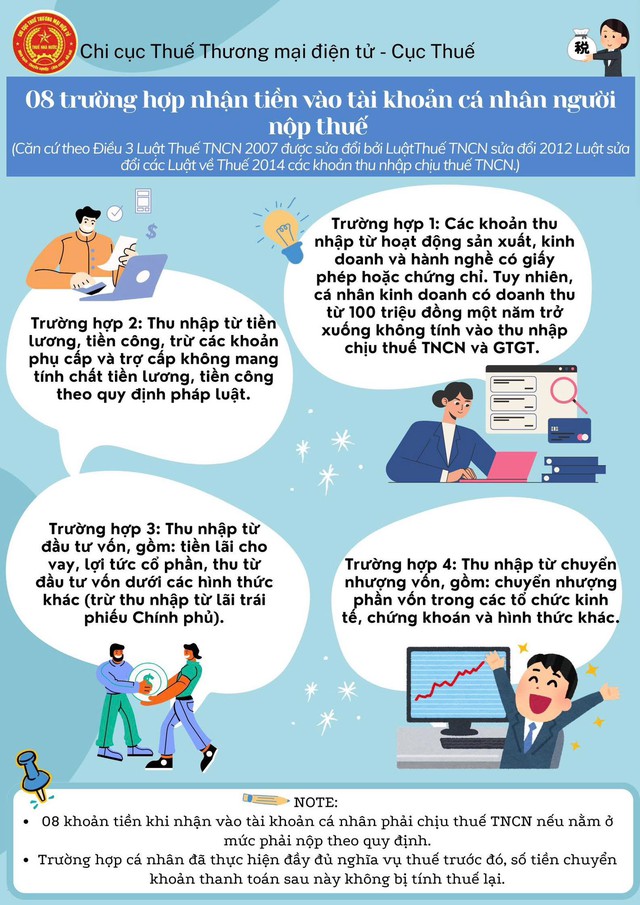

E-Commerce Tax Department – Tax Agency provides information on 8 cases where personal account deposits are subject to taxation, unless exempt or below the specified threshold.

(Based on Article 3 of the 2007 Personal Income Tax Law, amended by the 2012 Personal Income Tax Law and the 2014 Law Amending Tax Laws.)

These cases include:

Case 1: Income from licensed production, business, or professional activities. However, individuals with annual revenue of VND 100 million or less are exempt from personal income tax (PIT) and value-added tax (VAT).

Case 2: Income from salaries and wages, excluding allowances and subsidies not classified as salary or wages under the law.

Case 3: Investment income, including interest from loans, dividends, and other capital investment returns (excluding interest from government bonds).

Case 4: Capital transfer income, such as transfers of capital in economic organizations, securities, and other forms.

Case 5: Real estate transfer income, including land use rights, housing, attached assets, land and water leases, and other related transfers.

Case 6: Prize winnings, from lotteries, promotions, betting, games, and competitions. Includes all legally defined prize winnings.

Case 7: Royalty income, from the transfer or assignment of intellectual property rights and technology transfer.

Case 8: Franchise income.

E-Commerce Tax Department outlines 8 cases where personal account deposits are taxable.

The E-Commerce Tax Department emphasizes that the above 8 income categories, when deposited into personal accounts, are subject to personal income tax if they meet the taxable threshold.

Transfers between individuals, such as gifts, family support, personal loans, or non-commercial transactions, are not considered revenue for tax purposes.

If individuals have already fulfilled their tax obligations, subsequent transfers are not subject to additional taxation.

Proposed Reduction of Personal Income Tax Threshold to 25%

The current maximum tax rate of 35% is widely considered excessive relative to income levels, potentially driving skilled workers to seek opportunities abroad. Numerous proposals advocate for lowering the cap to 25% to address this concern.

Gold Transaction Tax: Are Wedding Gold Purchases Subject to Taxation?

Are you wondering if gold rings, classified as jewelry, are subject to taxation? Or perhaps you’re curious whether buying or selling wedding gold falls under taxable transactions?

Revised Title:

Amended Personal Income Tax Law: Does It Lack Support Mechanisms for Freelancers?

Taxpayers have expressed concerns regarding the proposed personal income tax (PIT) regulations, highlighting a lack of support mechanisms for freelancers. The current policy on taxing financial investment income remains unclear and lacks legal framework, posing potential risks for citizens. Additionally, the taxation of cryptocurrency assets continues to raise significant uncertainties.