According to the announcement, ACB has issued new terms for gold bar transactions, effective from October 10th. These transactions will be conducted at select branches, featuring gold bars from brands such as ACB, SJC, and other types as specified by the bank during different phases.

Mr. Trần Huỳnh Huy, Chairman of Asia Commercial Bank (ACB).

For SJC gold bars, branches will only trade the 1 tael variant. ACB-branded gold bars, however, will be available in all weights. Payments must be made in Vietnamese Dong through an ACB account, with settlement and delivery completed within the same day or a maximum of two business days.

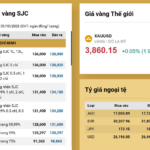

ACB also notes that gold prices will be based on listed rates or agreements at the time of transaction. Individual customers must provide valid identification, while organizations require a gold trading license issued by the State Bank of Vietnam. Buyers have the right to request invoices and must provide them when reselling to the bank.

The bank reserves the right to verify gold quality and charge associated fees for packaging and processing. It is also responsible for issuing sales invoices and providing transaction details to authorities upon request. ACB emphasizes that prices displayed on its website and ACB One app are for reference only; in case of system issues, counter prices will apply.

Previously, during a meeting with the State Bank of Vietnam, Techcombank revealed plans to enter the market to increase supply and enhance transparency in gold trading.

Mr. Phạm Quang Thắng, Deputy General Director of Vietnam Technological and Commercial Joint Stock Bank (Techcombank), stated that the bank had previously engaged in gold trading but suspended operations in recent years. However, with the liberalization brought by Decree 232/2025, Techcombank has actively prepared and awaits the issuance of the guiding Circular to formally request permission from the State Bank to import raw gold and begin production.

The bank is currently seeking international partners for raw gold imports and exploring the creation of Techcombank-branded gold bars. It is also preparing domestic infrastructure, including personnel, storage, supply chain processes, and distribution networks. Beyond physical branches, Techcombank aims to develop a digital platform for online gold trading.

Upgrade to iPhone with ACB: 0% Down Payment, Stress-Free Installments

It takes the average Vietnamese worker a staggering 99 days of wages to afford an iPhone 17 Pro, a stark contrast to the mere 3 days for Luxembourgers and 4 days for Americans. Yet, the allure of the iPhone remains unwavering, as evidenced by over 100,000 pre-orders on the first day of availability.

Latest Updates on Gold Bullion Licensing

For the first time, businesses and commercial banks can apply for gold bar production licenses under the new draft circular from the State Bank of Vietnam. Streamlined administrative procedures and the elimination of unnecessary conditions make gold trading more accessible and efficient.

Why Automated Profitability is the Inevitable Trend in Modern Banking?

As a pioneer in digitalization, Techcombank leverages its innovative edge and trusted financial solutions to empower over 16.5 million customers. By ushering in the era of Automated Profitability, we redefine how Vietnamese manage their finances—safely, flexibly, and around the clock—while maximizing value and experience. Our customer-centric strategy not only optimizes wealth management but also extends our legacy of success through a uniquely differentiated approach.