I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 2, 2025

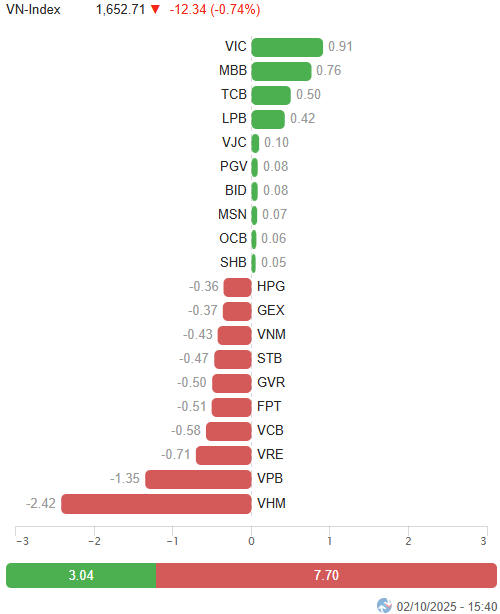

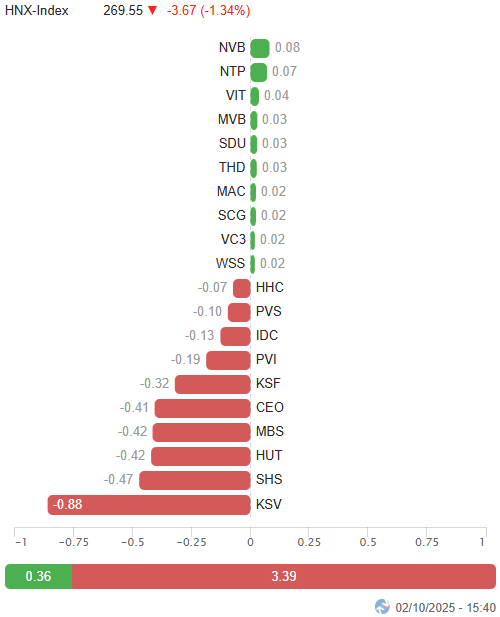

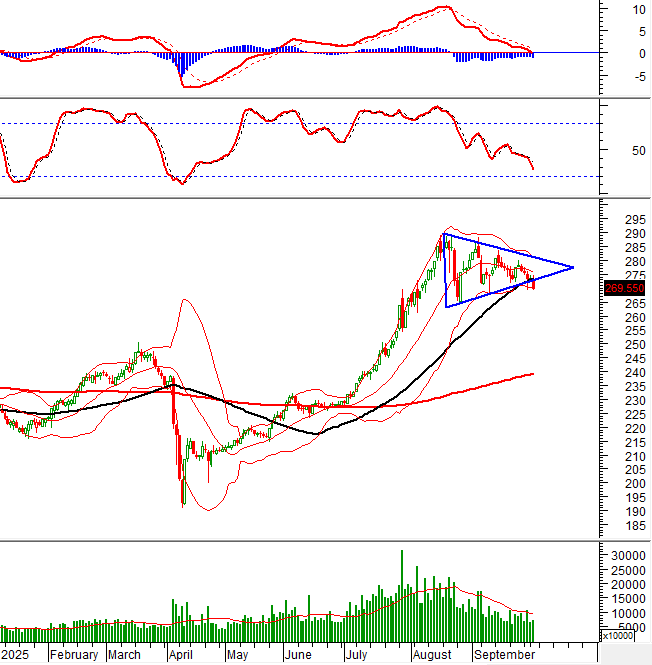

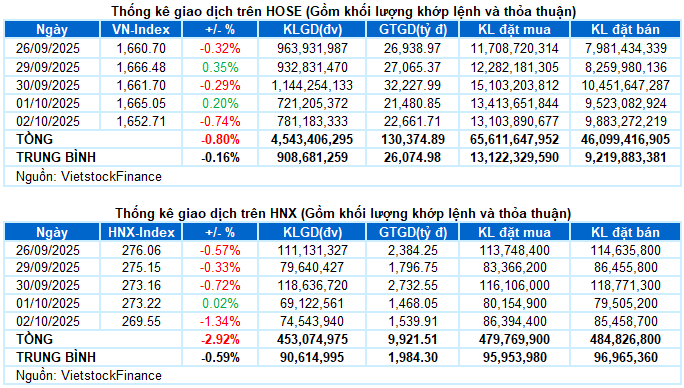

– Major indices unanimously declined during the October 2 trading session. Specifically, the VN-Index dropped by 0.74%, closing at 1,652.71 points, while the HNX-Index saw a sharp decline of 1.34%, settling at 269.55 points.

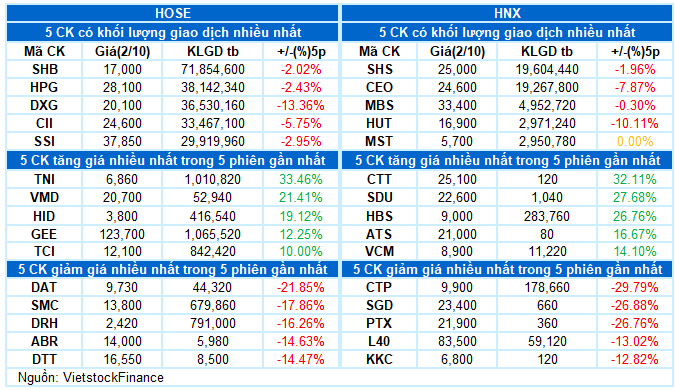

– Trading volume on the HOSE increased by 10.5%, reaching nearly 736 million units. The HNX recorded over 72 million matched units, a 10% rise compared to the previous session.

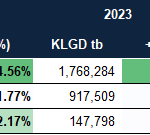

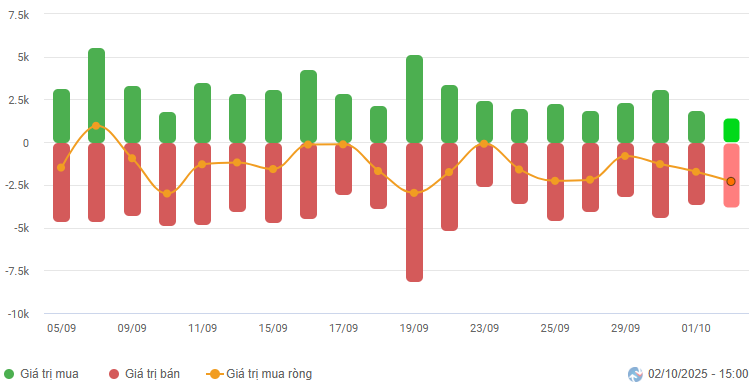

– Foreign investors continued to net sell, with a value exceeding VND 2.2 trillion on the HOSE and over VND 44 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

