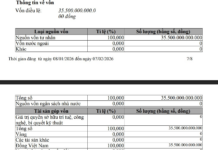

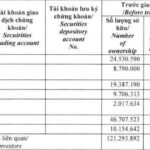

Dragon Capital, a leading foreign fund group, recently reported the sale of 2.2 million shares of DXG during the trading session on September 25, 2025.

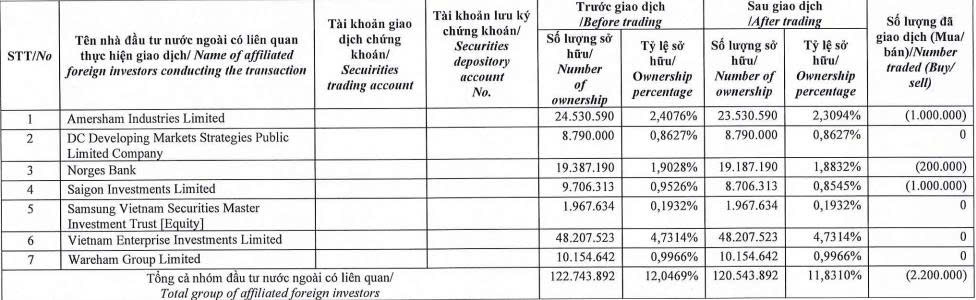

The transaction was executed through three member funds: Amersham Industries Limited sold 1 million shares, Norges Bank sold 200,000 shares, and Saigon Investments Limited sold 1 million shares.

Following this transaction, Dragon Capital’s ownership in DXG decreased from over 122.7 million shares to more than 120.5 million shares, reducing its stake from 12.0469% to 11.831% of Dat Xanh Group’s capital.

Source: DXG

Based on the share price of DXG at 23,200 VND per share on September 25, 2025, the foreign fund group is estimated to have earned over 51 billion VND from this sale.

In other developments, Dat Xanh Group recently announced a Board of Directors resolution approving the investment plan for a Saigon Riverfront project in Ho Chi Minh City by a wholly-owned subsidiary.

However, the specific subsidiary responsible for this project has not yet been disclosed.

The project, a high-rise residential and commercial complex, spans 23,000 m² with 6 blocks of 40 floors each. The total construction area is 286,000 m², offering approximately 3,000 units, with a total investment of 7 trillion VND.

Legally, the project aligns with the 1/2000 zoning plan and has obtained investment approval and a 1/500 site plan approval.

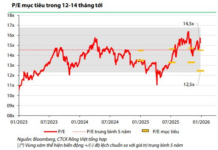

Notably, Dat Xanh Group’s land expansion comes amid signs of recovery in the real estate market. The company has also prepared significant capital since early 2025 to support this growth.

According to the audited consolidated financial report for the first half of 2025, Dat Xanh Group’s cash and bank deposits totaled nearly 3.375 trillion VND, an increase of approximately 2.048 trillion VND from the beginning of the year. At the end of Q1 2025, this figure was over 5.191 trillion VND.

Additionally, in early August 2025, Dat Xanh Group announced a resolution to issue 93.5 million private placement shares, as approved at the 2025 Annual General Meeting. The issuance is expected to take place in Q3-Q4 2025.

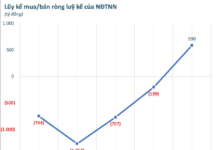

Landmark Group’s Stock Plunges Amid Persistent Sell-Off

The DXG stock of Dat Xanh Group has faced consistent sell-offs by Dragon Capital, with multiple large-scale transactions. Additionally, the company’s CEO, deputy CEO, and board members have collectively offloaded nearly ten million DXG shares.