Camenco’s headquarters in Ca Mau Province – Image: Camenco

|

According to the plan, the People’s Committee of Ca Mau Province aims to auction nearly 536,000 Camenco shares at a starting price of 19,537 VND per share, potentially raising approximately 10.5 billion VND. The 2025 semi-annual financial report reveals that the People’s Committee of Ca Mau Province currently holds over 12 million shares, representing a 91.88% stake in Camenco.

HOSE announced that information regarding the auction will be available from October 3, with the auction scheduled for October 23.

Camenco originated as the Ca Mau Urban Works Company, established in 1991 through the merger of three entities: the Ca Mau Township Construction Materials Company, the Ca Mau Township Sanitation Company, and the Ca Mau Township Housing Construction Department.

In June 2001, the Ca Mau Urban Works Company merged with the Minh Hai Water Supply Company, becoming the Ca Mau Water Supply, Drainage, and Urban Works Company. By June 2010, the provincial government transformed it into a 100% state-owned enterprise, renaming it the Single-Member LLC Ca Mau Water Supply, Drainage, and Urban Works Company.

In September 2013, the Single-Member LLC Ca Mau Urban Environment Company was spun off from the Single-Member LLC Ca Mau Water Supply, Drainage, and Urban Works Company to privatize the water supply division, as directed by the provincial government. On January 1, 2020, the company officially transitioned from a Single-Member LLC to a joint-stock company, adopting the name Ca Mau Urban Environment Joint Stock Company, which it retains to this day.

In the stock market, the company was previously approved for trading on UPCoM under the code CAM. However, in December 2021, the State Securities Commission issued a notice halting the review of Camenco’s public company registration due to its capital as of December 31, 2020, being below 30 billion VND and the number of non-major shareholder investors holding less than 10% of voting shares.

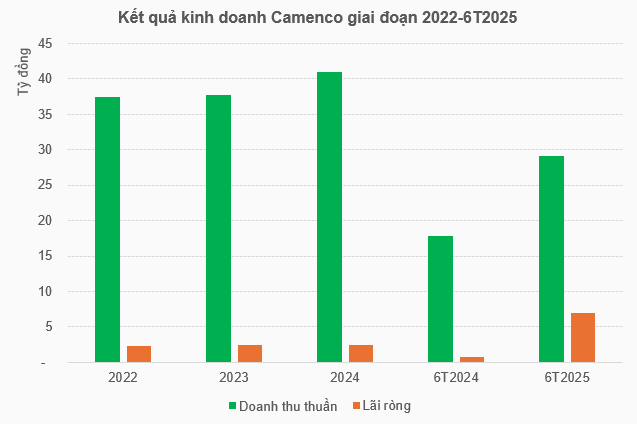

In recent years, Camenco has maintained a steady performance, with consistent growth in revenue and profit. In the first half of 2025, the company generated over 29 billion VND in net revenue and nearly 7 billion VND in net profit, marking a 63% increase in revenue and a 7.6-fold rise in profit compared to the same period last year.

Source: VietstockFinance, compiled by the author

|

– 11:28 01/10/2025

Billionaire Nguyen Thi Phuong Thao Shares Story of “Rescuing” HOSE from System Overload

Billionaire Nguyễn Thị Phương Thảo revealed that she, alongside FPT Corporation Chairman Trương Gia Bình and other prominent business leaders, collaborated to “rescue” the Ho Chi Minh City Stock Exchange (HOSE) during a critical system overload.