Here’s the content of the program “Trên Ghế 177” broadcast on HTV9 on September 30th.

Below is the discussion between host Việt Anh and journalist Đinh Văn Nam on the topic: What does Suzuki Fronx need to do to establish itself in Vietnam?

Suzuki Fronx is confirmed to launch on October 17th. This is a globally new model, debuting in Vietnam. What are your expectations for this vehicle?

I believe a completely new product debuting in Vietnam will make the compact SUV segment more appealing, offering consumers a fresh choice. I expect it to be a youthful, competitively priced vehicle, bringing a new dynamic to a segment that lacks variety.

What do you think about Fronx’s competitiveness in the compact SUV segment against rivals like Toyota Raize, Kia Sonet, and Hyundai Venue?

Raize benefits from a strong brand. Venue and Sonet stand out with their features, and Korean brands are well-received in Vietnam.

Fronx, in my opinion, will maintain the appeal of Japanese vehicles. Vietnamese consumers have a preference for Japanese cars, and with its novelty and potential feature-rich offerings, Fronx can directly compete with Korean models. However, pricing will be the most critical factor. Given that compact SUVs are entry-level vehicles, customers will scrutinize and calculate carefully. Therefore, the price will significantly determine Fronx’s success in Vietnam.

Suzuki Fronx will launch in Vietnam on October 17th. Photo: AP Team

What features do you think Fronx needs to win over Vietnamese consumers?

As I mentioned, pricing is key, and it must come with convenient features.

Fronx’s coupe-inspired design brings a fresh look to the segment.

However, Vietnamese consumers now demand more advanced features. Wireless connectivity with Apple CarPlay and Android Auto is increasingly popular. Safety and convenience features are also highly valued. Many buyers insist on multiple airbags and ADAS, even though some may disable ADAS due to perceived incompatibility with local driving conditions.

p>I believe meeting these feature expectations will be essential for Fronx to compete effectively.

During my trip to Indonesia, I test-drove the Fronx and noted its ADAS active safety package. Do you think ADAS could be Fronx’s standout feature in this segment, giving it a competitive edge?

Vietnamese consumers love comparing features. If a vehicle offers truly standout features, it will catch their attention.

However, turning that attention into sales and revenue depends most critically on pricing.

Previously, the Honda City with rear drum brakes was criticized, but the upgraded version with disc brakes was better received. The Kia Sonet in this segment uses 4-wheel disc brakes. If Fronx offers a good price but uses rear drum brakes, do you think it will lose appeal?

I think rear drum brakes are a point of concern for many.

Recently, I experienced the Skoda Slavia, a well-equipped Czech model assembled in Vietnam. Despite its drum brakes, many commented on this detail. I believe Fronx will face similar scrutiny.

While rear drum brakes don’t significantly impact daily performance compared to disc brakes, Vietnamese consumers prioritize safety based on perception, herd mentality, and trends. Therefore, Suzuki will need a clear communication strategy to address these concerns.

