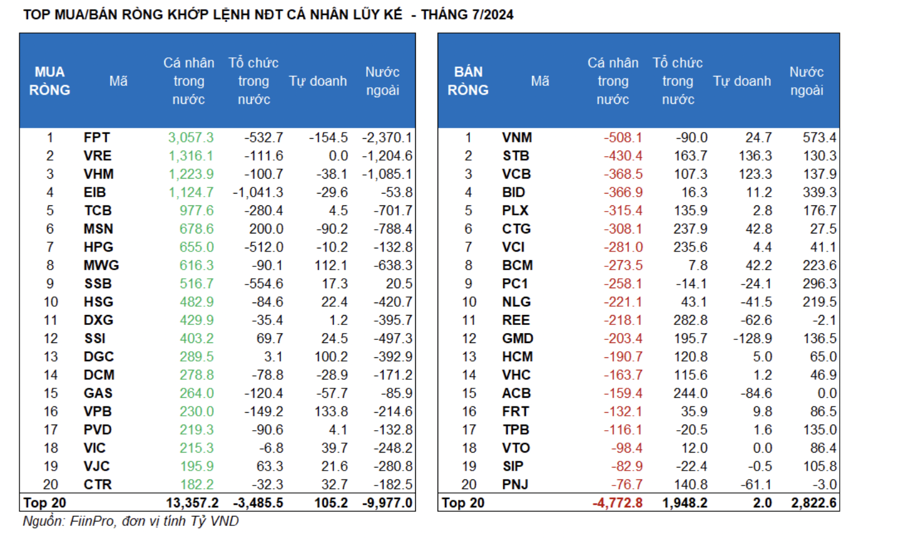

At the seminar titled “Identifying Q4/2025 Trends: Preparing for the Next Surge,” held on the afternoon of September 30th, Mrs. Vũ Thị Thu Thủy – Director of Market Information and Analysis, Individual Client Division (HSC), emphasized that foreign investors have been on a prolonged selling streak for the past two years. To date, no one can predict when this trend will reverse.

As of September 2025, the net selling value has reached 3.6 billion USD, surpassing the 2024 record. Consequently, foreign ownership has dropped below 16% and continues to decline.

HSC experts cited a September survey by Bank of America (BofA) among global fund managers, revealing that the primary concern is no longer trade wars or AI bubbles but inflation (26% of respondents).

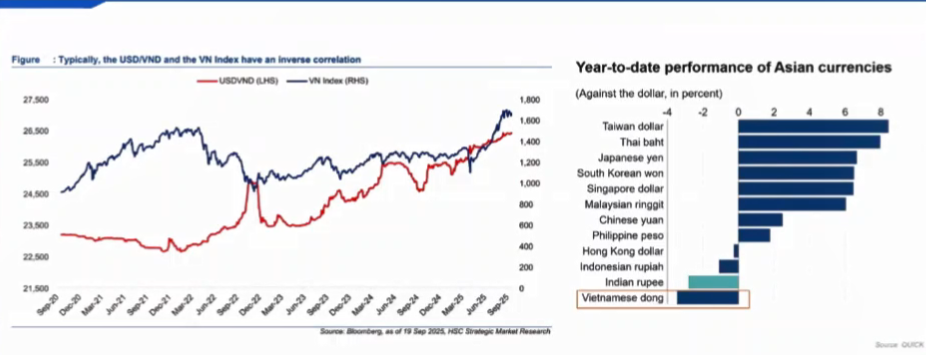

However, according to Mrs. Thủy, Vietnam’s inflation rate is just over 3%, even lower than HSC’s forecast, making it a minimal risk. The most significant concern for foreign investors in Vietnam is the exchange rate.

The USD/VND exchange rate has risen continuously in August and September, depreciating by approximately 4%, the highest in Southeast Asia. Historically, a currency fluctuation exceeding 3% often triggers a stock market correction.

Notably, the VND depreciation occurs while the USD itself is weakening. This worries foreign investors, as their profits in USD terms shrink. For instance, despite strong returns from VN-Index investments, the VND’s depreciation and market adjustments significantly erode these gains. In July, P-Notes funds entered Vietnam with upgrade expectations but quickly withdrew due to exchange rate concerns.

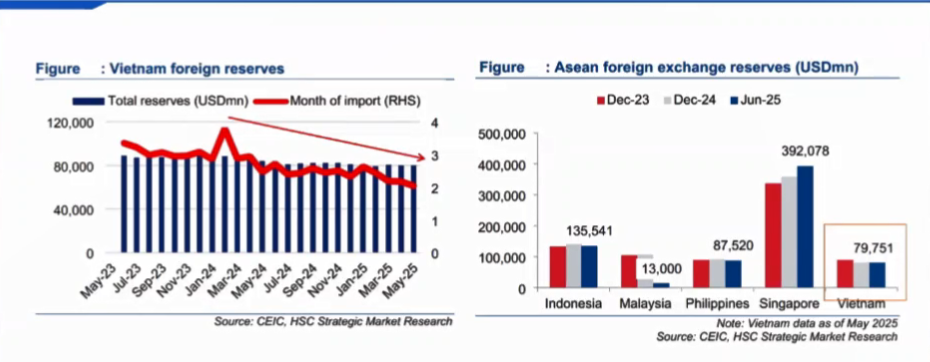

Another risk tied to the exchange rate is Vietnam’s foreign reserves, which stand at around 80 billion USD (as of May 2025), equivalent to just two months of imports—an unsafe level. This further amplifies foreign investors’ concerns.

The VND depreciation has garnered significant attention recently – Source: HSC

|

Vietnam’s declining foreign reserves – Source: HSC

|

Addressing why the exchange rate remains volatile despite the Federal Reserve’s (Fed) rate cuts, Mrs. Thủy explained that such actions boost asset prices, shifting capital to gold, locking long-term bond investments, or redirecting funds to developed markets before reaching emerging ones like Vietnam.

Regarding gold, Mrs. Thủy noted that rising gold prices, coupled with global forecasts of further increases, have heightened demand in Vietnam—a nation with high speculative and storage demand. This has led to increased gold imports and higher USD payments. Given the one-month delivery lag for gold purchases, this trend is unlikely to reverse soon.

However, there is reason to hope for exchange rate stabilization by year-end. The Fed’s rate-cutting trajectory, year-end remittance inflows, and improved trade surpluses are expected to bolster foreign reserves.

Despite risks, Mrs. Thủy believes Vietnam’s stock market remains promising, driven by market and credit rating upgrades, robust growth, and reasonable valuations. Long-term, Vietnam is poised to attract foreign capital.

– 11:15 01/10/2025

Vietstock Daily 02/10/2025: Prolonged Accumulation Ahead?

The VN-Index continues to oscillate around the Middle Bollinger Band, forming a Doji candlestick pattern. Alternating sessions of gains and losses on low liquidity suggest the market is not yet primed for a breakout, indicating that sideways consolidation is likely to persist in the near term.

Market Pulse 30/09: Capital Flows Return as VN-Index Experiences Deep Correction

After a sharp decline at the start of the afternoon session, the market gradually recovered, closing near the reference level. However, the indices still ended the day in negative territory. The VN-Index closed at 1,661.7 points, down nearly 5 points, while the HNX-Index settled at 273.16 points, shedding 2 points.

Vietstock Daily 01/10/2025: Market Remains in Tug-of-War

The VN-Index remains locked in a volatile tug-of-war around the Bollinger Bands’ Middle line. While the Stochastic Oscillator has flashed a buy signal, market churn persists. The August 2025 low (1,600-1,630 range) will serve as a critical support level for the index in the coming period.