Vietcombank Securities (VCBS) has released a report forecasting the business performance of the third quarter and the entire year of 2025, with a spotlight on the banking and securities sectors.

VCBS highlights a strong quarter for securities companies, particularly in proprietary trading. Mid-sized and smaller firms maintaining large stock portfolios like VIX, SHS, and CTS saw profit growth doubling. Meanwhile, leading firms focusing on margin lending achieved high growth by boosting loan balances (50-70%).

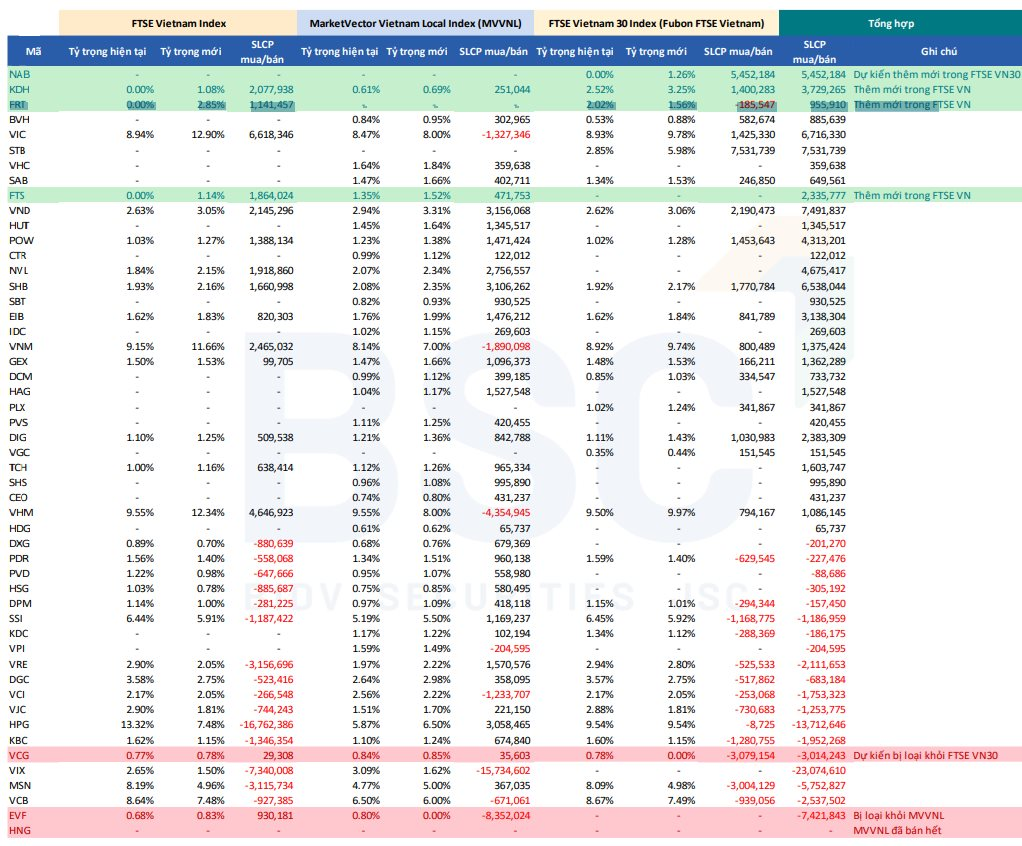

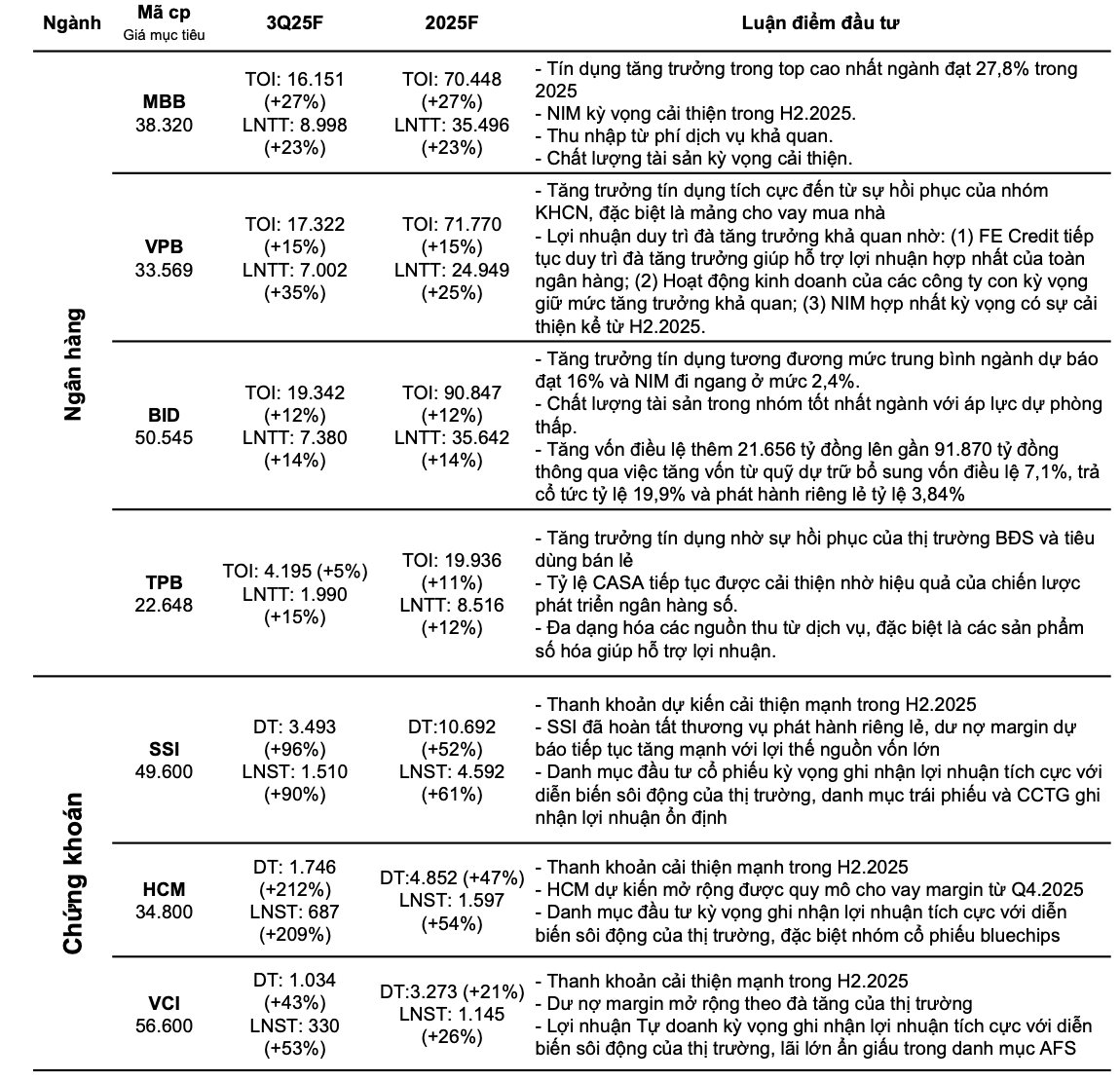

For HCM, revenue is projected at VND 1,746 billion, with after-tax profit reaching VND 687 billion, up 212% and 209% respectively year-on-year. The primary growth driver is the significant improvement in market liquidity in the second half of 2025. Additionally, HCM plans to expand its margin lending scale from Q4/2025, and its investment portfolio is expected to yield positive returns due to the vibrant market, especially in large-cap stocks (bluechips).

SSI Securities is expected to achieve revenue of VND 3,493 billion and after-tax profit of VND 1,510 billion, both up over 90% year-on-year. Similar to HCM, SSI’s growth is driven by improved market liquidity in the second half of 2025. The company has completed a private placement, providing a substantial capital advantage to further expand margin lending. The stock investment portfolio is anticipated to yield positive returns with the dynamic market, while the bond and deposit certificate (CCTG) portfolio offers stable income.

Ban Viet Securities (VCI) is also in the growth group, with margin lending expanding in line with market trends. Proprietary trading is expected to record positive profits due to market vibrancy. Notably, significant gains hidden in the financial assets available for sale (AFS) portfolio are projected to boost VCI’s profit by 53% to VND 1,034 billion in Q3.

In the banking sector, BID is forecasted to achieve 14% profit growth in Q3/2025, reaching VND 7,380 billion. Credit growth is projected at 16%, in line with the industry average, while net interest margin (NIM) remains stable at 2.4%. BIDV continues to maintain one of the best asset qualities in the industry with low provisioning pressure. Notably, the bank will increase its charter capital by VND 21,656 billion, raising it to nearly VND 91,870 billion through: a 7.1% increase from the supplementary capital reserve fund, a 19.9% stock dividend, and a 3.84% private placement.

