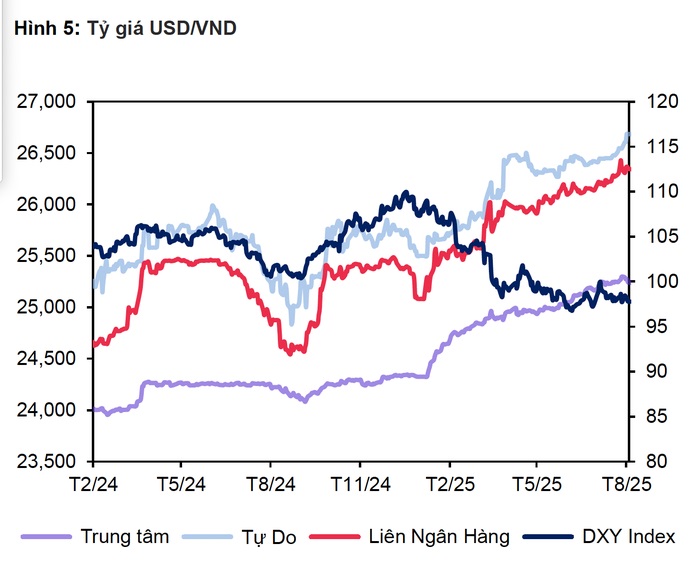

On October 2, the State Bank of Vietnam set the central exchange rate at 25,177 VND/USD, marking a 10-point decrease from the previous day and extending a week-long downward trend.

Commercial banks also reflected this cooling trend. Vietcombank, BIDV, and ACB all quoted the USD at around 26,215 VND for buying and 26,435 VND for selling, an 11-point drop compared to the day before.

Since its peak of over 26,536 VND/USD in mid-August, the USD has fallen by approximately 100 points.

USD prices have significantly cooled from their peak over the past month. |

This shift occurs as the greenback weakens globally. The USD Index (DXY) has held steady at 97.7 points for a month, following the U.S. Federal Reserve’s first interest rate cut of the year, with further reductions expected. This has eased pressure on the USD/VND exchange rate.

According to a recent forecast by UOB Bank (Singapore), the DXY is projected to decline further, potentially reaching 96.3 points in Q4 2025 and 93.9 points in 2026. This trend could strengthen other major currencies.

Mr. Đinh Đức Quang, Director of the Currency Trading Division at UOB Vietnam, noted that Vietnam’s highly open economy makes it vulnerable to global fluctuations. He suggested expanding the exchange rate management band to 5-6% annually, up from the previous 2-3%.

To maintain long-term exchange rate stability, Quang emphasized the need for comprehensive reforms, including upgrading the stock market, developing corporate bonds, attracting FDI, and establishing an international financial center. These measures would increase foreign currency supply, bolster confidence, and stabilize the exchange rate.

USD/VND exchange rate trends. Source: MBS

|

Thái Phương

– 14:53 02/10/2025

Central Bank Reverses Course, Injects Over 33 Trillion VND into Open Market

After a week of net withdrawals, the State Bank of Vietnam (SBV) resumed net injections into the open market during the final week of September (22-29/9) to support system liquidity.

USD Free Market Rates Experience Significant Fluctuations

Over the past two months, the free USD rate has consistently declined in the open market, moving further away from its peak of 27,000 VND.