On October 1st, the VN-Index closed at 1,665 points, up 3 points (+0.20%) from the previous session.

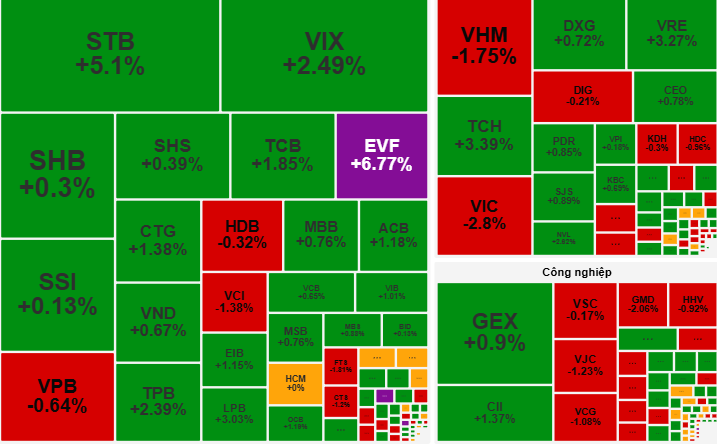

The VN-Index opened the morning of October 1st with a slight upward trend within a narrow range. Banking and consumer stocks led the rally, attracting strong inflows. Meanwhile, the Vingroup duo (VIC, VHM) and several large-cap stocks like BCM and GMD exerted downward pressure on the market. Notably, securities (VIX, VND, HCM) and real estate stocks (TCH, HHS, NVL) saw a resurgence in buying interest after facing heavy selling in previous sessions.

In the afternoon session, the VN-Index continued to consolidate gains, supported by the banking sector’s strong performance. Standout performers included STB (+5.1%), TCB (+1.85%), and LPB (+3.03%). However, selling pressure from VIC and VHM somewhat restrained the market’s upward momentum. A highlight of the afternoon was the inflow into agricultural stocks, with HAG rising 3.68%, alongside sustained interest in securities and real estate shares.

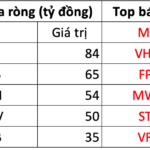

At the close, the VN-Index settled at 1,665 points, up 3 points (+0.20%). Trading volume plummeted 35% from the previous session, totaling over 21 trillion VND. Foreign investors continued their net selling spree, focusing on stocks like FPT, VHM, and MWG, with a total net sell value exceeding 1,651 billion VND.

According to VCBS Securities, the market is retesting supply and demand within the 1,650-1,670 point range, with slightly lower liquidity compared to recent sessions, reflecting investor caution. Capital flows are distinctly polarized, favoring stocks with unique narratives or positive Q3 earnings expectations, such as banking, securities, and retail sectors.

“Investors can leverage intraday corrections or volatility to deploy capital, prioritizing stocks trading significantly below their intrinsic value,” advises VCBS Securities.

Several other securities firms forecast that the market on October 2nd will continue to oscillate within the 1,650-1,670 point range. Intraday fluctuations will present opportunities for portfolio rebalancing. Capital flows may remain polarized, favoring sectors with strong fundamentals and positive business outlooks. Investors should closely monitor liquidity trends and foreign investor activity to make informed trading decisions.

Afternoon Technical Analysis October 1st: Current Trend Showing Weakness

Amidst subdued ADX levels, the VN-Index is poised to persist in its sideways movement around the Bollinger Bands’ Middle line. Conversely, the HNX-Index is finding robust support at the lower boundary of its Triangle pattern, signaling potential stability in its trajectory.

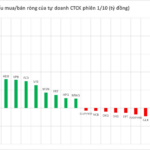

Surprise Powerhouse Deploys Nearly $300 Billion to Sweep Up Vietnamese Stocks in Month’s Opening Session

Proprietary trading desks at securities companies recorded a net buy of VND 285 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Market Pulse 01/10: VN-Index Sustains Green at 1,665 Points

At the close of trading, the VN-Index climbed 3.35 points (+0.2%) to reach 1,665.05, while the HNX-Index edged up 0.06 points (+0.02%) to 273.22. Market breadth favored the bulls, with 418 gainers outpacing 295 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 6 retreated, and 2 remained unchanged.