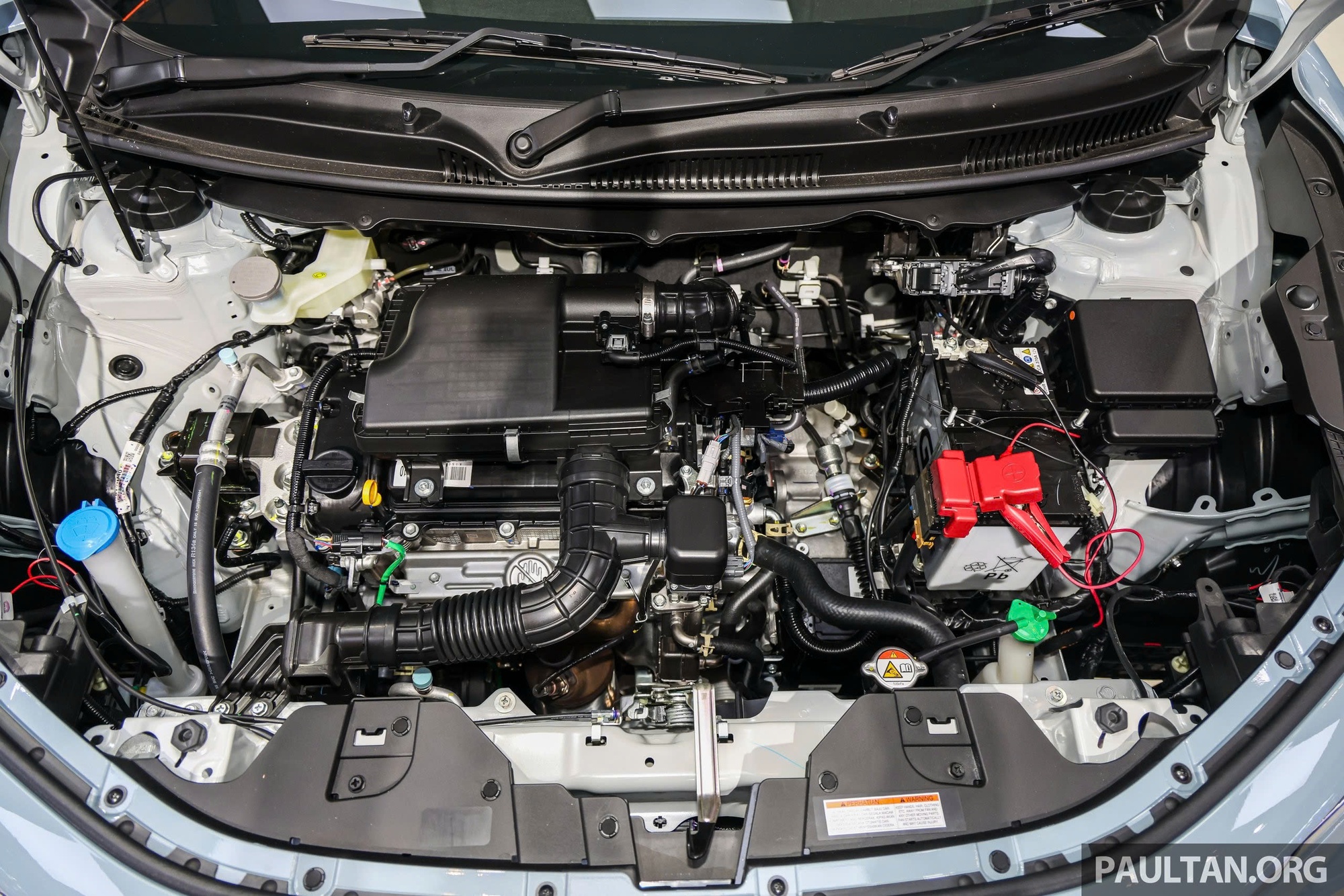

Suzuki XL7, currently sold in Vietnam, only offers a mild hybrid engine, with decent sales. Fronx in Indonesia has both pure gasoline and mild hybrid options. Which engine do you think Suzuki Vietnam should choose for the local market?

If possible, I think both engines should be offered. This provides consumers with more choices and allows the brand to cater to different customer segments.

Pure gasoline offers a more competitive price and broader accessibility. Mild hybrid engines appeal to environmentally conscious consumers.

First-time buyers often plan to keep their vehicles long-term, making mild hybrids a safer choice. If priced reasonably, this version will attract customers willing to pay extra, not for fuel savings, but for peace of mind amid Vietnam’s emission reduction measures.

Fronx offers two engine options: gasoline and hybrid. Photo: Paultan

In the compact SUV segment, Toyota Raize is priced at 510 million VND, Hyundai Venue at 499-539 million VND, and Kia Sonet at 499-624 million VND. What price range do you think Fronx should target to compete effectively?

For a newcomer like Fronx to gain attention, I believe it needs a starting price aligned with the segment average, around 500 million VND. Toyota Raize previously even dipped below 500 million VND.

Therefore, I suggest Fronx start at 500-520 million VND for the base model. Suzuki Vietnam should focus on 2-3 versions, capping the top version at 580 million VND to maintain competitiveness.

I believe Suzuki Vietnam has high expectations for Fronx. The brand needs strong determination to set a competitive price from the start, rather than launching at a high price and relying on discounts, which are less appealing. Many consumers wait for price reductions when a vehicle launches at a high price, diminishing its appeal. Thus, setting a reasonable price from the outset makes the vehicle more accessible and fosters a positive perception of value retention.

