TNH Hospital Group Joint Stock Company (Stock Code: TNH, HoSE) has recently submitted a report detailing the outcomes of its share issuance to increase equity capital from owner’s equity.

As of the issuance closure on September 25, 2025, TNH Hospital successfully distributed over 21.6 million bonus shares to 4,595 shareholders. The remaining 1,317 fractional shares will be canceled.

The rights ratio was set at 100:15, meaning shareholders holding 100 shares received 15 new shares. The final registration date for rights allocation was September 25, 2025.

Illustrative image

The total issuance value, based on par value, exceeded 216 billion VND, sourced from the capital surplus as of December 31, 2024, as per the audited 2024 financial statements of TNH Hospital.

Following the successful issuance, TNH Hospital’s chartered capital increased from over 1,441.8 billion VND to nearly 1,658 billion VND.

Regarding TNH shares, the Ho Chi Minh City Stock Exchange (HoSE) recently announced the inclusion of TNH in the list of securities ineligible for quarterly trading.

This decision was due to the negative after-tax profit of the parent company’s shareholders in the consolidated semi-annual financial report for 2025.

In terms of business performance, the consolidated semi-annual financial report for the first half of 2025 showed that TNH Hospital generated nearly 216.3 billion VND in net revenue, a slight decrease of 3%. After deducting expenses, the hospital reported a loss of over 54 billion VND, compared to a profit of more than 53 billion VND in the same period last year.

As of June 30, 2025, TNH’s total assets stood at 2,735 billion VND, a 7% increase from the beginning of the period. Cash and cash equivalents amounted to 42 billion VND, down 23%.

Construction in progress totaled over 404 billion VND, up by more than 40%. This primarily included 332 billion VND for the TNH Lang Son Hospital construction project, over 62 billion VND for Phase 3 of the Thai Nguyen International Hospital project, and 10 billion VND for the Da Nang Oncology Hospital construction project.

On the liabilities side, TNH Hospital’s total payables reached over 940 billion VND, an increase of more than 35% since the beginning of the year. Loans and finance leases accounted for 893 billion VND, up 36%.

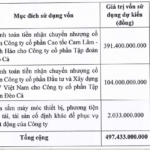

Cà Mau Province Authorities to Auction Shares of Local Environmental Enterprise

On September 30th, the Ho Chi Minh City Stock Exchange (HOSE) announced the opening of registration for auction agents to participate in the sale of nearly 536,000 shares held by the People’s Committee of Ca Mau Province in Ca Mau Environment and Urban Joint Stock Company (Camenco). The expected scale of this auction is over 10 billion VND.