Nam A Bank has reported impressive financial results for the first nine months of 2025, with pre-tax profits exceeding VND 3.8 trillion, a significant increase of nearly VND 520 billion (16%) compared to the same period last year, achieving 77% of the annual target. As of September 2025, total assets reached over VND 377 trillion, a remarkable surge of more than VND 132 trillion since the beginning of the year. This growth is particularly notable given the banking sector’s focus on supporting private economic development in line with Resolution No. 68 of the Politburo.

Nam A Bank’s 9-month business results in 2025 show numerous positive indicators.

|

In response to the government’s efforts to boost production and business recovery, Nam A Bank has proactively increased credit in priority sectors, effectively channeling capital into the real economy. Alongside credit expansion, the bank has strategically capitalized on opportunities in the secondary market, particularly the interbank market, and invested in secure instruments like government bonds, securities, and bonds issued by other credit institutions. This approach has not only diversified revenue streams but also enhanced capital efficiency and reduced reliance on net interest income.

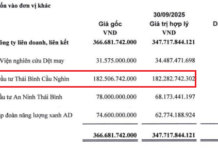

The bank’s exceptional growth in the first nine months is attributed to improvements in both capital mobilization and asset allocation. Deposits from economic organizations and individuals rose by over VND 35 trillion, a 20% increase from the beginning of 2025. On the asset side, outstanding loans grew by more than VND 30 trillion (17.88%), while the bond investment portfolio increased by nearly VND 14 trillion, optimizing asset structure and ensuring sustainable profitability. The bank maintains a Capital Adequacy Ratio (CAR) well above the State Bank of Vietnam’s requirements.

Operational efficiency has significantly improved, with the cost-to-income ratio (CIR) decreasing from over 40% in 2024 to 33.7%. Non-interest income accounted for 17.1% of total operating income, nearly double the figure from the beginning of 2025, driven by strong contributions from digital banking services, foreign exchange, investment, and service fees. Profitability metrics remain high among mid-sized banks, with a Net Interest Margin (NIM) of 3.2%, Return on Assets (ROA) of 1.42%, and Return on Equity (ROE) approaching 20%.

Asset quality remains well-managed, with non-performing loans (NPLs) decreasing to 2.53% before CIC and 2.73% after CIC, down from 2.85% as of June 30, 2025. The NPL coverage ratio (LLR) increased significantly from 39% to nearly 46% during the same period, reflecting proactive provisioning and effective risk management. The liquidity reserve ratio stands at nearly 20%, double the minimum requirement set by the State Bank of Vietnam, strengthening liquidity and market resilience.

In its digital transformation journey, Nam A Bank continues to expand its digital banking ecosystem. The OneBank 365+ digital transaction network now includes over 130 automated service points nationwide. Open Banking services, such as 100% online mortgage loans and cross-border QR payments in Thailand, Laos, and Cambodia, provide seamless customer experiences. As of now, over 98% of transactions are conducted digitally, reducing operational costs and increasing productivity.

A significant milestone was achieved on September 16, 2025, when FiinRatings, a strategic partner of S&P Global Ratings, assigned Nam A Bank a long-term credit rating of “A-” with a “Stable” outlook. This rating reflects expectations of stable credit performance over the next 12-24 months, supported by the bank’s growth, improved profitability, and robust capital and liquidity buffers. This achievement enhances Nam A Bank’s reputation in the financial market and facilitates access to medium- and long-term funding at competitive rates.

– 5:13 PM, October 2, 2025

SHB Seeks Shareholder Approval via Written Consent for 2025 Capital Increase Plan

Saigon-Hanoi Commercial Joint Stock Bank (SHB) announces October 16, 2025, as the final registration date for shareholders to be included in the list for written voting on the 2025 charter capital increase plan and other matters within the authority of the General Meeting of Shareholders (GMS).

Is Modern Technology and Retail Reshaping the Food Industry?

From growing food safety concerns to the rising demand for convenience, Vietnam’s meat market is undergoing a transformative shift. Beyond the foundational market demand, what key factors will empower branded processed meat companies to leverage their strengths and surge ahead in an increasingly competitive landscape?

SHB: Leading National Budget Contributor and Dedicated Social Welfare Partner for Years

Recently, SHB was honored in the TOP 10 Most Profitable Private Enterprises in Vietnam 2025 (PROFIT500), solidifying its robust financial capabilities, efficient operations, and significant contributions to the nation. The bank has officially increased its chartered capital to 45,942 billion VND, maintaining its position as one of the Top 5 largest private joint-stock commercial banks in the system.