From September 30 to October 1, 2025, Comrade To Huy Vu, Secretary of the Party Committee and Chairman of the Board of Members of Agribank, along with a delegation from the Head Office, conducted a working program with three branches in Nghe An province: West Nghe An, South Nghe An, and Nghe An. The aim was to promptly assess the operational performance of the early months of 2025 and the implementation of network restructuring across these branches, as outlined in Agribank’s Restructuring Plan linked to Non-Performing Loan Resolution for the 2021-2025 period.

During this working program, Comrade To Huy Vu, Secretary of the Party Committee and Chairman of the Board of Members of Agribank, directly oversaw and directed the inauguration of the Do Luong II South Nghe An Branch (under South Nghe An Branch) and Vinh Nghe An Branch (under Nghe An Branch). This underscores the Party Committee’s, Board of Members’, and Management Board’s keen attention, decisive leadership, and management in enhancing the operational capacity of the existing branch network in Nghe An province. It also reaffirms Agribank’s commitment to realizing the national comprehensive financial strategy, continuously striving to expand digital financial services to rural residents, remote areas, and deep-rooted communities. This effort aims to narrow the development gap between regions, promote new rural development, and foster local socio-economic growth.

Expanding Network in “Agriculture, Farmers, and Rural Areas” – A Strategy Aligned with Local Realities

Following the State Bank’s approval of Agribank’s Restructuring Plan linked to Non-Performing Loan Resolution for the 2021-2025 period, Agribank has implemented synchronized measures to enhance the overall system’s operational quality. This includes a strong focus on network restructuring, organizational streamlining, and personnel realignment to maximize resource utilization.

Circular 32 of the State Bank, effective from August 15, 2024, has facilitated Agribank’s efforts to restructure and reorganize its network more scientifically and efficiently. The provision allowing branch location changes between provinces/cities has significantly resolved challenges and obstacles, enabling Agribank to flexibly deploy its network in alignment with practical realities and legal regulations. This ensures not only improved operational efficiency but also timely fulfillment of Agribank’s strategic business goals in the new phase.

Therefore, based on an assessment of the local socio-economic characteristics, Agribank identifies expanding its branch and transaction office network to mountainous and challenging areas as not only a political mandate but also a strategic move to maintain market share, enhance customer service effectiveness, and contribute to rural economic development.

Comrade To Huy Vu – Secretary of the Party Committee and Chairman of the Board of Members of Agribank, along with delegates, inaugurates the Do Luong II South Nghe An Branch of Agribank.

In Nghe An province, a region with significant development potential, boasting the largest area in Vietnam (nearly 16,500 km²), a GDP growth rate second in the North Central region and 13th nationally, and one of 11 provinces maintaining its administrative status, which underscores its potential and development prospects. Notably, by 2030, Vinh City and the Southeast Economic Zone are planned to become smart cities and growth hubs for the entire region.

Comrade To Huy Vu – Secretary of the Party Committee and Chairman of the Board of Members of Agribank, along with delegates, inaugurates the Vinh Nghe An Branch of Agribank.

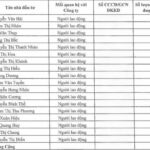

Currently, Agribank’s network in Nghe An province comprises 3 Type I Branches, 19 Type II Branches, and 47 Transaction Offices. In 2025, based on an assessment of the socio-economic situation and with maximum support from the Provincial Party Committee, People’s Council, and People’s Committee of Nghe An, Agribank’s leadership decided to strengthen and expand its branch and transaction office network in rural and mountainous areas of Nghe An province. This aims to support farmers, cooperatives, and small and medium-sized enterprises in accessing capital and applying technology in production and business, thereby increasing income and promoting sustainable local economic development. Consequently, transferring two small-scale, underperforming Type II Branches from Nha Trang city to Nghe An province—a locality with significant growth potential—and restructuring them into two Type II Branches under Agribank in Nghe An province, namely Vinh Nghe An Branch (under Nghe An Branch) and Do Luong II South Nghe An Branch (under South Nghe An Branch), is both necessary and strategically sound. This move demonstrates Agribank’s commitment to fulfilling its mission: to become a leading bank, a key player in serving agriculture, farmers, and rural areas, and to bring prosperity to its customers.

Affirming the Role as a Key Bank in “Agriculture, Farmers, and Rural Areas”

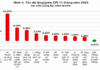

The network development strategy in Nghe An is part of Agribank’s broader national strategy, aimed at realizing the Party and State’s policies on developing agriculture, farmers, and rural areas. With a network of nearly 2,300 branches and transaction offices nationwide, predominantly in rural areas, Agribank leads in providing credit and banking services to the “backbone of the economy,” serving 65% of the population and contributing to 30% of the national GDP.

