|

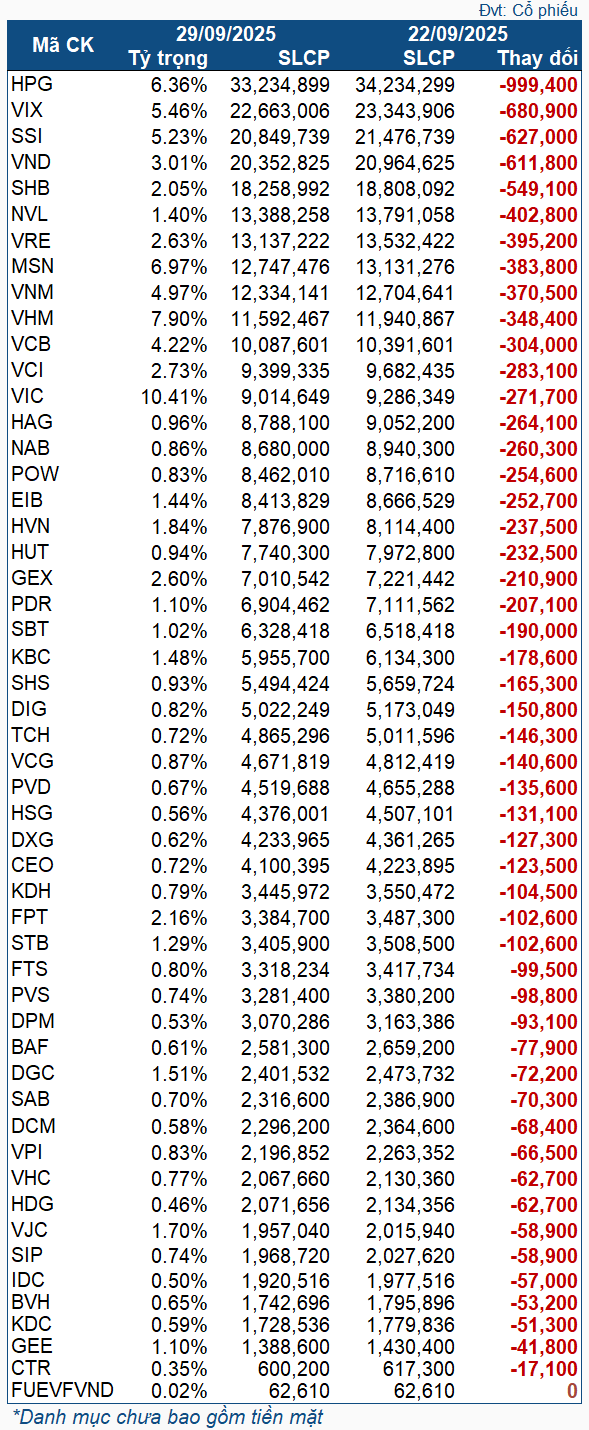

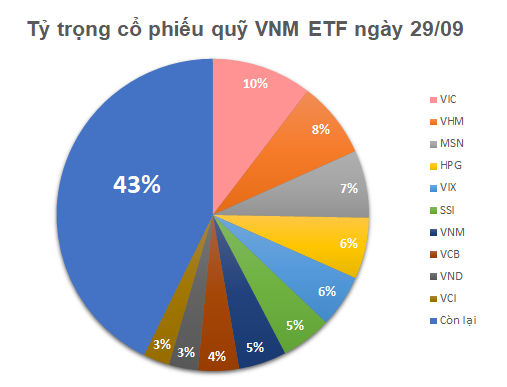

VNM ETF Treasury Stock Changes During September 22-29

|

During this period, the stock with the highest sell-off volume was HPG, with nearly 1 million shares. VIX followed closely with over 680,000 shares. Next in line were VND and SSI, both with over 600,000 shares sold. Conversely, the Fund did not net buy any shares.

As of September 29, the total asset value of the VNM ETF reached over 566 million USD, down from nearly 575 million USD on September 22. Assets were allocated across 51 stocks and 1 fund certificate. The top holding was VIC with a 10.41% weighting, reflecting its strong price performance during the period. This was followed by VHM (7.9%), MSN (6.97%), HPG (6.36%), and VIX (5.46%).

– 12:00 01/10/2025

Vingroup Surpasses Vietcombank, Setting Unprecedented Record Under Billionaire Pham Nhat Vuong’s Leadership

Since the beginning of the year, Vingroup’s stock has surged by nearly 290%, adding approximately VND 450 trillion to its market capitalization.