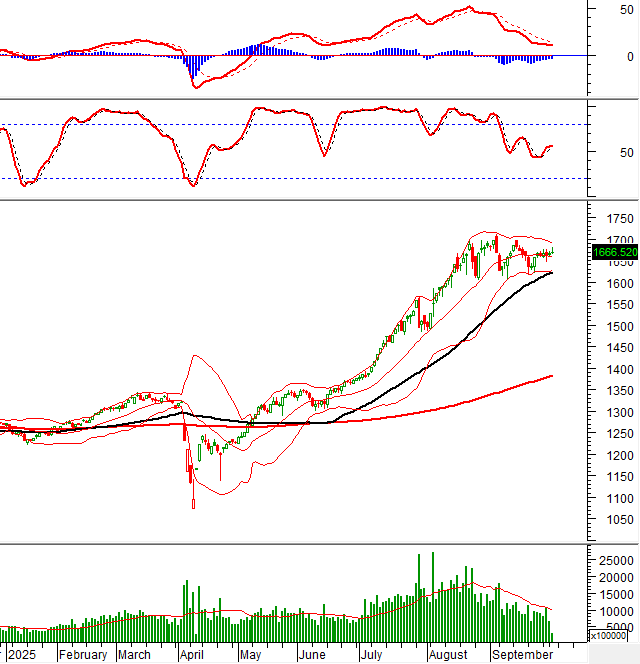

Technical Signals of the VN-Index

During the morning trading session on October 2, 2025, the VN-Index narrowed its gains while forming a Long Upper Shadow candlestick pattern.

The sideways consolidation phase is likely to persist, given the consistently low trading volume observed in recent sessions.

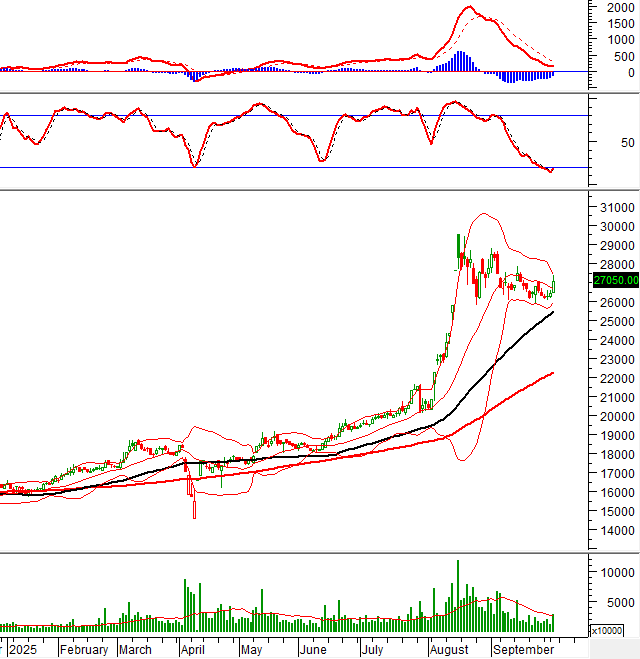

Technical Signals of the HNX-Index

In the morning session of October 2, 2025, the HNX-Index declined, retesting the lower boundary of the Triangle pattern (around 270-272 points).

The short-term outlook remains subdued, as both the Stochastic Oscillator and MACD indicators continue their downward trajectory following earlier sell signals.

MBB – Military Commercial Joint Stock Bank

On the morning of October 2, 2025, MBB shares surged, breaking above the Middle line of the Bollinger Bands. Trading volume is projected to exceed the average by session close, reflecting investor optimism.

The Stochastic Oscillator has generated a buy signal from the Oversold region. Sustained buying momentum and an exit from this zone would further bolster the stock’s short-term prospects.

TCB – Vietnam Technological and Commercial Joint Stock Bank

During the October 2, 2025 morning session, TCB shares extended gains, forming a Rising Window candlestick pattern.

The MACD has crossed above its Signal Line, generating a buy signal, while the Stochastic Oscillator continues its upward trajectory post-buy signal. Confirmation of these signals in upcoming sessions would likely sustain the positive short-term momentum.

(*) Note: The analysis is based on real-time data as of the morning session close. Signals and conclusions are for reference only and may change after the afternoon session ends.

Technical Analysis Department, Vietstock Advisory Division

– 12:42 October 2, 2025

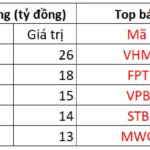

Foreign Investors Continue Sell-Off: Which Stocks Faced the Heaviest Dumping in Session 2/10?

Foreign investors’ trading activity has been a notable drawback, as they engaged in significant net selling across all three major exchanges.

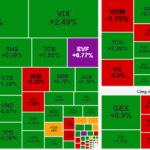

Seizing Market Volatility: Strategic Investment Opportunities on October 2nd

The market continues to oscillate in a state of indecision. However, these intraday fluctuations present strategic opportunities for investors to deploy capital effectively.