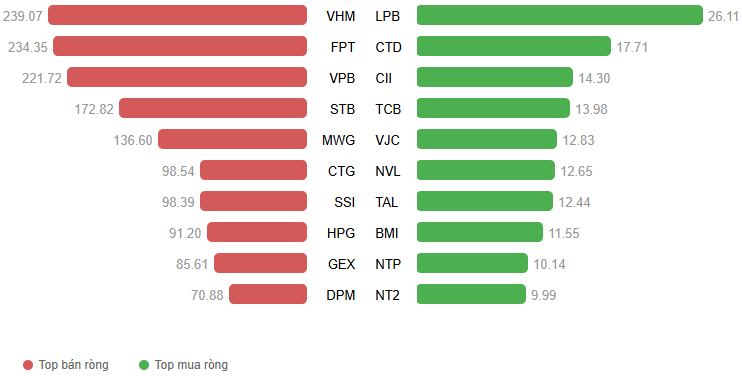

Net Trading Value by Stock Code. Unit: Billion VND

– The October 2 session began positively, with the VN-Index quickly approaching the 1,680-point mark, driven by large-cap stocks. However, the lack of investor enthusiasm caused the upward momentum to wane. The initial euphoria faded, and the VN-Index narrowed its gains, retreating close to the reference level by the end of the morning session. In the afternoon, the index fluctuated around 1,665 points before plunging under widespread selling pressure. Weak recovery attempts toward the end of the session were insufficient to salvage the situation. The VN-Index closed near its intraday low, falling to 1,652.71 points, a loss of over 12 points from the previous session.

