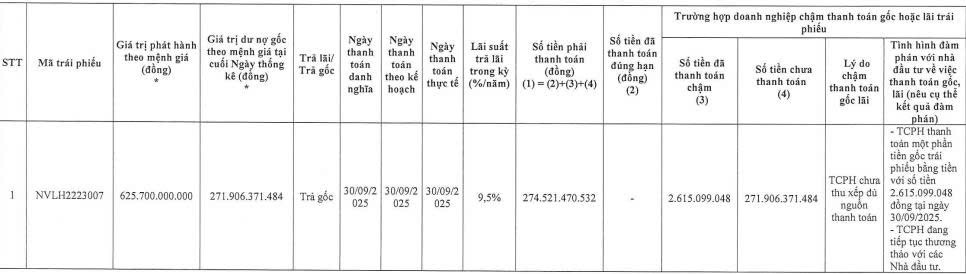

Recently, the Hanoi Stock Exchange (HNX) published official documents detailing the payment status of principal and interest on bonds issued by Nova Group Investment Corporation (Novaland, Stock Code: NVL, listed on HoSE).

Specifically, on September 30, 2025, Novaland was scheduled to pay over VND 274.5 billion in principal for the bond series NVLH2223007. However, the company has only settled VND 2.6 billion, leaving an outstanding balance of more than VND 271.9 billion.

The NVLH2223007 bond series consists of 6,257 bonds, each with a face value of VND 100 million, totaling VND 625.7 billion in issuance value. With a 12-month term, the bonds were set to mature on March 31, 2023.

Source: HNX

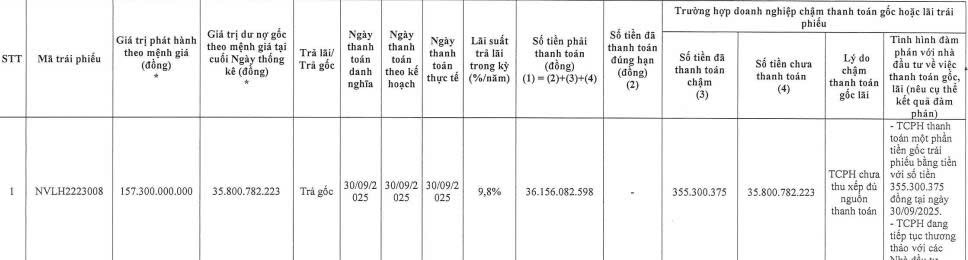

Similarly, on the same day, Novaland paid only VND 355.3 million out of the nearly VND 36.2 billion in principal due for the NVLH2223008 bond series, leaving an outstanding balance of over VND 35.8 billion.

This bond series was issued by Novaland on March 31, 2022, with a total issuance value of VND 157.3 billion.

In its explanation, Novaland stated that the delayed payments were due to the company’s inability to secure the necessary funds. The company is currently negotiating with investors to settle the remaining debt.

In other developments, Novaland recently announced a decision by its CEO to extend the payment period for the ESOP share purchase and the issuance of bonus shares to employees.

The extended payment period for the ESOP share purchase and bonus shares is from September 5, 2025, to October 2, 2025.

Under the issuance plan, Novaland intends to offer nearly 48.8 million ESOP shares to employees, representing 2.5% of the total outstanding shares. These shares will be subject to a one-year transfer restriction from the end of the issuance period.

With a sale price of VND 10,000 per share, Novaland expects to raise over VND 487.5 billion, which will be used to strengthen the company’s business operations and working capital.

Additionally, Novaland will issue nearly 48.8 million bonus ESOP shares to employees, also subject to a one-year transfer restriction.

The total issuance value, based on par value, exceeds VND 487.5 billion. The funding for this issuance will come from the company’s capital surplus, as reflected in the audited standalone financial statements for 2024.

The purpose of these ESOP issuances is to recognize the contributions of employees to the company’s business operations.

It also aims to attract and retain talented and experienced employees, motivating them to contribute to the company’s sustainable growth and share in its achievements.

IPA Shareholders Approve Plan to Issue 50 Million Shares

Through a written consent process, IPA shareholders have approved a private placement of 50 million shares. The proceeds from this offering will be utilized to repurchase outstanding bonds issued in 2024 ahead of their maturity date.