Illustrative Image

According to Oilprice, Russia’s crude oil exports have reached a 16-month high, indicating that U.S. efforts to curb Moscow’s energy flow have yet to yield the desired results.

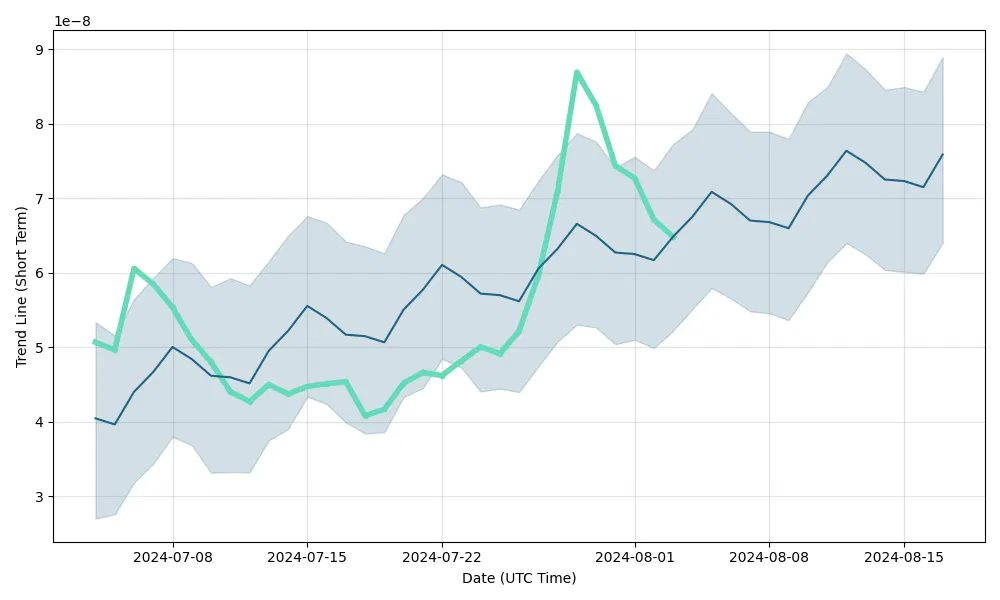

Specifically, data from Reuters’ oil tanker tracking on September 30 revealed that in the four weeks leading up to September 28, Russia exported an average of 3.62 million barrels of crude oil per day (bpd) via sea routes. This marks the highest level since May 2024, despite Washington’s persistent pressure on Russia’s major buyers.

India, Russia’s second-largest crude oil importer after China, has been a focal point in the U.S. strategy to halt Russian oil exports. The Trump administration recently imposed a 50% tariff on Indian goods due to the country’s continued purchases of Russian oil.

However, New Delhi officials stated they would not cease imports and even suggested that India might consider reducing imports from Russia if granted access to supplies from Iran and Venezuela—two nations also under U.S. sanctions. Shifting to additional crude oil from these countries or the Middle East would incur higher costs, increasing overall import expenses for the Asian nation.

An Indian official told Reuters that simultaneously cutting off supplies from Russia, Iran, and Venezuela could drive up global oil prices, destabilizing the international market.

Beyond India, several European countries have also maintained their stance despite U.S. pressure. Last week, Hungary confirmed it would continue importing Russian oil. Speaking on the sidelines of the UN General Assembly in New York, Hungarian Foreign Minister Peter Szijjarto stated, “We cannot ensure energy security without Russian supplies.” Hungary remains one of the EU nations most reliant on Russian oil and gas, alongside Slovakia, while Turkey has also sustained its imports.

Despite the surge in export volumes, Russia’s oil and gas revenues are projected to drop by 23% in September compared to the same period last year. This decline is primarily attributed to falling international crude oil prices and the strengthening of the ruble, as estimated by Reuters.

This situation highlights a global oil market tug-of-war: while Russia maintains significant export volumes despite sanctions, its energy profits face pressure from price fluctuations and currency exchange rates.

Source: Oilprice

Russia Eyes Strategic Export Shift: Offering India a World-Leading Commodity Amid US Oil Sanctions

Indian officials have confirmed the nation’s readiness to import a critical commodity from Russia, signaling a strategic move to secure essential resources.