In Q3/2025, Vietnam’s stock market continued its robust growth, setting a positive tone for the final quarter of the year. Experts predict that Q4/2025 will be a period of sustained uptrend, driven by a stable economy, low interest rates, and the anticipated market upgrade. This is considered the “golden” moment for investors to engage in trading and capitalize on the year-end growth momentum.

Beyond market profitability, investors are further incentivized by attractive trading promotion programs. Recently, MB Securities (MBS) launched the year’s biggest lottery campaign, “Breakthrough Trading – Win VF3,” running from October 1 to December 31, 2025, with a prize structure that has surprised many investors.

For every VND 10 million traded, investors receive one lottery ticket, offering a chance to win valuable prizes. Notably, there’s no limit to the number of tickets, meaning the more you trade, the greater your chances of winning. The program highlights trendy prizes that resonate with the modern lifestyle of the younger generation, including the VF3 electric car, Feliz S electric motorcycle, iPhone 17 Pro, and other appealing tech and fashion items. New MBS account holders opening from October 1, 2025, need only trade VND 2 million to receive VND 100,000 directly into their securities account—a lucky start to their investment journey. MBS not only encourages trading but also demonstrates a deep understanding of customer needs by offering both practical and trendy rewards.

The year-end period is traditionally a peak trading season as capital flows into the market. The “Breakthrough Trading – Win VF3” campaign provides a “double boost” for investors: the opportunity to profit from market growth and the chance to own cutting-edge technology and electric vehicles.

MBS is one of the first six securities companies in Vietnam and a member of Military Commercial Joint Stock Bank (MB). The company is currently implementing a plan to increase its charter capital to nearly VND 6.7 trillion, as per the 2025 Shareholders’ Resolution, further solidifying its position as a leading and reputable securities firm in the market. As of August 2025, MBS is among the billion-dollar market-cap securities companies and has been honored by Forbes in the Top 50 Best Listed Companies in Vietnam 2025.

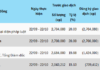

Foreign Investors Continue Selling Spree, Offloading Nearly VND 400 Billion in Real Estate Stocks on September 30th

In the afternoon session, CII and SHB emerged as the top net buyers in the market, with impressive purchase values of 90 billion VND and 82 billion VND, respectively.