Illustrative Image

The Russia-Ukraine conflict has presented a golden opportunity for Chinese automakers, allowing them to swiftly fill the void left by international competitors in Russia post-2022. However, this new landscape has placed them in a precarious position: facing the risk of international sanctions and mounting protectionist pressures from the Moscow government.

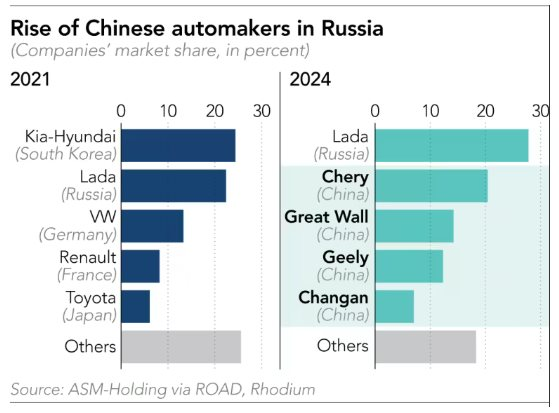

Market data reveals that from a near-absent position in Russia at the end of 2021, brands like Chery, Great Wall Motor (GWM), Geely, and Changan surged to capture over 60% of the market share by the end of 2024, second only to the domestic brand Lada. Yet, their paths are now diverging.

Chery, China’s largest automaker in Russia, recently announced a near-complete withdrawal from the market to mitigate sanction risks. The company has transferred all inventory, distribution networks, and warranty obligations since late July.

Comparison of growth rates among automakers in Russia over the past three years. Source: Nikkei

Over the past two years, Russia contributed 25.5% and 17.7% of Chery’s revenue, equivalent to $5.8–6.7 billion. However, the company forecasts that by 2027, revenue from this market will become negligible. Beyond sanctions, Chery faces pressure from rising recycling fees for imported vehicles, reducing its global profit margin to 13.2% in 2024.

This move is seen as bold, especially as Chery expands in Europe. The company has begun electric vehicle production in Spain with a €400 million investment, aiming for a capacity of 150,000 units by 2029. Additionally, Chery has halted sales in Iran and Cuba to avoid sanction risks.

In contrast to Chery, Great Wall Motor has doubled its presence in Russia. Thanks to its Tula plant (200 km from Moscow), operational since 2019, GWM is exempt from recycling fees and local taxes until 2028.

Last year, the plant produced 132,500 vehicles, with a capacity utilization rate exceeding 165%—the highest across the company’s network. GWM plans to expand the plant and utilize vacant facilities from Western brands to add 50,000 units in annual capacity.

While increasing investment in Russia, GWM has scaled back in Europe, closing its Munich headquarters and SVOLT battery plant. Beyond Russia, the company operates production facilities in Thailand, Brazil, and assembly plants in Ecuador, Malaysia, and Pakistan—locations that offer flexibility against Western sanctions.

Unlike Chery and GWM, Geely operates in Russia through a joint venture, BelGee, in Belarus. This venture manufactures Geely vehicles and exports them to Russia, bypassing recycling fees due to trade agreements between the two countries.

Experts suggest that Chery’s withdrawal and GWM’s expansion signal a turning point for Chinese automakers in Russia. Increasing protectionism, particularly recycling fees, and pressure from the European Union may reshape the automotive relationship between the two nations.

Gregor Sebastian, an analyst at Rhodium Group, notes: “Moscow’s message is clear: Russia welcomes Chinese cars, but they must be produced locally.”

Source: Nikkei Asia

Chinese Cars Continue to Slash Prices in Vietnam’s Automotive Market

In a bid to challenge the market dominance of established Japanese and Korean automakers, Chinese car manufacturers and their dealerships have recently rolled out aggressive discount programs, offering substantial price reductions to attract buyers.