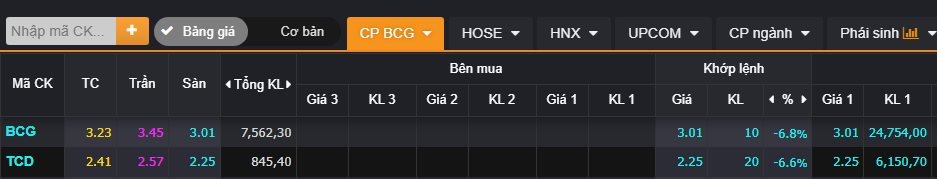

Turbulent times persist for shareholders of the Bamboo Capital group stocks. The Ho Chi Minh City Stock Exchange (HoSE) recently announced the suspension of trading for BCG – Bamboo Capital Corporation (BCG) and TCD – Tracodi Construction Corporation (TCD), effective immediately. These stocks were previously under restricted trading status.

Reacting to this news, both BCG and TCD shares plummeted by the maximum daily limit of 7%, with no buyers in sight. Selling pressure intensified, particularly for BCG, where nearly 25 million shares (approximately 3% of the company’s outstanding shares) were dumped at the floor price of VND 3,010 per share by the end of the morning session, with no matching buy orders. TCD also witnessed a sell-off, with over 6 million shares offered at the floor price of VND 2,250 per share.

Currently, both Bamboo Capital and Tracodi are under restricted trading due to delays in submitting their audited financial statements for 2024 (both standalone and consolidated) beyond the 45-day grace period. HoSE stated that as of now, neither company has published these required financial reports, leading to the suspension of trading.

Bamboo Capital’s business operations have stagnated amid ongoing leadership changes within its ecosystem, following the March 2025 indictment of its founder, Nguyễn Hồ Nam.

Bamboo Capital has repeatedly explained the delays in its financial reporting. In its latest communication, the company cited ongoing coordination with relevant parties to resolve bond-related issues and debt management as critical steps for finalizing the audited financial statements. However, progress has fallen short of expectations due to personnel changes at both the parent company and its subsidiaries, coupled with partner and service provider concerns stemming from the indictment.

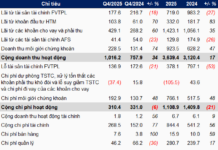

According to self-reported Q4 2024 results, Bamboo Capital recorded full-year 2024 revenues of VND 4,372 billion and after-tax profits of VND 845 billion, representing year-over-year increases of 9% and 394%, respectively.

Billionaire Nguyen Thi Phuong Thao Shares Story of “Rescuing” HOSE from System Overload

Billionaire Nguyễn Thị Phương Thảo revealed that she, alongside FPT Corporation Chairman Trương Gia Bình and other prominent business leaders, collaborated to “rescue” the Ho Chi Minh City Stock Exchange (HOSE) during a critical system overload.

Dragon Capital Exits Major Shareholder Status at The Gioi Di Dong, Selling Over 3 Million Shares

Dragon Capital Group has offloaded over 3.2 million shares of MWG, reducing its ownership stake below 5% and ceasing to be a major shareholder in the retail company. This transaction occurred amid a rising MWG stock price and the company’s positive first-half 2025 financial performance.