Novareal Joint Stock Company (a brokerage firm of Novaland) has issued an official statement clarifying issues related to the credit contract dispute between VPBank and the borrower, in which the company is identified as a related party with rights and obligations.

According to Novareal, the case between the plaintiff VPBank and the defendants, who are the borrowers, is currently in the first instance stage at the People’s Court of Ward 7, Ho Chi Minh City. The company alleges that during the proceedings, the presiding judge committed procedural violations, failed to collect sufficient documents as requested by the Prosecutor’s Office, and did not comprehensively compile the case file for all involved parties.

Novareal emphasizes that the first-instance judgment is not yet legally binding, and the conclusions in the judgment do not align with the practicalities of the case or the nature of the transaction. Notably, previous judgments and arbitration decisions have recognized the legal validity of consulting, brokerage, and civil contracts between customers and Novareal, as well as financial institutions.

Therefore, the company will continue to appeal against these procedural violations during the handling of the plaintiff’s judgment, particularly regarding the subjective and legally unfounded conclusions of the trial panel concerning Novareal.

Regarding the large-scale resort real estate project in Lam Dong, where Novareal serves as a consultant and broker, the company stated that the project has received attention and guidance from the Government and relevant authorities to resolve legal obstacles, approve investment policies, and is currently being implemented in phases in accordance with the law.

This project is also a key tourism initiative for Lam Dong Province, not a residential project as concluded by the trial panel.

The company affirmed its close collaboration with the developer and partners to ensure customer rights and warned investors to exercise caution against misleading information on social media that could cause confusion and impact the real estate market.

On September 30th, the People’s Court of Ward 7, Ho Chi Minh City, heard the dispute between VPBank and Mr. Tran Hong Son and his wife, Mrs. Nguyen Thi Xuan Dao.

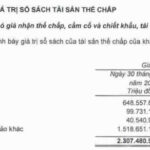

According to the case file, in late 2020, Mr. Son borrowed VND 3.65 billion from VPBank to pay a deposit for a semi-detached villa in the NovaWorld Phan Thiet/Ocean Valley project (Lam Dong).

The loan was disbursed directly to Novareal as per the “deposit agreement” between the customer and the company. However, the court determined that Novareal acted solely as a broker and, under regulations, was not permitted to receive deposits on behalf of the developer.

Meanwhile, the agreement outlined payment schedules, deposits, and other details, which exceeded the authority of a brokerage firm. The court suggested this could be an attempt to conceal an illegal deposit transaction.

Additionally, the court noted that local authorities lacked project documentation proving the villa’s foundation had been constructed; the authorization of a third party (Novareal) to sign the deposit contract was deemed contrary to the 2014 Housing Law.

Consequently, the credit contract was declared void due to the illegal deposit transaction, rendering the bank’s loan unenforceable.

VPBank Honored at the Customer Experience Awards of the Year

VPBank has been honored with the prestigious “Customer Experience of the Year – Banking Sector” award at the Asia Experience Awards ceremony. This recognition underscores VPBank’s leadership in digital transformation and reinforces its commitment to enhancing customer experience and fostering sustainable growth.

VPBank Partners with VTV2 to Launch “Caution 247”

In response to the increasingly sophisticated high-tech financial fraud, the program “Cảnh giác 247” officially launched on VTV2, with the companionship of Vietnam Prosperity Joint Stock Commercial Bank (VPBank), carries the mission of building a “community shield” to protect customers in the digital age.

Unlock Super Profits at VPBank’s “Profit Hub”

Following the official launch of its new profit-generating product, Super Sinh Lời Premier, VPBank recently hosted a virtual discussion session to delve into the details of this innovative offering.