Agribank continuously enhances operational efficiency, meeting the growing demand for banking products and services from residents and businesses.

The restructuring and reorganization of branches and transaction offices in Nghe An province aim to proactively expand Agribank’s market share in the region while meeting the increasing demand for banking products and services from residents and businesses. This significantly enhances the operational efficiency of branches and transaction offices. Additionally, it reflects the deep commitment and high responsibility of Agribank’s Party Committee, Board of Members, and Management Board in supporting Nghe An province’s socio-economic development strategy across multiple dimensions:

First, developing modern agriculture linked to value chains and digital transformation. Given Nghe An’s advantages in area, labor, and production traditions, Agribank prioritizes credit for clean agriculture, organic agriculture, and high-tech agriculture.

Second, promoting industrialization and urbanization linked to regional connectivity. As the “gateway to the North Central region,” connecting the East-West economic corridor, and closely linked with Thanh Hoa, Ha Tinh, and neighboring countries like Laos and Thailand, Agribank will support industrial, logistics, and international trade enterprises with credit and digital banking services, acting as a bridge for Nghe An’s businesses to reach global markets.

Third, building a digital economic ecosystem and comprehensive financial services. Agribank not only serves “agriculture, farmers, and rural areas” but also pioneers in digital transformation, developing digital banking and modern payment services. In Nghe An, Agribank aims to connect banks, customers, and local authorities to create a synchronized cashless payment ecosystem, ensuring that every resident, whether in urban or remote areas, can easily access modern banking services.

Speaking at the inauguration of Vinh Nghe An Branch (under Nghe An Branch) and Do Luong II South Nghe An Branch (under South Nghe An Branch), Comrade To Huy Vu – Secretary of the Party Committee and Chairman of the Board of Members of Agribank, expressed confidence that the branch leaders would demonstrate the highest sense of responsibility, strong determination, and unity to ensure the branches operate effectively, safely, and sustainably from the outset. He expects that with continuous efforts, the branches will make significant contributions to helping residents and businesses access capital, thereby strongly promoting local economic development. Chairman To Huy Vu also expressed confidence and hope that the three branches—Nghe An, South Nghe An, and West Nghe An—would continue to develop safely and strongly, working together to contribute positively to the comprehensive development of Nghe An province in the future.

Agribank strengthens resources for “Agriculture, Farmers, and Rural Areas,” affirming its commitment to inclusive finance and sustainable development.

Agribank’s network expansion in Nghe An province is not merely about increasing market share but also reflects the political and social responsibility of a state-owned commercial bank. It focuses not only on quantity but also on quality, combining traditional branch and transaction office models with mobile transaction points using specialized vehicles, digital banking, and mobile banking services. This ensures comprehensive coverage, from plains and urban areas to mountainous and remote regions of Nghe An, leaving no resident behind in accessing modern financial services.

By enhancing the presence of the Agribank system and increasing resources for rural areas in Nghe An province and nationwide, Agribank demonstrates its long-term development strategy, aligning business goals with social responsibility. This affirms Agribank’s sustainable commitment to supporting farmers, businesses, and rural areas—sectors in need of significant financial impetus for production development, new rural construction, and local capacity enhancement. Agribank pledges to continue partnering with localities in promoting inclusive finance, aiming for a comprehensive and sustainable economy, and significantly contributing to the industrialization and modernization of the country. These efforts also concretely realize the Party’s resolutions, including Resolution No. 68-NQ/TW dated May 4, 2025, on private economic development, laying the foundation for Vietnam’s sustainable growth.

Agribank Honored with Three Outstanding Financial Products and Services in 2025, Solidifying Its Leadership Position

The 3rd Vietnam High-Level Financial Advisor Forum – 2025 has recognized outstanding financial products and services. Among the honorees, the Agricultural and Rural Development Bank of Vietnam (Agribank) stood out, receiving accolades in three distinct categories.

Unveiling Ecopark’s The Campus 2: The Future-Connecting Boulevard at North Central Vietnam’s Premier Economic Hub

Campus 2 stands as the gateway to Eco Central Park, seamlessly connecting the entire metropolis to the heart of Nghe An’s central wards via Nguyen Sy Sach Boulevard (70m) and Au Co Avenue (34m). Positioned directly opposite the iconic Quang Truong Anh Sang (3.5ha), it offers unparalleled accessibility and prominence.