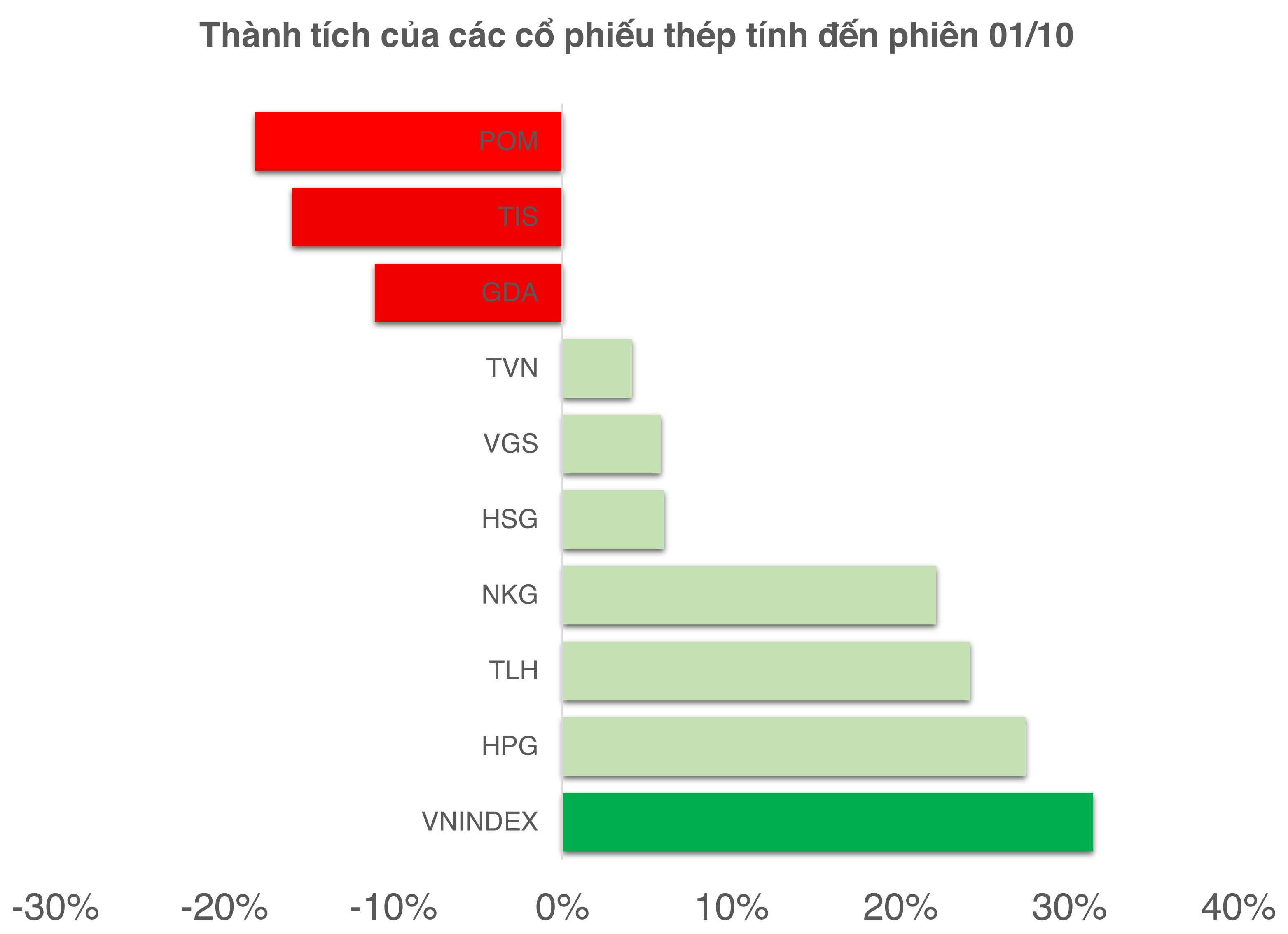

Steel stocks underperform the VN-Index

As of the close of trading on October 1st, HPG, the steel industry leader, saw the highest growth at +27.4% since the beginning of 2025.

