The cryptocurrency market is thriving in today’s trading session. As of the morning of October 2nd, Bitcoin (BTC) surged past the $118,600 mark, marking a remarkable 3.62% increase in the last 24 hours and inching closer to its all-time high. Bitcoin’s market capitalization now stands at approximately $2.36 trillion.

Bitcoin’s rally has extended to major altcoins, with Ethereum (ETH), Solana (SOL), and XRP all posting gains of 4–6% over the past 24 hours.

Bitcoin’s sharp rise (morning session, October 2nd).

This surge comes as global investors seek safe-haven assets following the U.S. government’s announcement of a shutdown at midnight on October 1st (Eastern Time), or 11 AM Vietnam Time.

This marks the 15th U.S. government shutdown since 1981 and the first since the longest shutdown in history, which lasted 35 days six years ago.

Despite intense negotiations in Congress, Democrats and Republicans failed to reach a budget agreement to keep the government operational beyond September 30th, the end of the 2024-2025 fiscal year.

Historically, government shutdowns have led to financial market instability, including a weaker U.S. dollar, volatile stock markets, and surging bond yields. In such environments, investors often shift capital to alternative assets like gold and Bitcoin, viewed as safe havens against systemic risks.

Beyond macroeconomic factors, Bitcoin ETFs continue to drive prices higher. In September, global Bitcoin ETFs saw net inflows of $3 billion, rebounding from outflows in August. Year-to-date, these inflows exceed $22 billion.

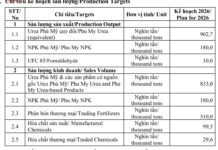

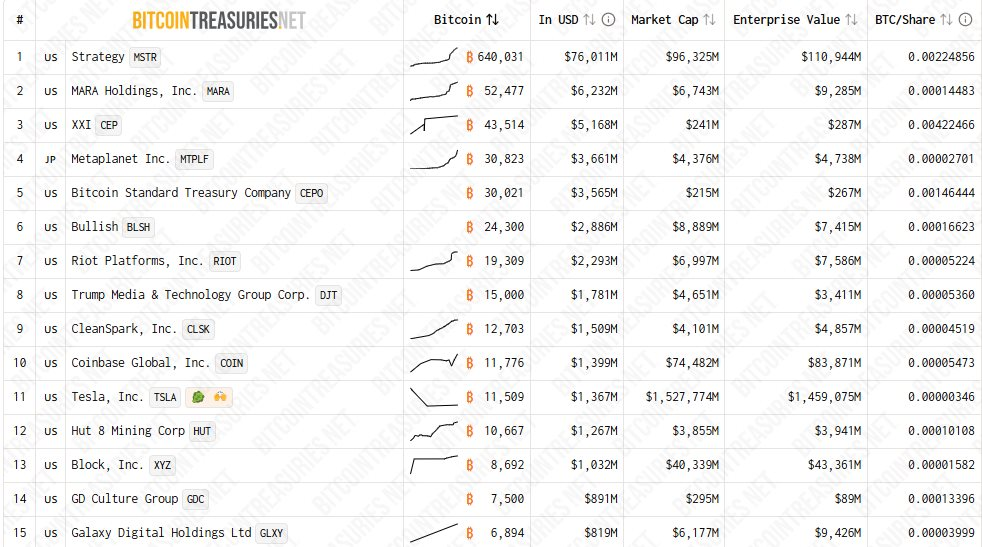

Another factor bolstering Bitcoin’s rise is the accumulation by corporate treasuries and large institutional investors. Data from Bitcoin Treasuries shows that publicly listed companies globally now hold nearly 1,040,000 BTC.

Most recently, Metaplanet, a Japanese-listed company focused on crypto treasury management, acquired an additional 5,268 Bitcoin, valued at approximately $616 million.

According to an announcement on October 1st, this purchase brings Metaplanet’s Bitcoin holdings to 30,823 BTC, worth over $3.5 billion, propelling it from the top 5 to the 4th spot among publicly traded companies with the largest Bitcoin holdings.

Leading the list is Strategy, which has consistently expanded its Bitcoin portfolio in recent weeks, now holding over 640,000 BTC—far ahead of its competitors.

While the outlook is positive, experts caution investors to remain vigilant against sudden market shifts. A last-minute budget deal in Congress or a more hawkish signal from the Federal Reserve on interest rates could quickly reverse market sentiment. Additionally, Bitcoin’s proximity to its previous peak may trigger short-term profit-taking.

“Transforming Trillions in Fraudulent Funds into Cryptocurrency Assets”

Authorities report that in cases of online fraud, the majority of stolen funds have been converted into cryptocurrency through transactions on international exchanges. Statistics reveal that between December 2019 and May 2024, nearly 20,000 fraud cases were detected, involving over 17,000 perpetrators and causing losses exceeding 12 trillion Vietnamese dong.

Amidst Allegations of $250 Million Embezzlement, Stock Plunges After Crypto Asset Firm Investment

This brokerage firm has garnered attention for its strategic investment in VimExchange, a leading corporation specializing in cryptocurrency and digital asset trading.

Shark Bình’s Blunt Take on Crypto Investors: Early Profits Rarely Earn Thanks, But Losses Spark Blame and Backlash

Mr. Binh believes that investing requires embracing both rewards and risks: profits are enjoyed, losses are accepted—much like investing in gold or stocks.