Illustrative Image

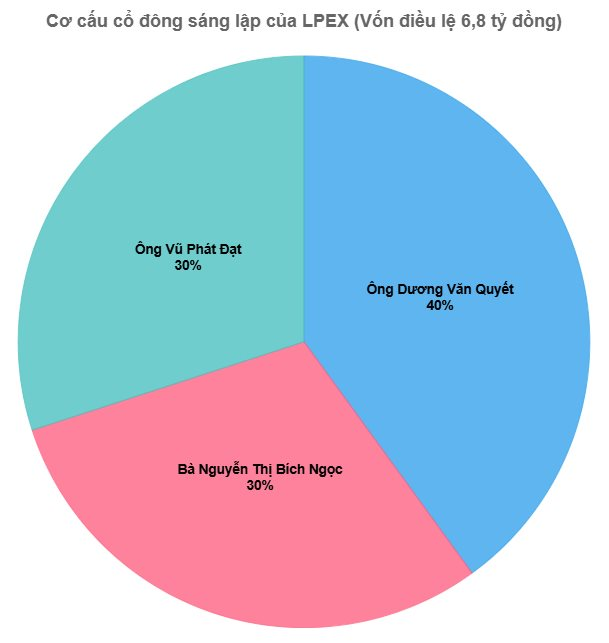

According to business registration information, Loc Phat Vietnam Cryptocurrency Exchange JSC (LPEX) was established on September 30, 2025, with an initial charter capital of 6.8 billion VND. The company’s headquarters is located at LPB Tower, 210 Tran Quang Khai Street, Hoan Kiem District, Hanoi. This address is also the main office of LPBank.

LPEX’s founding shareholder structure includes three individuals: Mr. Duong Van Quyet (holding 40% of the capital), Ms. Nguyen Thi Bich Ngoc (30%), and Mr. Vu Phat Dat (30%). The largest shareholder, Mr. Duong Van Quyet, born in 1989, was previously a major shareholder in Thaigroup Corporation, owning at least 16.8% of its charter capital.

Thaigroup is closely linked to Thaiholdings JSC (Stock Code: THD). Thaiholdings once held over 80% of Thaigroup’s shares but has since reduced its ownership to 48%.

In May 2021, Thaiholdings (then the parent company holding 81.6% of Thaigroup’s capital) proposed acquiring an additional 18% of Thaigroup’s shares, including those held by Mr. Duong Van Quyet and two other individuals. However, this plan was rejected at the Annual General Meeting of Shareholders on May 23, 2021.

Beyond his role at LPEX, Mr. Duong Van Quyet serves as Chairman of the Board of Directors of Hai Au High-Speed Ship JSC. This company is the developer of the Hai Au Resort project, spanning 11.2 hectares in Duong To Commune, Phu Quoc City, Kien Giang Province (now Phu Quoc Special Economic Zone).

Prior to LPEX, Vietnam’s cryptocurrency market has seen participation from several entities linked to major financial institutions. Notable examples include Techcom Cryptocurrency Exchange JSC (TCEX), VIX Cryptocurrency Exchange JSC (VIXEX), Vietnam Prosperity Cryptocurrency Exchange JSC (CAEX), and most recently, HD Cryptocurrency Exchange JSC (HDEX).

A common feature among these companies is their shareholder structure, which includes securities firms. The involvement of such institutions is mandatory to meet legal requirements for the pilot cryptocurrency market under Resolution 05/2025/NQ-CP. Specifically, the resolution mandates that exchanges have a minimum capital of 10 trillion VND, with at least 35% held by two or more financial institutions.

Although these companies are named “cryptocurrency exchanges,” they must obtain state approval to operate in this field.

Launchpad for Vietnam’s Logistics and E-commerce to Conquer the Global Market

The FIATA World Congress 2025, the premier global logistics event, will make its debut in Hanoi from October 6th to 10th. This landmark occasion marks the first time the prestigious congress will be held in Vietnam, bringing together industry leaders, innovators, and experts from around the world to shape the future of logistics.

Marvell Urged to Support Vietnam’s Data Center Development by General Secretary To Lam

On the afternoon of October 1st, at the Party Central Headquarters, General Secretary Tô Lâm received Mr. Sandeep Bharathi, Chairman of Marvell Global Group, USA. The General Secretary highlighted key priorities for Marvell to enhance its investment in Vietnam, including supporting the development of data centers, advancing the semiconductor industry, and training the workforce.