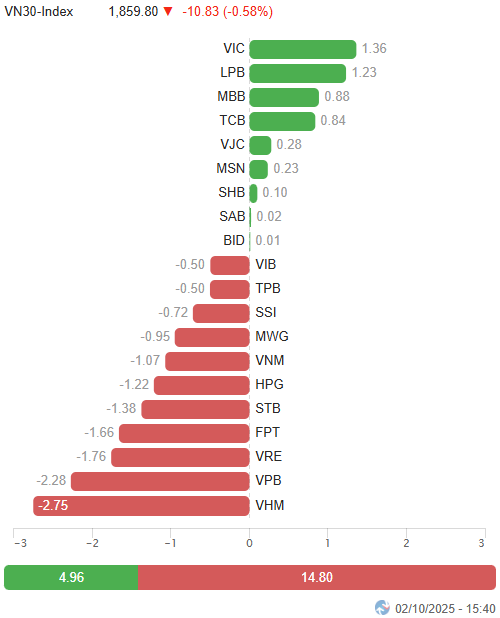

– In terms of impact, VHM, VPB, and VRE exerted the most significant downward pressure on the market, causing the VN-Index to decline by a total of 4.5 points. Conversely, VIC, MBB, and TCB led the opposite direction but managed to retain only slightly over 2 points for the overall index.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index fell by nearly 11 points, closing at 1,859.8 points. The basket’s breadth favored sellers, with 20 decliners, 9 advancers, and 1 unchanged stock. Among these, VRE led the decline with a 4.2% drop. VHM, TPB, and VPB also lost over 2%. In contrast, only MBB and LPB maintained gains of more than 1% until the session’s end.

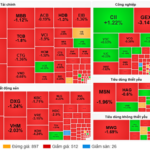

Red dominated all sectors. Information technology ranked last, pressured by the sector leader FPT (-1.39%), while energy was the least affected, adjusting by only 0.2%.

Large-cap sectors such as real estate, industry, and finance weighed heavily on the overall index, with widespread declines. Numerous stocks adjusted by over 2%, including VHM, VRE, KDH, KBC, DXG, NLG; GEE, GEX, VGC, CII, VSC; VPB, TPB, VIX, EIB, SHS, and MBS. Only a few names bucked the trend, notably VIC (+0.59%), SJS (+1.03%); MVN (+1.15%), CC1 (+6.31%), CTD (+1.37%); TCB (+0.78%), LPB (+1.18%), and MBB (+1.52%).

