Kazuhisha Okawa, CEO of Olympia Lighting Vietnam, a Japanese FDI company, announced plans for an IPO and listing on the Vietnamese stock market.

Decree 245/2025/NĐ-CP, recently issued by the government, streamlines the IPO and listing process. The Vietnam Stock Exchange now reviews listing applications concurrently with the State Securities Commission’s IPO evaluation, reducing timelines. Notably, foreign issuers no longer require SSC approval for listings.

Founded in Shanghai in 2003, Olympia Lighting initially focused on OEM/ODM manufacturing for Japanese brands like Toshiba and Mitsubishi Electric.

In 2012, amid the “China+1” trend, Olympia explored alternatives, ultimately choosing Vietnam over Pakistan, Myanmar, and Cambodia. Vietnam’s advanced infrastructure and skilled workforce were decisive factors. By late 2012, Olympia Lighting Vietnam was established and began factory construction.

To address local supply chain gaps, Olympia integrated metal casting and painting/assembly in-house, ensuring Japanese quality standards and cost efficiency. This enabled OEM/ODM exports to Japan.

During the COVID-19 pandemic, Olympia’s flagship product, AKARINA, was fully manufactured in Vietnam, serving both Japan and Europe.

Local production of branded products has strengthened Olympia’s global supply chain, with private-label revenue now comprising 50% of total sales after 12 years in Vietnam.

“To achieve our public listing goals, we’re committed to contributing to Vietnam’s economy and collaborating with non-Japanese multinationals here. Expanding in the US market—a challenging yet strategic priority—is also key,” said Okawa.

Kazuhisha Okawa, CEO of Olympia Lighting Vietnam

Okawa highlights Vietnam’s evolving lighting market, shifting from basic functionality to design-focused solutions. Unlike Japan’s tiered market, Vietnam lacks mid-range options, presenting opportunities for quality, aesthetically driven products.

“As Vietnamese living standards rise, lighting is no longer just utilitarian. Consumers seek products that enhance ambiance and emotional depth, particularly in premium spaces like offices and cafes,” Okawa noted.

Olympia is adapting by building a trend-responsive team and aligning production with Vietnamese cultural preferences, rather than imposing Japanese styles.

This market integration underpins Olympia’s Vietnam listing strategy, reflecting its long-term commitment to the region.

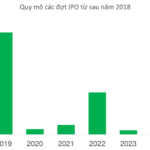

The IPO Season Arrives: Largest Capital Raise Since 2018

After years of stagnation, Vietnam’s primary market is entering its most vibrant IPO season since 2018, with a wave of major corporations simultaneously launching plans to raise billions of dollars in capital.

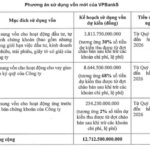

Gelex Infrastructure Unveils IPO Plan: Targeting $28,000–$30,000 per Share, Aiming to Raise $300 Million, Potentially Valuing Company at $1 Billion

According to BVSC Securities, Gelex Infrastructure Corporation is poised to raise approximately VND 3,000 billion, a strategic move to bolster capital for its real estate segment and re-evaluate the market’s perception of the “engine” that currently constitutes two-thirds of the group’s total assets.

TCBS Secures Stock Code TCX, Poised for HOSE Listing in October

Technological Commercial Securities Corporation (TCBS) has officially been granted the stock code TCX by the Vietnam Securities Depository and Clearing Corporation (VSDC).