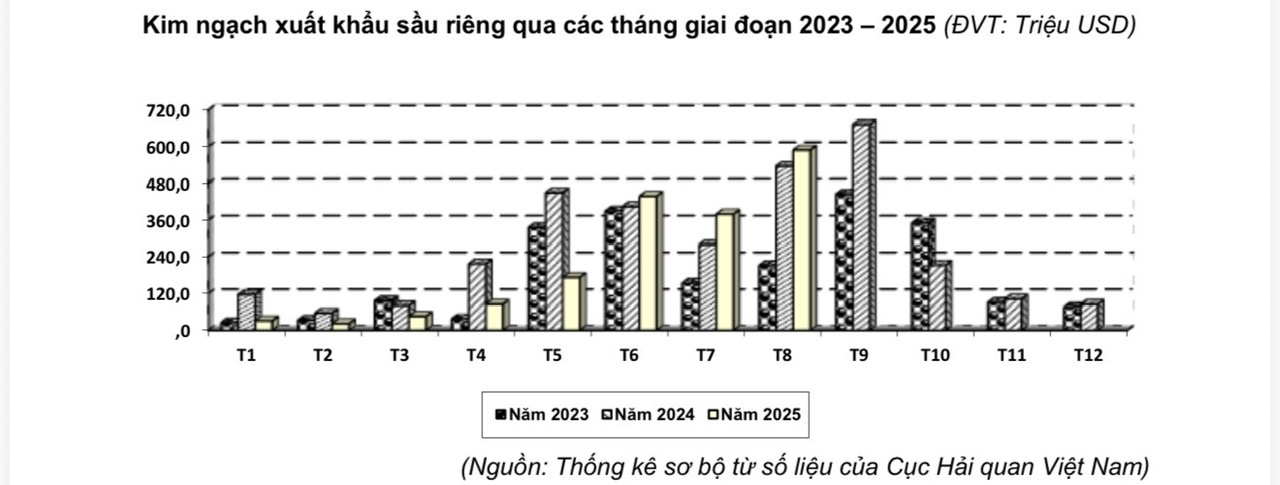

On October 1, the Vietnam Fruit and Vegetable Association (VINAFRUIT) released detailed data on durian exports for August 2025, revealing a record-breaking value of $589 million. This marks a 55% surge compared to July 2025 and a 10% increase year-over-year. The milestone is particularly significant as it follows Vietnam’s signing of the durian export protocol with China.

China Dominates with Over 90% of Vietnam’s Durian Exports

In the first eight months of 2025, durian exports totaled $1.79 billion, though still 16% lower than the same period last year due to earlier challenges. China remains the dominant market, accounting for 97% of August exports ($572 million) and 91% of the year-to-date total ($1.628 billion).

Among Vietnam’s top 10 durian importers, Malaysia saw the highest growth, soaring by 1,026% to $1.85 million in the first eight months.

According to Dang Phuc Nguyen, Secretary-General of VINAFRUIT, September typically marks the peak export season for durians. Given recent positive trends, exports are projected to reach $700–800 million, with over 90% destined for China.

Durian exports rebounded from June 2025, driven by strong seasonal demand.

Nguyen noted that September coincides with peak harvests in Vietnam’s Central Highlands, where the high-value Dona (Monthong) variety dominates exports, outpacing Ri6 durians in both price and demand from China.

While durian prices have cooled this year, increased volumes have sustained export revenue. Farmers in Dak Lak report lower purchase prices from traders compared to previous years.

Farmers harvesting Dona durians in the Central Highlands.

Lower Durian Prices: A Double-Edged Sword

Last year, some farms sold durians at over $3.40/kg, but prices have dropped to $2.50/kg or lower in 2025. Some farmers report selling below $1/kg, with rising labor and input costs squeezing profitability.

Nguyen explains that while farmers prefer higher prices, lower costs benefit the industry by expanding market access. Reduced prices make fresh, frozen, and processed durians more affordable, broadening consumer reach beyond premium segments.

As of October 1, durian wholesalers in the Central Highlands quoted Dona variety A at $3.50/kg, with variety B priced $0.70 lower. Prices fell by $0.07–$0.18/kg compared to the previous week.

Exporting the “Queen of Fruits” Reaps $1.5 Billion

In the first half of the year, durian was crowned the “queen of fruits” with its impressive export value. Accounting for 40% of the total fruit export revenue, durian reigned supreme with a whopping $1.5 billion in exports.