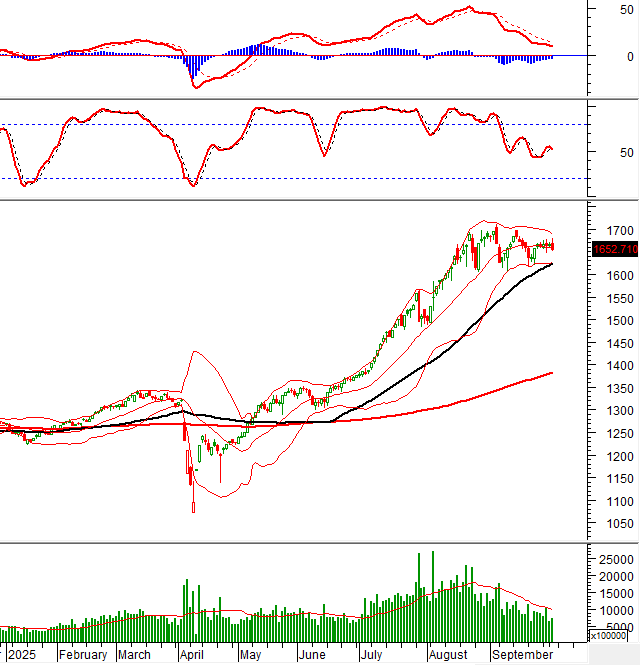

The VN-Index plunged toward the end of the session, slicing through the Middle line of the Bollinger Bands. This movement reflects a resurgence of pessimism as buying interest remains subdued. Meanwhile, the Stochastic Oscillator has issued a sell signal, and the MACD continues to weaken. The August 2025 low (equivalent to the 1,600-1,630 point range) is expected to provide support if selling pressure intensifies.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Signals Sell

The VN-Index plummeted toward the session’s end, slicing through the Middle line of the Bollinger Bands. This movement reflects a resurgence of pessimism as buying interest remains subdued.

Meanwhile, the Stochastic Oscillator has issued a sell signal, and the MACD continues to weaken. The August 2025 low (equivalent to the 1,600-1,630 point range) is expected to provide support if selling pressure intensifies.

HNX-Index – Big Black Candle Pattern Emerges

The HNX-Index saw a sharp decline, marked by the emergence of a Big Black Candle pattern. Risks are escalating as the index has breached the lower boundary of the Triangle pattern (equivalent to the 270-272 point range).

Additionally, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, further reinforcing the short-term bearish outlook.

Capital Flow Analysis

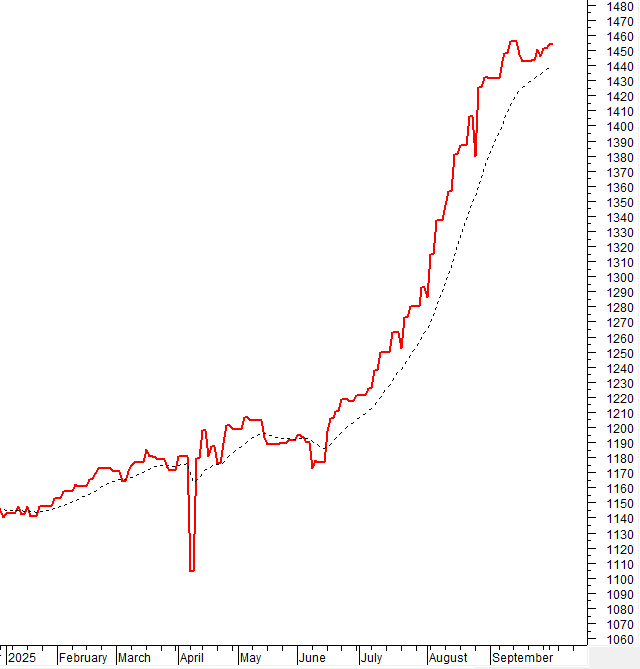

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued to net sell during the October 2, 2025 session. If foreign investors maintain this stance in upcoming sessions, the outlook will become increasingly pessimistic.

III. MARKET STATISTICS FOR OCTOBER 2, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:31 October 2, 2025

Top Stocks to Watch at the Opening Session on October 2nd

Discover the most volatile stocks in recent trading sessions with Vietstock’s comprehensive list of top gainers and losers. Stay ahead of the market trends by exploring the stocks that have experienced significant price movements, providing valuable insights for informed investment decisions.

Steel Industry Shareholders Profit, But Celebrations on Hold

Following the sharp decline in April 2025 due to tariff shocks, many steel stocks have successfully formed a V-shaped recovery. However, compared to the broader market’s upward momentum, the sector still appears sluggish, as all steel stocks underperformed the VN-Index. This reflects investors’ lingering caution toward the industry.

Which Stocks Typically Surge in the First Month of Q4?

As September drew to a close with a series of fluctuating market movements, the VN-Index entered October amid heightened uncertainty. Historically, this month has often seen more stocks declining than advancing, adding to investor apprehensions about the market’s trajectory.