Recently, Deo Ca Transport Infrastructure Investment Joint Stock Company (Stock Code: HHV, HoSE) announced a resolution by its Board of Directors approving a detailed plan for the issuance of additional shares to existing shareholders in 2025.

Accordingly, Deo Ca Transport Infrastructure plans to issue over 49.7 million shares to existing shareholders through a rights offering. The maximum rights ratio is 10:1, meaning shareholders holding 10 shares can purchase 1 new share. The shares are unrestricted for transfer.

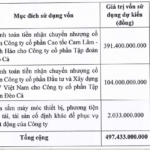

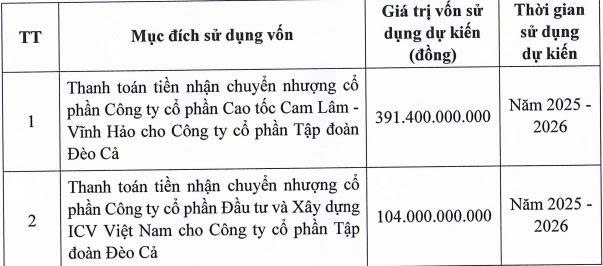

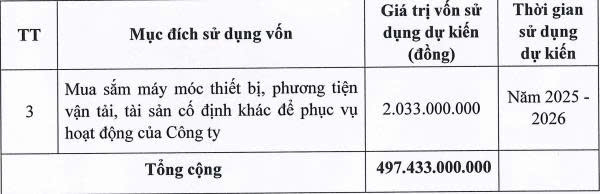

With an offering price of VND 10,000 per share, Deo Ca Transport Infrastructure expects to raise approximately VND 497.4 billion, which will be allocated for the following specific purposes:

Source: HHV

The share issuance is expected to commence immediately after the company receives the securities offering registration certificate from the State Securities Commission (SSC) and must be completed within 90 days from the effective date of the certificate.

If the issuance is successful, the number of outstanding shares of Deo Ca Transport Infrastructure will increase from over 497.4 million to nearly 547.2 million, with the corresponding charter capital rising from VND 4,974.3 billion to nearly VND 5,471.8 billion.

Regarding business performance, according to the audited consolidated financial report for the first half of 2025, Deo Ca Transport Infrastructure generated net revenue of nearly VND 1,682.1 billion, an 11.9% increase compared to the same period in 2024.

After deducting taxes and fees, the company reported a net profit of nearly VND 324.4 billion, a 33% increase year-over-year.

For 2025, Deo Ca Transport Infrastructure has set a business target of VND 3,585 billion in revenue and over VND 555.6 billion in after-tax profit, representing increases of 8% and 12%, respectively, compared to 2024.

Thus, by the end of the first two quarters, the company has achieved 46.9% of its revenue target and 58.4% of its after-tax profit target for the year.

As of June 30, 2025, Deo Ca Transport Infrastructure’s total assets increased slightly by 2.4% from the beginning of the year to over VND 39,836.9 billion. Fixed assets account for 69.4% of total assets, amounting to over VND 27,627.7 billion.

On the liabilities side, total payables stand at over VND 28,011.4 billion, a slight increase of VND 34.7 billion from the beginning of the year. Of this, loans and finance leases amount to over VND 18,683 billion, representing 66.7% of total liabilities.

HHV Seeks to Raise Nearly VND 500 Billion for Cam Lam – Vinh Hao Expressway Share Acquisition

Dèo Cả Infrastructure Investment Joint Stock Company (HOSE: HHV) has approved a plan to issue nearly 50 million shares to existing shareholders. The primary purpose of this issuance is to settle the payment for shares acquired from Deo Ca Group.

Coteccons (CTD) Bets on VND 30 Trillion Target: Ambitious Push to Surpass Historical Peak Amid Concerns Over VND 1.1 Trillion Negative Cash Flow

Following a year of surpassing profit targets, Coteccons has set an ambitious goal for the 2026 fiscal year: achieving a record-breaking revenue of 30 trillion VND. This plan is underpinned by a substantial backlog but also presents significant challenges in cash flow management and cost efficiency.