According to statistics from the Customs Department, Vietnam’s timber and wood product exports in August 2025 reached nearly $1.5 billion, a 3.4% decrease compared to August 2024.

For the first eight months of 2025, the total export value of timber and wood products reached $11.1 billion, a 6.5% increase compared to the same period in 2024. Specifically, wood product exports accounted for $7.6 billion, a 6.2% rise year-over-year.

Despite global economic challenges and uncertainties, Vietnam’s timber and wood exports have maintained a positive growth trend. From February to July 2025, export values showed consistent growth. However, in August 2025, exports slightly declined compared to July 2025 and the same period in 2024.

Nevertheless, the overall eight-month performance in 2025 remains promising, providing a solid foundation for the industry to strive toward its $18 billion annual target.

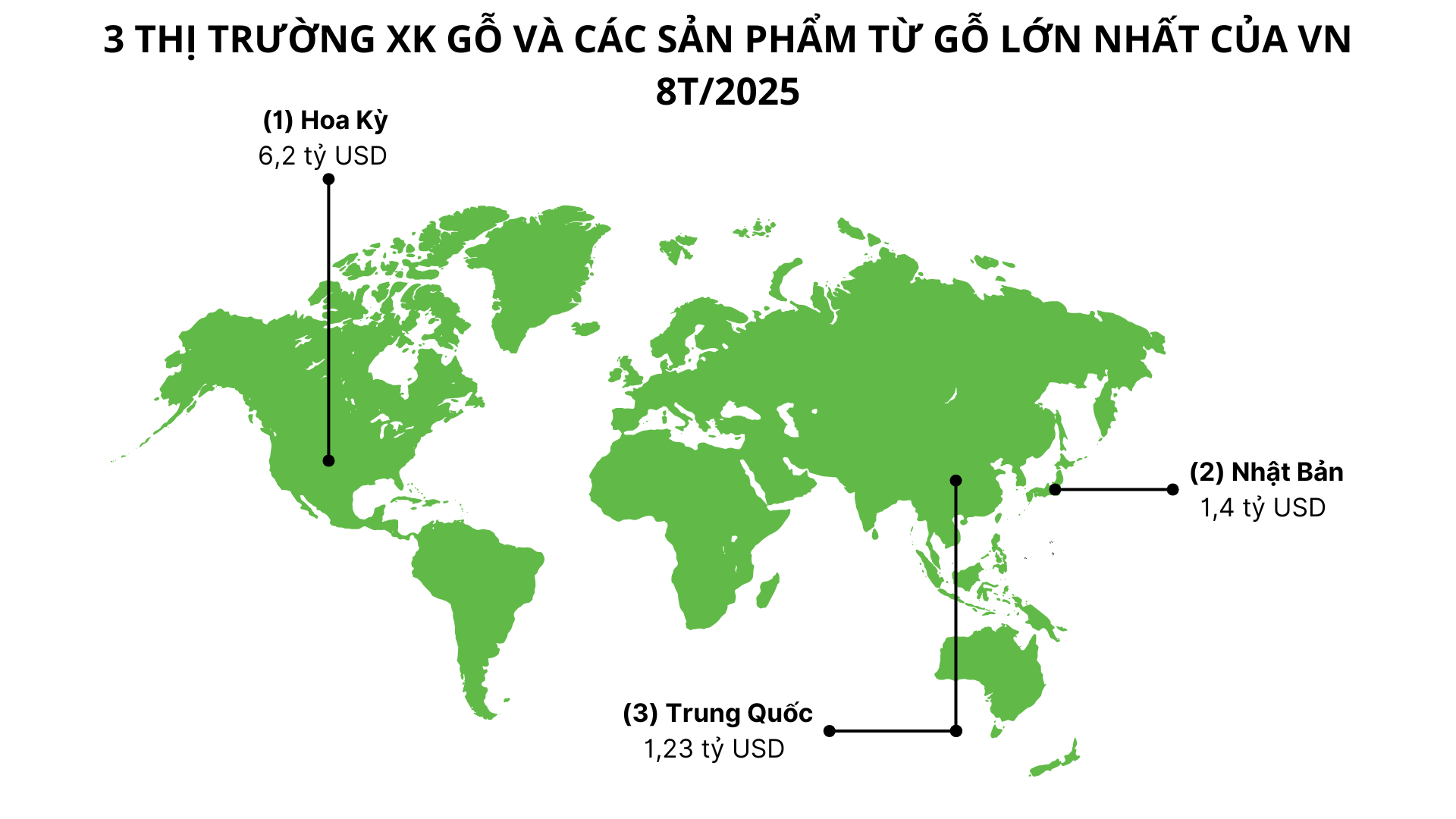

In terms of export markets, the United States remained the largest market in the first eight months of 2025, with exports valued at $6.2 billion, a 7% increase compared to the same period in 2024.

Japan followed with $1.4 billion in exports, a 24% increase year-over-year, indicating a stable shift in orders and consumer demand in this market.

Additionally, exports to markets such as Canada, the UK, Malaysia, and Australia also showed positive growth during the first eight months of 2025. Although these markets represent a smaller share, the results underscore the effectiveness of market diversification strategies, reducing reliance on traditional markets and opening new growth opportunities.

On September 29th, U.S. President Donald Trump unexpectedly signed an executive order imposing a 10% tariff on softwood and sawn timber imports, along with a 25% tariff on kitchen cabinets, bathroom cabinets, and upholstered wood furniture.

In his announcement, President Trump emphasized that imported wood is weakening the U.S. economy, threatening the closure of wood processing plants and disrupting the wood product supply chain.

Vietnam’s wood industry is expected to be significantly impacted by these tariffs. In the U.S. market, Vietnam holds the largest market share, far surpassing other competitors. According to the International Trade Centre (ITC), Vietnam’s market share in the first seven months of the year reached 46%, significantly ahead of China’s 12%.

Despite growing challenges, some businesses view this as an opportunity for Vietnam to enhance the value-added of its wood products, targeting high-end segments where consumers prioritize quality over price sensitivity. Products meeting international standards, with unique designs and strong branding, can maintain their position in the U.S. market despite tariff barriers.

Forecasts for Q4 2025 indicate increased demand in major markets like the U.S. and EU, driven by the year-end shopping season, particularly for high-value furniture and wood products. If the current pace is maintained, and production and logistics costs are managed effectively, Vietnam’s wood industry could achieve a strong finish to the year.

Vietnam’s Economy Through an International Lens: The 2025 Momentum and Long-Term Prospects

International financial institutions recognize Vietnam as a regional growth highlight, with a 7.5% GDP increase in the first half of 2025. This strong performance sets the stage for the country’s ambitious full-year target of 8.3-8.5%, reinforcing confidence in its sustainable economic outlook.

Fruit and Vegetable Exports: Surging Past Stagnation, Aiming for New Record Highs

After a challenging start to the year, Vietnam’s fruit and vegetable exports have staged a remarkable comeback.