Ending the Gold Bar Monopoly from October 10

The State Bank of Vietnam is seeking public input on the draft Circular guiding Decree 24/2012/NĐ-CP on gold trading activities, amended and supplemented by Decree 232/2025/NĐ-CP. The Circular is expected to take effect from October 10.

According to the State Bank, Decree 232 eliminates the state monopoly on gold bar production, allowing qualified businesses and commercial banks to produce gold bars and expand import and export rights.

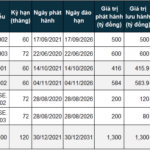

The draft specifies that by November 15 each year, licensed businesses and commercial banks must submit their gold import and export quota requests to the State Bank.

Entities wishing to produce gold bars must submit an application, proof of charter capital, internal production process regulations, and any post-inspection remediation documents (if applicable) to the State Bank.

By December 15, the State Bank will issue gold bar and raw gold import quotas to eligible businesses and commercial banks.

The draft Circular guiding Decree 24/2012/NĐ-CP on gold trading activities, amended by Decree 232/2025/NĐ-CP, is currently open for public consultation.

Speaking to Người Lao Động reporters on September 30, several businesses and experts expressed concerns that the draft’s deadlines—effective October 10 with a November 15 filing deadline—leave little time to prepare the required documentation.

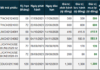

Huỳnh Trung Khánh, Vice Chairman of the Vietnam Gold Traders Association and Senior Advisor to the World Gold Council in Vietnam, advised commercial banks and businesses to promptly prepare their applications. He noted that few entities meet the capital requirements outlined in Decree 232 for gold bar production licenses.

“Companies like SJC, DOJI, PNJ, and some commercial banks have prior experience in gold bar production. However, others will need to invest in machinery, branding, and strategize to compete with SJC’s established gold bars,” said Khánh.

Will Imported Gold Narrow the Gap with Global Prices?

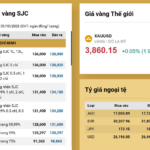

Experts and gold companies predict that if raw gold imports and gold bar production are approved, SJC gold bar prices will decrease, reducing the current 15-16 million VND/tael gap with global prices.

However, gold expert Nguyễn Ngọc Trọng questioned how many businesses and banks will receive import licenses, what the import quotas will be, and how much additional gold will enter the market.

“These decisions depend on the State Bank’s criteria. Businesses must forecast demand, request quotas, and apply for licenses. The State Bank will then determine total market needs for the upcoming year based on these requests,” explained Trọng.

The draft Circular establishes a Council to set and adjust gold bar export and import quotas. Members include leaders from the Foreign Exchange Management Department, Monetary Policy Department, Forecasting and Statistics Department, and Credit Institution Supervision Department.

This Council will advise the Governor of the State Bank on quota allocation, considering monetary policy goals, gold supply and demand, foreign exchange reserves, and gold import/export trends.

Proposing Fresh Content Ideas on Deposit Insurance

Some argue that the insurance payout limit of 125 million VND has become outdated in relation to today’s living standards, necessitating a more flexible adjustment.

SHB Officially Increases Chartered Capital to VND 45,942 Billion

The State Bank of Vietnam (SBV) has recently approved amendments to the charter capital outlined in the establishment and operation license of Saigon-Hanoi Commercial Joint Stock Bank (SHB). As a result, SHB’s new charter capital is now recorded at VND 45,942 billion, solidifying its position as one of the Top 5 largest private commercial banks in the system.