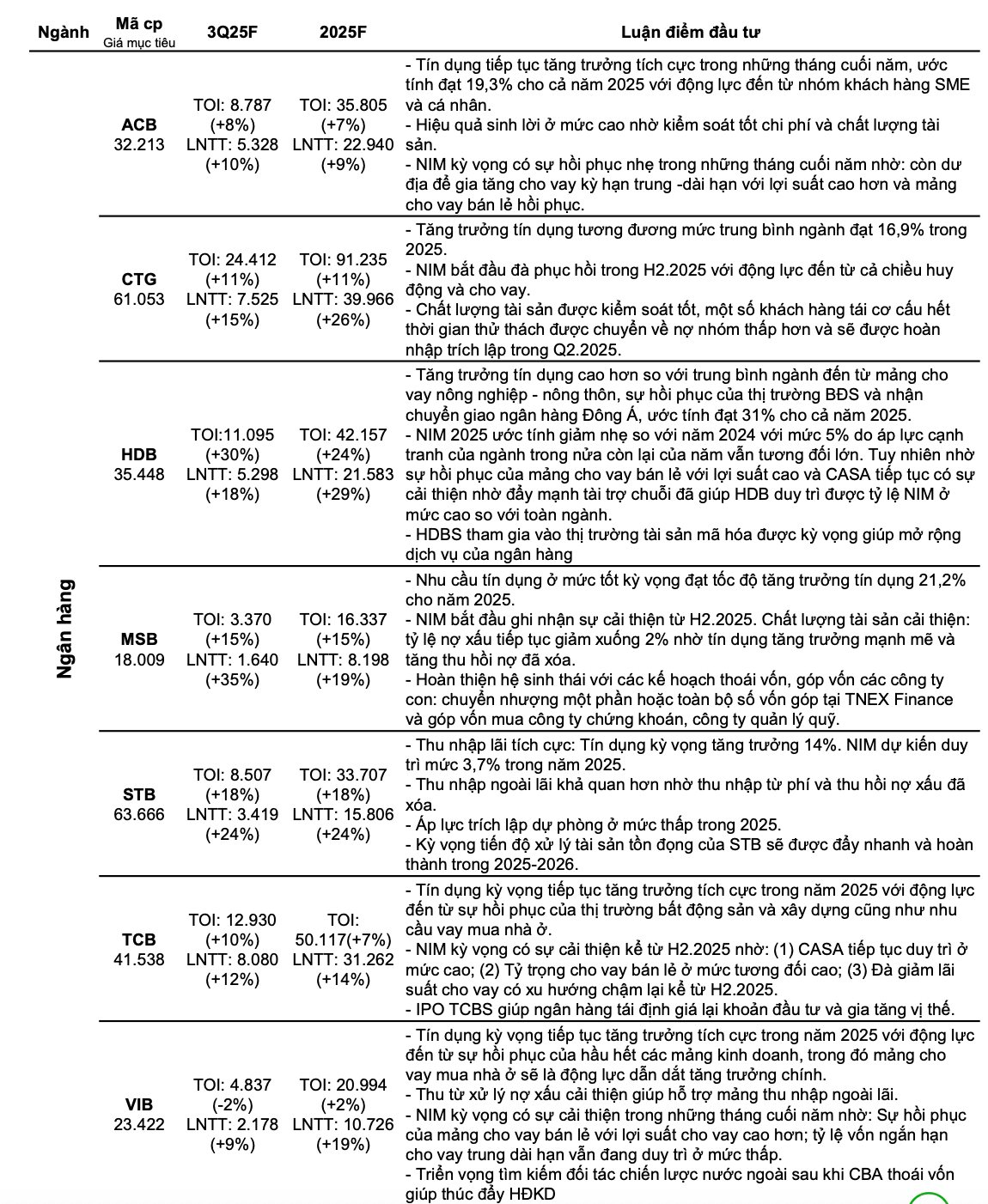

For CTG, net interest margin (NIM) is expected to begin recovering in the second half of 2025, driven by both deposit and lending activities. Asset quality remains strong, with some restructured customers completing their probationary period and being reclassified to lower-risk groups. This allows CTG to reverse provisions in Q2/2025, creating additional profit growth potential.

TCB’s credit growth is expected to remain positive in 2025, supported by the recovery in real estate, construction, and housing loans. Net interest margin (NIM) is anticipated to improve from the second half of 2025 due to three factors: high CASA ratio, large retail lending share, and slowing loan interest rate reductions. Additionally, the IPO of Techcombank Securities (TCBS) will help TCB revalue its investment and strengthen its market position.

Why Are Top Businesses Boldly Scaling Up Their 2025 Plans?

The stock market’s remarkable surge and the exceptional first-half financial results have prompted numerous brokerage firms to significantly elevate their 2025 targets. Additionally, companies across various sectors are revising their projections upward, fueled by unexpected revenue streams, leading to a widespread shift in business objectives.