The offering price is set at VND 10,000 per share, approximately 37% lower than the current market price. Shareholders have the right to transfer their purchase rights, but the recipients cannot transfer them further. All newly issued shares will be restricted from trading for one year. If the distribution is not fully subscribed, the Board of Directors may sell the remaining shares to other investors under the same unfavorable conditions as for existing shareholders, ensuring foreign ownership does not exceed 49%.

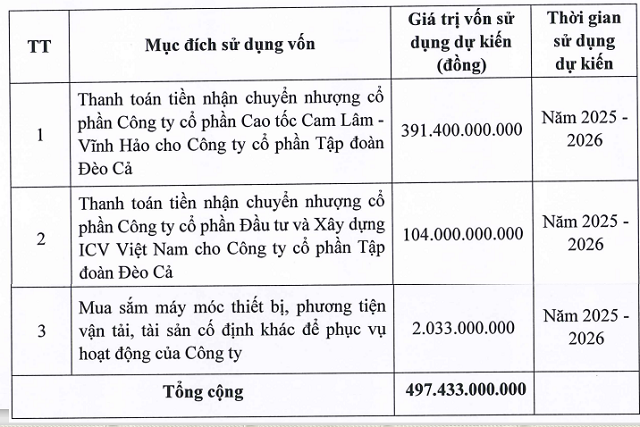

From this issuance, HHV expects to raise nearly VND 500 billion, with over VND 495 billion allocated to settle the payment for shares acquired from Deo Ca Group, including VND 391 billion for Cam Lam – Vinh Hao Expressway JSC and VND 104 billion for ICV Vietnam Construction and Investment JSC. This payment is scheduled for 2025-2026 and may be adjusted based on circumstances. This move will increase the company’s charter capital from VND 4.97 trillion to over VND 5.47 trillion.

Capital Allocation Plan Post-Issuance by HHV. Source: HHV

|

Cam Lam – Vinh Hao Expressway JSC is the developer of the 79km expressway of the same name, inaugurated in late April 2024, connecting Ho Chi Minh City to Nha Trang. The route reduces travel time to 4-5 hours, compared to 8-10 hours via National Highway 1. The project is funded through a BOT (Build-Operate-Transfer) model with a total budget of nearly VND 9 trillion, including VND 2.7 trillion in loans and over VND 1 trillion in equity. The toll collection period spans approximately 16 years.

In late 2024, HHV acquired a 38% stake in Cam Lam – Vinh Hao from Deo Ca Group without immediate payment. In July, the HHV Board approved acquiring an additional 19.42% stake from Deo Ca Construction JSC, potentially increasing its ownership to 57.42%. If completed, Cam Lam – Vinh Hao will become a subsidiary of HHV.

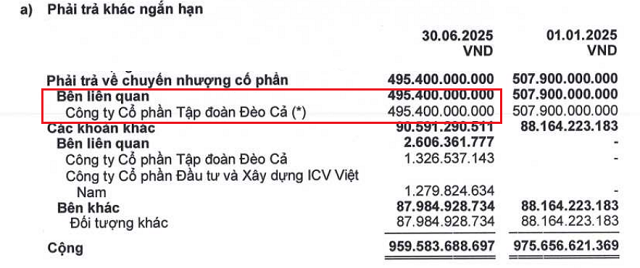

HHV owes Deo Ca Group over VND 495 billion for share transfers. Source: HHV’s 2025 H1 Consolidated Financial Report

|

HHV, established in 1974 as Thong Nhat Workshop under Construction Unit 67, has undergone multiple name changes and was equitized in 2014, adopting its current name in 2019. The company currently manages over 470km of roads, 31km of tunnels, and 18 BOT toll stations nationwide.

HHV’s charter capital has grown significantly over the years. In 2019, it surged from VND 79 billion to VND 2.27 trillion, followed by further increases through stock dividends and shareholder contributions. Most recently, in late 2023, the company issued shares to existing shareholders and added VND 236 billion from 2024 dividends.

The company’s business performance remains robust. In H1 2025, revenue reached VND 1.68 trillion, up 12% year-on-year, with net profit at VND 277 billion, a 35% increase—both record highs for the period. HHV attributes this to active construction projects, a 34% rise in tunnel and toll station revenue (28% of total revenue), and a 63% increase in associate profits from the Cam Lam – Vinh Hao investment.

HHV targets VND 3.58 trillion in revenue and VND 556 billion in post-tax profit for 2025, up 8% and 12% respectively. After six months, it has achieved 47% of its revenue goal and 58% of its profit target.

| HHV’s H1 Revenue and Profit Continue to Grow Year-on-Year |

HHV Reports H1 Net Profit of Nearly VND 280 Billion

– 15:58 02/10/2025

Century Thread Sets Date for Issuance of Over 43 Million Dividend Shares

Century Yarn is set to issue approximately 43.5 million shares as a dividend to shareholders at a ratio of 100:45. The final registration date for eligibility is October 31, 2025.

Unveiling Vietnam’s $13 Billion Vision: A 7,800-Hectare Mega-Project Set to Transform the Red River Legacy

This powerhouse conglomerate has forged strategic alliances with South Korea’s most renowned brands to bring the “Miracle on the Red River” to life.