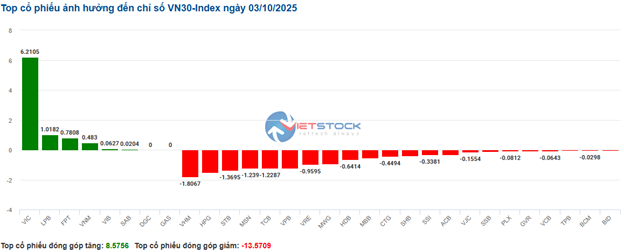

Among the top 10 stocks influencing the VN-Index, VHM had the most negative impact, deducting 1.87 points from the index. Closely following were TCB and CTG, which further dragged the index down by over 2 points. Conversely, VIC emerged as a significant bright spot, contributing nearly 6 points to the index.

| Stocks with the strongest impact on VN-Index during the morning session of 03/10/2025 (measured in points) |

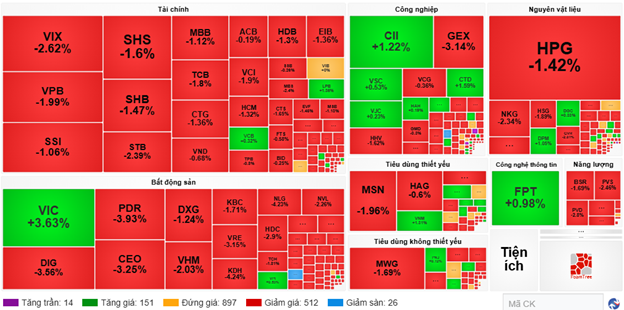

Most sectors were bathed in red. The energy sector temporarily lagged with a 1.57% decline due to negative performances from stocks like BSR (-1.69%), PLX (-1.47%), PVS (-2.77%), PVD (-3.03%), PVT (-1.1%), PVC (-1.74%), and MVB (-2.63%).

Large-cap sectors such as finance and industry placed significant pressure on the overall index, both plummeting by 0.8%. Numerous stocks fell by over 1%, including CTG, TCB, VPB, MBB, STB, HDB, SHB, VIX, BVH; HVN, GEE, GEX, VGC, PHP, PC1, and HHV.

On the flip side, the information technology sector temporarily led the market, largely thanks to the positive contribution of the leading stock FPT, which rose by 0.98%.

Source: VietstockFinance

|

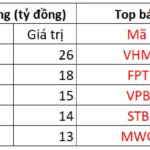

Foreign investors net sold nearly 902 billion VND across all three exchanges. Selling pressure was concentrated on two stocks: MWG and STB, with values of 149.97 billion and 124.61 billion, respectively. Meanwhile, VIC led the net buying list with a value of 164.73 billion VND, significantly outpacing other stocks.

| Top 10 stocks with the strongest net buying and selling by foreign investors during the morning session of 03/10/2025 |

10:30 AM: Red continues to dominate the market

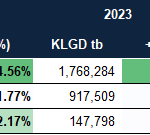

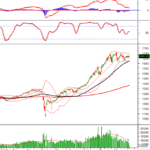

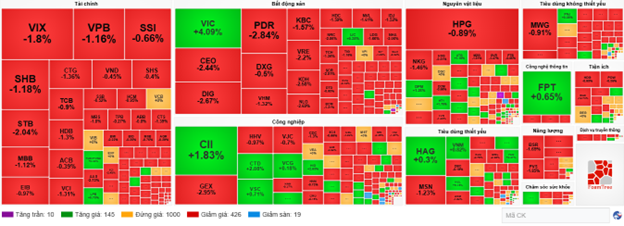

Negative trading sentiment caused major indices to weaken further. As of 10:30 AM, the VN-Index dropped by over 10 points, trading around 1,642 points. The HNX-Index fell by more than 2 points, trading around 266 points.

Banking stocks such as STB, TCB, VPB, and HDB negatively impacted the VN30-Index, deducting 1.36 points, 1.22 points, 1.22 points, and 0.64 points, respectively. In contrast, VIC, LPB, FPT, and VNM were among the few pillar stocks helping the VN30 retain over 8.4 points.

Source: VietstockFinance

|

The financial sector continued to face challenges, with widespread selling pressure. Specifically, CTG fell by 1.55%, VCB by 0.16%, BID by 0.25%, and MBB by 0.93%. On the other hand, a few stocks saw slight recoveries, such as LPB rising by 0.78%, DSE by 0.17%, and ORS by 0.37%.

The energy sector also performed poorly, with the largest market decline of 1.48%. Selling pressure was concentrated on large-cap oil and gas stocks like BSR (-1.69%), PLX (-1.32%), PVS (-1.85%), and PVD (-1.82%).

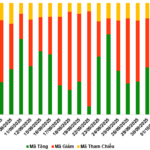

Compared to the opening session, sellers gradually gained the upper hand, with 425 declining stocks and 145 advancing stocks.

Source: VietstockFinance

|

Opening: Pillar stocks continue to pressure the VN-Index

The market opened with red dominating most sectors. The VN30 index had the most negative impact, as most stocks within this group declined.

The financial sector followed suit, with stocks like VIX, SSI, VPB, SHB, STB, and HDB all in the red.

Real estate stocks also performed negatively from the opening, particularly DIG (-1.34%), PDR (-1.31%), CEO (-1.22%), and DXG (-0.25%).

Additionally, the industrial sector saw a less-than-positive start, with declining stocks outnumbering advancing ones, such as CII (-0.2%), VJC (-0.62%), GEX (-1.48%), and HHV (-0.97%).

The information technology sector performed well, primarily supported by FPT, which rose by 1.09% at the opening.

– 10:35 03/10/2025

Steel Industry Shareholders Profit, But Celebrations on Hold

Following the sharp decline in April 2025 due to tariff shocks, many steel stocks have successfully formed a V-shaped recovery. However, compared to the broader market’s upward momentum, the sector still appears sluggish, as all steel stocks underperformed the VN-Index. This reflects investors’ lingering caution toward the industry.

Foreign Investors Continue Sell-Off: Which Stocks Faced the Heaviest Dumping in Session 2/10?

Foreign investors’ trading activity has been a notable drawback, as they engaged in significant net selling across all three major exchanges.