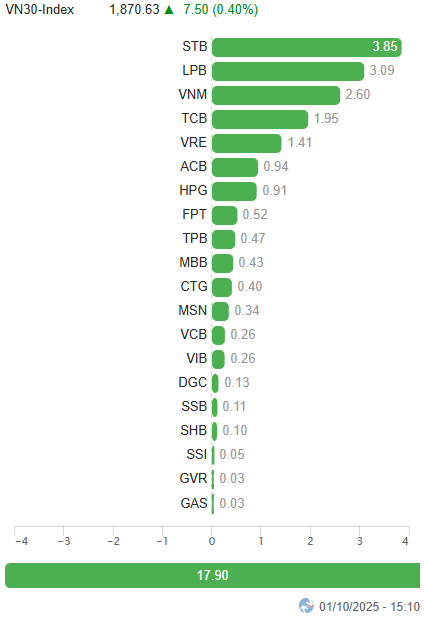

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index ended the session 7.5 points higher at 1,870.63 points. Buyers dominated, with 22 gainers, 6 losers, and 2 unchanged stocks. STB led the pack with a notable 5.1% gain, followed by VNM, VRE, and LPB, all surging over 3%. Conversely, VIC ended its winning streak with a near 3% decline, while VHM and VJC were also under selling pressure, dropping over 1%.

Sector performance was mixed, with narrow fluctuations. Real estate was the only sector down more than 1%, pressured by VIC and VHM, though other stocks like TCH (+3.39%), VRE (+3.27%), NVL (+2.62%), IDC (+1.56%), and SZC (+1.92%) performed well.

The financial sector was today’s standout, led by “blue-chip” stocks such as STB (+5.1%), TPB (+2.39%), CTG (+1.38%), LPB (+3.03%), and TCB (+1.85%). Meanwhile, the securities sector saw only VIX (+2.49%) gain significantly with notable liquidity, while insurance stocks like BVH, PVI, BMI, BIC, MIG, and PRE were in the red.

Additionally, positive performances from VNM (+3.5%), HAG (+3.68%), KDC (+1.55%), ASM (+1.24%), and HNG (+1.67%) helped the essential consumer goods sector rise by 0.78%. Other sectors saw modest gains of less than 0.5%.

The VN-Index continues to oscillate around the Middle line of the Bollinger Bands, forming a Doji candlestick pattern. Alternating sessions of gains and losses on low volume indicate the market isn’t ready for a breakout, suggesting sideways accumulation is likely to persist in the short term.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Doji Candlestick Pattern Emerges

The VN-Index continues to oscillate around the Middle line of the Bollinger Bands, forming a Doji candlestick pattern.

Alternating sessions of gains and losses on low volume indicate the market isn’t ready for a breakout, suggesting sideways accumulation is likely to persist in the short term.

HNX-Index – Stochastic Oscillator and MACD Continue to Weaken

The HNX-Index halted its decline and is finding support at the lower boundary of the Triangle pattern (around 270-272 points).

However, the index’s short-term outlook remains uncertain as the Stochastic Oscillator and MACD continue downward after issuing sell signals.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Flow: Foreign investors continued net selling on October 1, 2025. If this trend persists in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS FOR OCTOBER 1, 2025

Economic & Market Strategy Analysis Department, Vietstock Advisory Division

– 17:48 October 1, 2025

Market Retreats as Blue-Chip Stocks Take a Breather

The VN-Index closed today’s session (September 30) down nearly 5 points, weighed down by weakness in real estate and public investment stocks. Even Vingroup’s blue-chip shares lost momentum, despite VRE hitting its ceiling price.

Market Pulse 10/01: Recovery Momentum Spreads Across Financial Sector, VN-Index Poised for Breakout

As of 10:30 AM, the market remains bullish, with the VN-Index climbing over 3.5 points to trade at 1,665. The HNX-Index also saw a modest uptick, hovering around 273 points. Leading the charge in this upward trend are the finance, industrial, and materials sectors, which continue to make significant contributions to the overall market gains.

Market Pulse 30/09: Capital Flows Return as VN-Index Experiences Deep Correction

After a sharp decline at the start of the afternoon session, the market gradually recovered, closing near the reference level. However, the indices still ended the day in negative territory. The VN-Index closed at 1,661.7 points, down nearly 5 points, while the HNX-Index settled at 273.16 points, shedding 2 points.