Illustrative image

According to preliminary statistics from the General Department of Customs, footwear exports in August 2025 reached nearly $2 billion, a 9% decrease compared to the previous month. For the first eight months of 2025, the total export turnover of this sector exceeded $16.08 billion, marking a 7.6% increase compared to the same period in 2024.

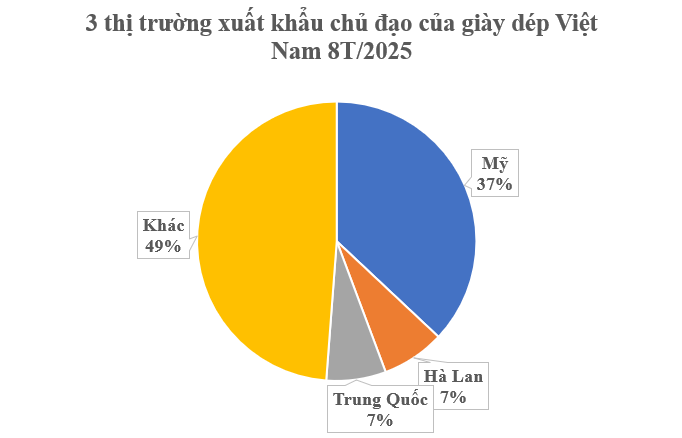

Overall, footwear exports to most markets in the first eight months of this year saw increased turnover compared to the same period last year. Among these markets, the United States remains the largest importer of Vietnamese footwear. By the end of the first eight months, exports to the U.S. reached over $6.07 billion, accounting for 37.8% of the total footwear export turnover and representing a 9% increase compared to the same period in 2024.

Exports to the Netherlands ranked second, reaching over $1.17 billion, an 11.4% increase compared to the same period in 2024. China followed in third place with nearly $1.12 billion, accounting for 7%, although this represents a 15% decline compared to the previous year.

According to the Vietnam Leather, Footwear, and Handbag Association (LEFASO), Vietnam currently ranks third globally in footwear production and second in exports, trailing only China. This achievement is the result of over 30 years of development, supported by substantial production capacity and a skilled workforce. Asia accounts for approximately 87% of global footwear production (23 billion pairs), with China producing 13 billion pairs, India over 2.6 billion, and Vietnam more than 1.4 billion pairs annually. Notably, Vietnam exports 90–95% of its total production, a significantly higher ratio compared to other major producing countries that primarily serve domestic markets.

Key export markets for Vietnamese footwear and handbags include the United States, the EU, South Korea, China, and the United Kingdom. Among these, the U.S. market remains the largest, with export turnover in 2024 reaching nearly $8.3 billion, a 15.6% increase.

This sustainable growth is supported by several key factors. Firstly, Vietnam effectively leverages tariff preferences from 16 free trade agreements (FTAs) signed with major markets, enhancing the price competitiveness of its leather and footwear products. Additionally, the industry benefits from an abundant labor force with competitive wages, ranging from $181 to $200 per month, a fundamental advantage in maintaining production competitiveness.

Vietnam is also a primary manufacturing hub for many international brands, producing 50% of Nike’s and 30% of Adidas’ products.

For 2025, the leather and footwear industry aims to achieve a 10% export growth compared to the previous year, targeting a turnover of approximately $29 billion.

Vietnam’s Commitments to Developing an International Financial Center

In a world of constant flux, the World Alliance of International Financial Centers (WAIFC) stands as a beacon of collaboration and stability. Deputy Prime Minister Nguyễn Hòa Bình underscored Vietnam’s unwavering commitment to advancing its International Financial Center through three bold pledges, reinforcing its role as a pivotal player in the global financial landscape.

SHB: Leading National Budget Contributor and Dedicated Social Welfare Partner for Years

Recently, SHB was honored in the TOP 10 Most Profitable Private Enterprises in Vietnam 2025 (PROFIT500), solidifying its robust financial capabilities, efficient operations, and significant contributions to the nation. The bank has officially increased its chartered capital to 45,942 billion VND, maintaining its position as one of the Top 5 largest private joint-stock commercial banks in the system.