Following the 2025 tariff shock, HPG was among the first to complete a V-shaped recovery.

However, HPG’s performance still lags behind the VN-Index’s 31.4% increase over the past nine months.

Steel stocks underperforming the VN-Index

|

Other stocks like HSG (+6%), NKG (+22.1%), and TLH (+24.1%) remain profitable but haven’t outpaced the market. Notably, some steel stocks have declined year-to-date, including GDA (-11.1%), TIS (-16%), and POM (-18%).

While some argue the VN-Index is boosted by large-cap stocks like VIC and banks, sectors like securities, real estate, and public investment have seen many stocks surpass the market.

The steel sector’s lackluster momentum makes it one of the few major industries yet to regain market leadership, reflecting divided investment flows and investor caution.

Domestic recovery contrasts with weak exports

According to MBS Securities, Q3 2025 domestic steel consumption is expected to rise 21% year-on-year to 6.3 million tons.

This growth is driven by construction steel and HRC (65% of the total), fueled by recovering real estate markets in Hanoi and Ho Chi Minh City, and an 18% increase in public investment disbursement.

HRC production is projected to surge 48% to 1.7 million tons, as Dung Quat 2 Phase 2 begins operations, capturing over 60% of the domestic market. MBS forecasts local HRC producers like HPG and Formosa will gain market share as wide-coil HRC imports from China face tighter controls.

|

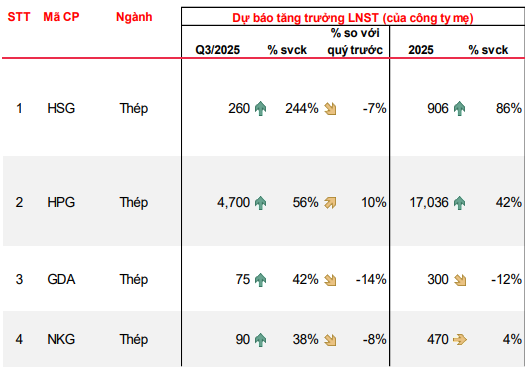

MBS Securities’ forecast

|

In contrast, exports are expected to drop 10% due to weak demand from the EU and US.

Domestic steel prices rebounded slightly in Q3, with HRC up 2% and construction steel up 3% quarter-on-quarter. Input costs like coal and iron ore fell 6% and 5%, respectively, due to weak Chinese production demand, significantly improving gross margins.

HSG’s Q3 2025 net profit is forecast to rise 244% year-on-year, thanks to steel price recovery since August 2025 and stable HRC prices. Full-year 2025 net profit is expected to increase 86%, reaching 181% of the annual target.

HPG benefits from Dung Quat 2, with HRC output projected to rise 60% year-on-year. Net profit is expected to grow 56%, driven by a 23% production increase and a 4 percentage point rise in gross margin. Full-year 2025 profit is forecast at VND 17,036 billion, up 42% year-on-year.

NKG and GDA are expected to see Q3 2024 profits rise 40% year-on-year, but full-year 2025 profits will be less impressive, with GDA potentially declining 12% and NKG growing just 4%.

While improved domestic consumption and margins are positive signs, investment flows remain cautious, especially with weak exports and many stocks lacking market leadership potential.

Steel shareholders, though profitable, remain less enthusiastic as their returns trail overall market gains.

– 08:13 02/10/2025

Afternoon Technical Analysis, October 2: Cautious Sentiment Persists

The sideways accumulation phase of the VN-Index is likely to persist in the near term, awaiting liquidity improvement signals. Meanwhile, the HNX-Index continues to test the lower boundary of its Triangle pattern.

Stock Market Inflows Plummet

With the resurgence of large-cap stocks, particularly in the banking sector, the VN-Index climbed higher today (October 1st). However, market sentiment remains cautious, as evidenced by the HoSE trading value, which barely exceeded 21.3 trillion VND.