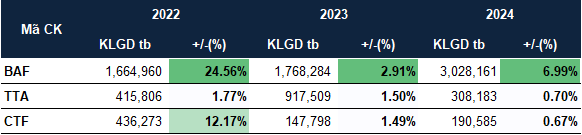

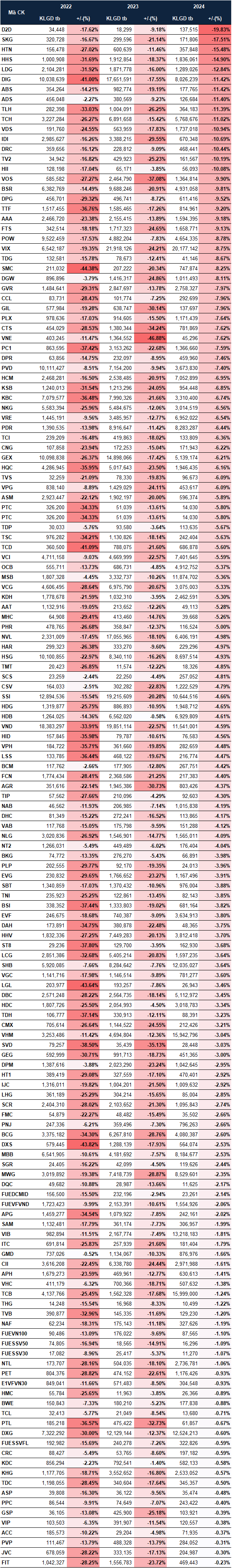

According to data from VietstockFinance, only three stocks on the HOSE exchange have consistently risen in October over the past three years (2022-2024): BAF, TTA, and CTF. In contrast, 155 stocks and fund certificates have consistently declined across various sectors, including KBC, PDR, DIG, and KDH in real estate; HTN in construction; BSR and PLX in petroleum; GVR and PHR in rubber; POW in electricity; FTS, VIX, and HCM in securities; NKG and SMC in steel; and OCB and MSB in banking.

|

Stocks on the HOSE exchange that increased in October from 2022-2024

Source: VietstockFinance

|

|

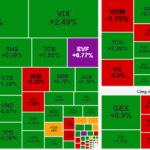

Stocks on the HOSE exchange that decreased in October from 2022-2024

Source: VietstockFinance

|

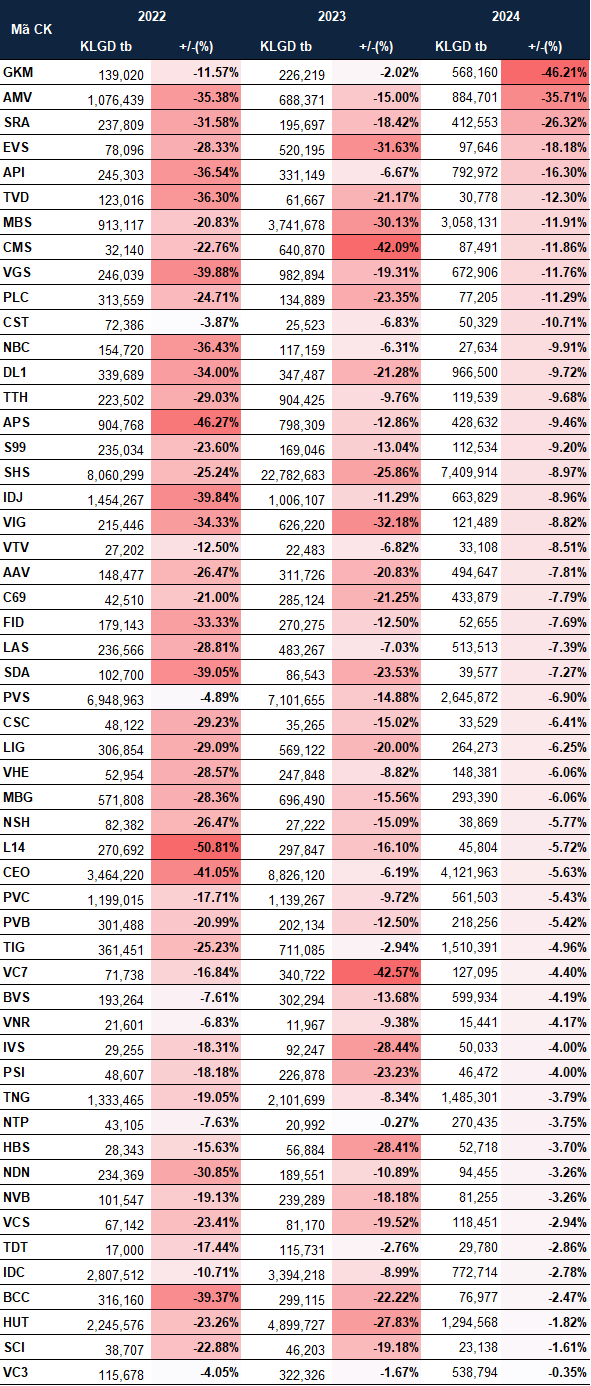

On the HNX exchange, similar to September, no stocks have consistently risen in October over the past three years (2022-2024). However, 53 stocks have consistently declined, including GKM, EVS, API, NBC, DL1, APS, L14, CEO, NDN, IDC, and HUT.

|

Stocks on the HNX exchange that decreased in October from 2022-2024

Source: VietstockFinance

|

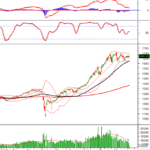

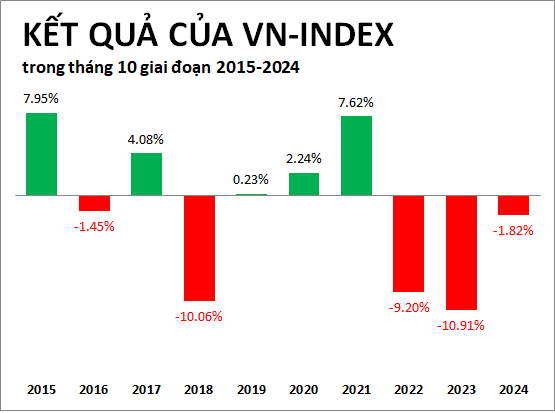

Analyzing the VN-Index over the past decade (2015-2024), the index has shown an even split between increases and decreases. However, in the last three years (2022-2024), the VN-Index has consistently declined in October.

Source: VietstockFinance

|

BIDV Securities (BSC) suggests that GDP data, Q3/2025 earnings forecasts, and potential upgrades will help the market maintain its peak accumulation phase. Investors may consider taking partial profits during strong stock rallies and await trend-forming signals supported by favorable news.

Meanwhile, Vikki Digital Bank Securities (VikkiBankS) notes that in the absence of a sell-off, investors can leverage short-term market fluctuations to select robust stocks with strong growth potential in Q4/2025 across sectors like banking, securities, public investment, retail, and real estate.

– 08:08 03/10/2025

Market Pulse 02/10: Market Shifts, Liquidity Dips, Foreign Investors Continue Heavy Selling

After a promising start to the session, Vietnamese stock indices took a sharp downturn in the afternoon, weighed down by lackluster liquidity and persistent foreign selling pressure.