In summary, I think Fronx’s suitable price range should be 510-580 million VND.

In Indonesia, Suzuki Fronx received 1,500 orders in its first month. Do you think this success can be replicated in Vietnam with the right pricing?

I think it’s unlikely.

First, achieving 1,500 units like in Indonesia is very challenging for Suzuki Vietnam due to distribution limitations. If demand surges but imports are limited, will there be enough vehicles to meet demand, or will price gouging occur?

However, I believe Fronx achieving a few hundred units per month would be a success. Urban SUV demand remains high, especially among young buyers. If Fronx meets this demand with competitive pricing, appealing design, and full features, it will undoubtedly attract buyers. If the brand cuts features to lower prices, consumers won’t accept it.

With a budget of around 550 million VND, consumers can opt for a VinFast electric vehicle with significant usage cost savings. Is launching a gasoline vehicle at this price point suitable in the current market?

I think Fronx will face significant pressure. Pressure from the high-selling VinFast VF 5, established gasoline competitors, and potential discounts. Therefore, I believe Fronx entering the 550 million VND segment will be challenging.

For commercial use, buyers will choose the VF 5 or sedan models like the Toyota Vios. This leaves Fronx targeting individual buyers, who demand high-quality experiences and features. This will be a complex equation for Suzuki Vietnam. In larger markets, competition might be easier, but in Vietnam, it’s not that simple.

VinFast VF 5 and Toyota Vios are popular choices for commercial services. Photo: Dealership

Currently, many high-selling models are primarily bought for commercial use. As Fronx targets the urban SUV trend in Vietnam, do you think it can achieve explosive sales?

Suzuki Fronx is unlikely to achieve explosive sales. It’s not suitable for commercial transport services. Suzuki already has the XL7 Hybrid, a 7-seater MPV that’s fuel-efficient and ideal for commercial use. Most compact SUV competitors aren’t chosen for commercial use, and Fronx will likely follow suit.

Therefore, selling a few hundred units per month would be a success for Fronx. Explosive sales in the current market are nearly impossible. The market can’t absorb such volumes, and commercial buyers prefer electric vehicles or spacious sedans like the Toyota Vios.

Suzuki Fronx is unlikely to achieve explosive sales. Photo: AP Team

But I think Suzuki Vietnam needs a flagship product to build its brand. What’s your opinion?

Absolutely.

Suzuki Vietnam still lacks a standout product that resonates with mainstream consumers. To make an impact and increase sales, they must enter popular segments like compact SUVs. Only by establishing a presence in these segments can the brand steadily grow its overall sales.

Additionally, expanding the dealership and service network is crucial. This is extremely important for Vietnamese buyers, especially given Suzuki’s 30-year presence but limited dealership coverage. Concerns about parts availability, pricing, and service consistency are significant for customers.

Particularly, Fronx’s target audience will mostly be first-time buyers, who prioritize safety and long-term peace of mind. If Suzuki doesn’t address these concerns, it will be difficult for Fronx or any other product to succeed in Vietnam.

Thank you, Mr. Nam, for your insightful sharing.

The program Trên Ghế is a collaboration between Ho Chi Minh City Television and VCCorp; produced by AutoPro; and commercially exploited by AdWheel.

The program airs on HTV9 at 18:10 from Monday to Saturday and rebroadcasts at 20:00 on VCCorp’s multi-platform.

Upcoming Car Launches in Vietnam This October: A Hybrid-Focused Lineup with ADAS Features Even in Affordable Models

As the Ghost Month ends and the Lunar New Year approaches, the automotive market is poised for a significant surge. This pivotal period also marks an opportional moment for manufacturers to unveil their latest vehicle models, setting the stage for a dynamic and competitive landscape.

Apple Elevates Vietnam to a Key Market: Live Subtitles in Vietnamese for the iPhone 17 Event

For the very first time, Apple’s iPhone 17 launch event was accompanied by official Vietnamese subtitles, marking a significant step forward in Apple’s recognition of Vietnam as a key market. This move underscores the country’s elevated status, now on par with Tier 1 markets like the US, Japan, and Singapore, as Vietnam was among the first countries to receive the new iPhone model.