Slight Uptick in New Orders

|

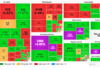

Vietnam’s manufacturing sector witnessed a modest improvement in business conditions in September, driven by a resurgence in new orders.

Both production output and purchasing activity increased, though firms continued to reduce their workforce. Meanwhile, inflationary pressures intensified.

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI®) remained steady at 50.4 in September, indicating a third consecutive month of slight improvement in manufacturing health. The overall business conditions were supported by a renewed rise in new orders following a minor dip in August, albeit at a modest pace.

New export orders, however, continued to decline, though the rate of reduction slowed to the softest in an 11-month sequence of decreases. International demand remained subdued, but stabilized U.S. tariff policies reportedly helped some firms secure new overseas orders.

With total new orders rising due to improved customer demand, manufacturers increased production for the fifth straight month in late Q3. The growth rate, though robust, was the weakest since June. The recent output expansion partly reflected a sharp decline in backlogs, which fell at the fastest pace in five months. Meanwhile, employment continued to fall for the twelfth consecutive month, attributed to lower workloads and unreplaced retirements.

On a positive note, firms increased purchasing activity for the third month running, aligning with higher production needs. However, the use of inputs for production led to further depletion of input stocks. Finished goods inventories also declined, marking the sharpest drop since July 2024.

Supplier delivery times lengthened for the 13th month in September, though the delay was marginal and the softest in four months. Survey respondents cited material shortages and transportation issues as key factors.

Inflationary pressures strengthened in late Q3, with both input costs and output prices rising at faster rates. The latest increase in input costs was the sharpest since July 2024, driven by higher market prices and unfavorable exchange rate fluctuations. Consequently, selling prices rose at the quickest pace in 14 months.

A more stable economic environment is expected to boost new orders and production growth in the coming year, supported by public sector investment. Despite remaining optimistic, business confidence dipped from August and was below the series trend.

Andrew Harker, Economics Director at S&P Global Market Intelligence, commented:

“Vietnamese manufacturers received positive news in September as new orders rebounded, and even exports, which had been declining since late last year, showed signs of stabilization. Greater clarity on tariffs appears to have bolstered customer demand for Vietnamese firms.

Increased stability is expected to support growth next year, but business confidence remains subdued due to recent weak demand. Inflation trends warrant close attention in the coming months.

Input costs and selling prices have been rising at increasingly faster rates in recent months. If this trend persists, we may see price pressures begin to limit demand.”

– 08:08 01/10/2025

Why Is Inflation Low Despite Surging Household Spending?

The Consumer Price Index (CPI) reveals a modest 3% increase, yet Ms. Hạnh from Ho Chi Minh City argues that her family’s actual living expenses feel “exorbitant,” soaring tenfold beyond the reported figure.

USD Weakens Further Ahead of Fed Meeting

During the week of September 8–12, 2025, the USD extended its decline in the international market following the release of additional U.S. inflation and labor market data, reinforcing expectations that the Federal Reserve will cut interest rates at its upcoming meeting.